Ariadna Masó

Editor’s note: Malte Susen and Ariadna Masó are both working as debt investment professionals at international corporate and investment banks.

As debt financing professionals, we have witnessed hundreds of challenging loan and bond financings for larger businesses. A company’s financing can be pivotal to its success, yet executives often struggle to optimize capital structures for their firms. In this context, why do the vast majority of start-ups think exclusively in the equity sphere?

Debt is not normally the first option that entrepreneurs consider for their ventures due to its common association with larger, established companies. However, a number of companies such as FastPay, Netflix, Teads and Uber recently made the move to seek additional venture financing through debt.

“Venture backed companies are raising ~$10 billion (equity) per quarter.. If the VC industry alone were to attempt to fund all current VC backed companies at today’s levels through a downturn, we would effectively run out of reserves in 3-4 quarters.”

The aforementioned potential shortage in venture equity funds and the search of a viable financing mix should encourage savvy entrepreneurs to consider debt financing.

In many cases debt financing can protect from dilution, optimize capital structures, and is a cheaper source of financing than equity.

Protection From Dilution

Debt can be used as key strategic toolkit to cover cash needs without giving away equity and so can be an effective way to contain dilutive effects. It can provide financial flexibility without having to sacrifice the control over your firm.

Optimized Capital Structure With Atrractive Valuation

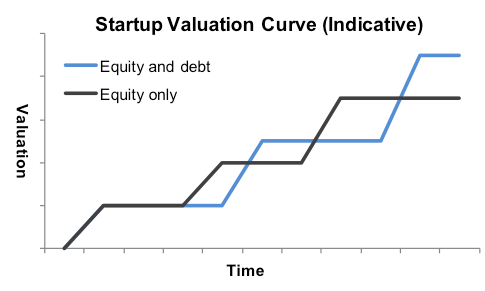

Adding debt to the venture’s capital structure can help postpone financing rounds to achieve higher valuations at a later point in time. This could mean having six months of additional reserves before having to take on another funding round. The “gained” time can be used to achieve entrepreneurial goals in order to convince equity sponsors that a higher venture valuation would be appropriate.

Additionally, debt can act as a bridge by providing capital between two rounds. The adjacent graph shows how debt can potentially help to postpone financing rounds to get to higher valuations at a later point in time.

Debt funding Is Cheaper Than Equity

Anyone who has dealt with cost of capital analysis (Finance 101) has surely noticed that debt is cheaper than equity. This is related to the simple fact that equity is subordinated in a company’s capital pecking order, meaning that claims for shares are considered after all claims for debthave already been served.

When thinking about how best to set up a venture’s capital structure, we of course want to minimise the costs of capital for our company. Adding debt to the capital structure can provide you with a cheap source of funding and hence lower your average capital costs.

While debt can be an attractive source of financing, there are risks associated with the structure that are also worth keeping in mind. With debt, there are fixed amortization and interest costs, covenants and restrictions, and potential problems when it’s time to refinance the debt.

Fixed Amortization And Interest Costs

When analyzing the downside of debt financing, we first have to point out that debt usually adds additional fixed payments to the cash flow statement. These payments can include interest as well as contractually fixed repayments. If you have opted in to an “amortization” scheme, payments are often fixed over a set period; whereas a “bullet” repayment is payable on maturity. Such agreed payments represent a cash outflow that could generate cash flow tensions for your start-up.

Covenants

Covenants will probably be the reason that will cause you sleepless nights when having debt on your balance sheet. Lenders usually want your venture not to cross certain “red lines”, for example, interest, or leverage ratios. To be clear, these agreements can seriously hinder your venture’s development, for instance, limiting expenditure for the company’s expansion or acquisitions. Furthermore (and this is where your eyes should scan this sentence twice) the non-compliance with certain covenants can provide lenders with a trigger to claim additional payments, and ultimately to take a hold in your company.

Refinancing Risk

After the maturity of your debt tranches, or if debt is reclaimed by lenders during new financing rounds, you have three choices: repaying the debt (i) through existing cash on your balance sheet, (ii) through releasing new equity, or (iii) through another loan. As cash on a balance sheet is normally limited, and debtrepayments via equity are often contractually restricted by venture capitalists, borrowings will have to be paid back through a new loan. In a worst-case scenario, you would find yourself losing part of your ownership through a debt-to-equity conversion mechanism, or in the default of your business. And let’s be honest, none of these outcomes are desirable.

The Two Sides Of The Table

Players involved in start-ups can have significantly different views on venture debt. For lenders, venture debt provides a way to get higher returns compared to lending to established companies. For venture capitalists, debt can also be a way to protect against dilutive effects.

Borrowed capital is, however, generally less popular among equity providers for one simple fact: debt providers are normally not lending against the creditworthiness of the start-up, but against the creditworthiness of the venture capitalist firms. Yes, you got it right, and this explains why equity sponsors prefer providing further equity to get paid for their own capital at risk.

Is My Venture Ready For Debt?

When it comes to determining whether your venture is ready for debt or not, you should be able to answer the following points with a clear “yes”:

- Debt financing will help me to raise a higher equity round at a later point in time

- I am able to meet my fixed-term repayments

- It is likely that my venture will be able to refinance debt at maturity

- My venture is profitable or close to being profitable and has assets I am able to borrow against

- I am willing to take on covenants that can restrict my venture in its future activities

Venture debt can be used as a strategic component to retain value for owners and to achieve higher valuation levels in your next rounds. The ability to take on debt will however depend on your capability as an entrepreneur to convince lenders and venture capitalists that you are a sound investment.

Sell yourself, and let them know how good you are and how the debt will benefit your business, and theirs. You should also leverage on good lawyers who can help you cover against undesirable clauses. This should ensure that there is a watchful eye on “equity kickers”, which may trigger a share purchase at a set price at some point in the future.

Comment