Global Founders Capital, the European investment fund set up in 2013 by Rocket Internet founders Oliver and Marc Samwer, has led a $3.5 million Series B funding round in Middle East hotel booking startup Yamsafer. Existing investor Sadara Ventures also participated in the round, along with some undisclosed U.S. based investors.

It’s GFC’s first investment in the online travel in this region, although Rocket Internet has previously invested in Namshi, a regional online fashion retailer — and has multiple global travel investments to its name such as Traveloka in Indonesia, or Germany’s Trivago (now owned by Expedia).

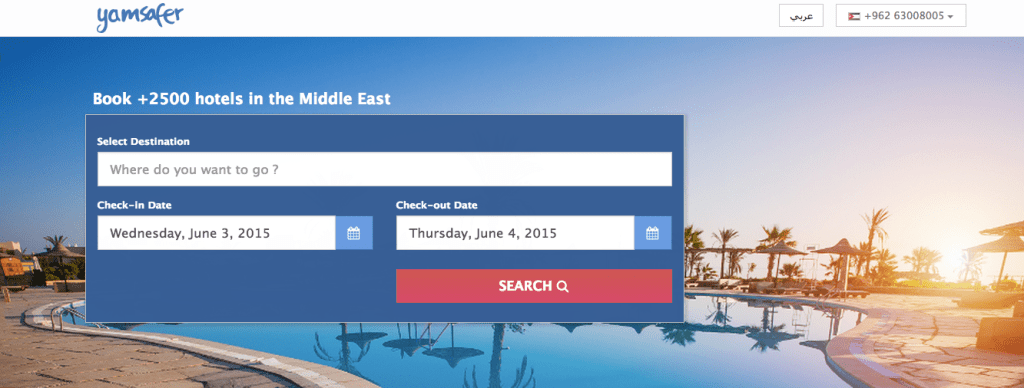

Yamsafer is located in the West Bank — and claims this is the first “foreign-led venture capital investment of its kind in a Palestine-based company”. It plans to use the funding to accelerate growth and expand its team. Currently it has some 4,000 properties bookable via its platform.

“[GFC] approached us because they are interested in building up their [travel] portfolio in the region. And the process was extremely fast relatively speaking,” says CEO Faris Zaher. “For a foreign investor coming into an unusual territory I think they were much faster than what a U.S.-based investor would have been. They’re more of a global investor than some U.S.-based investors so they move faster in those territories.”

“At the end of the day, capital crosses borders easier than people — at least here in the Middle East. If you’re a good company investors will find you, regardless of where you are,” he adds.

“What we’re going after, and what most Middle Eastern startups are going after right now is mostly cloning models which have been proven to be successful elsewhere is actually going to require them to be based in the Middle East… And capital will flow in because you can’t do this out of the Bay Area.”

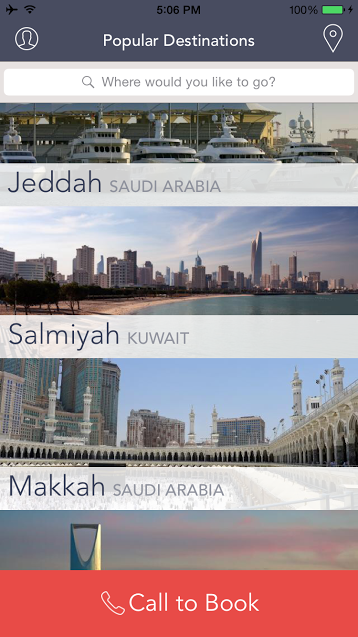

Yamsafer’s booking platform focuses on hotels in the Middle East and Turkey — catering to a region where, for cultural reasons, disruptive alternatives to traditional hotels (such as Airbnb) are less strong, according to Zaher.

“Airbnb is very weak in the Middle East. I think it’s probably one of its weakest markets, if not the weakest. Mostly because of cultural reasons — that business model does not work very well… Arab culture would not be very welcoming to renting out a room in your house or even renting out your entire house to strangers,” he tells TechCrunch.

Yamsafer’s main market is Saudi Arabia, which accounts for around 70 per cent of its transactions. Factor in the other Gulf countries and it’s around 90 per cent of its business. Only around 10 per cent comes from the Levant and European travel coming into the Middle East.

“We’ve been growing very fast over 2014 and we’re still seeing that growth. We’re now the second largest online booking service for hotels in terms of transaction volume after Booking.com,” he adds. “We currently cover 18 countries and are focused on inter-regional travel mainly, so people traveling within their own country or from one Arabic country to another. And that’s quite a large market.

“Annually the interregional travel market is $20 billion in hotel receipts. And the entire travel market is $50 billion. So you’re talking about a very large market that’s right now transitioning from booking through bricks and mortar travel agencies into online services.”

Zaher says the main competitor for Yamsafer is Booking.com. It has followed the same platform model as its rival but with a tighter regional focus, so it has localized maps and content, and offers things like cardless booking (to cater to travelers who don’t have credit cards) and telephone booking (for those not yet fully comfortable booking online), as well as seeking out more of the types of properties that are popular with its target demographic.

“The average family size in Saudi is 11 people and when they travel they look for either very large rooms or to rent an entire villa or a chalet. It obviously doesn’t make sense for a family to go on vacation and be scattered around five different rooms… So we’ve acquired these kinds of properties with, for example, large living rooms.”

“We’re hyper focused on seeing where the demand is going and then supplying that very specific demand of interregional travelers,” he adds.

Comment