T-Mobile today announced its intentions to get into the business of providing banking services to its wireless customers, and any others who want an alternative to traditional banking accounts. The new platform will compete with, and also potentially boost, other, less-known mobile banking services, like those provided by a banking startup called Simple, for example, or Amex’s Serve.

It’s not a new idea for a mobile carrier to get into the bank-by-phone business like T-Mobile is now doing – Kenya’s M-PESA, launched in 2007, is probably one of the best known examples of how successful such a tie-up can become. Today, there are nearly 20 million people around the world using M-PESA, which has since expanded from a basic mobile money transfer scheme, to include other loans and savings products, bill pay, salary disbursements, and more.

M-PESA, however, owes its leading position in the worldwide mobile banking business to a variety of factors, including not only its country of origin – a place where city workers regularly sent money back home to family in rural villages – but also because of fewer regulations, the backing of the country’s largest operator, Safaricom, and, as is often the case with new technologies, good timing. (Post-election violence in 2008 had Kenyans turning to M-PESA, which was regarded as safer than banks, The Economist explains).

In other words, what works in some parts of the world may not necessarily thrive in the U.S., and here, a carrier-backed mobile banking service is still something of a novelty. (Sprint prepaid subsidiary Boost Mobile launched something similar to T-Mobile’s last year, but has a smaller footprint).

Why Mobile Banking Now?

Besides being a good fit for its image as the un-carrier, T-Mobile is clever to now become an “un-bank,” too. In the wake of consumer distrust of big banks following the crash and government bail-out, job losses, and an overall tough economic climate, moving funds out of traditional banks into prepaid Visa accounts like T-Mobile offers, is the modern-day equivalent of cash in the sock drawer. It’s for the large swath of Americans who admit that traditional banking holds little value for them, because their lives are lived paycheck to paycheck, with things like savings or money market accounts, IRAs, and other investment plans and services as additional, unnecessary options that can only be aspired to.

Besides being a good fit for its image as the un-carrier, T-Mobile is clever to now become an “un-bank,” too. In the wake of consumer distrust of big banks following the crash and government bail-out, job losses, and an overall tough economic climate, moving funds out of traditional banks into prepaid Visa accounts like T-Mobile offers, is the modern-day equivalent of cash in the sock drawer. It’s for the large swath of Americans who admit that traditional banking holds little value for them, because their lives are lived paycheck to paycheck, with things like savings or money market accounts, IRAs, and other investment plans and services as additional, unnecessary options that can only be aspired to.

T-Mobile’s timing comes also at a time when there’s pent-up consumer demand for more seamless ways to transact, without having to constantly carry around a billfold stuffed with cash and cards. Other startup companies, like Square for example, have benefitted from banks’ and others’ failure to move quickly here. Even longtime payment tech companies, like PayPal, know they fell asleep at the wheel, so to speak. As PayPal President David Marcus said this week, his company “sucked so badly” at certain things in the payments space, it left room for startups like Square, Stripe and Dwolla to emerge.

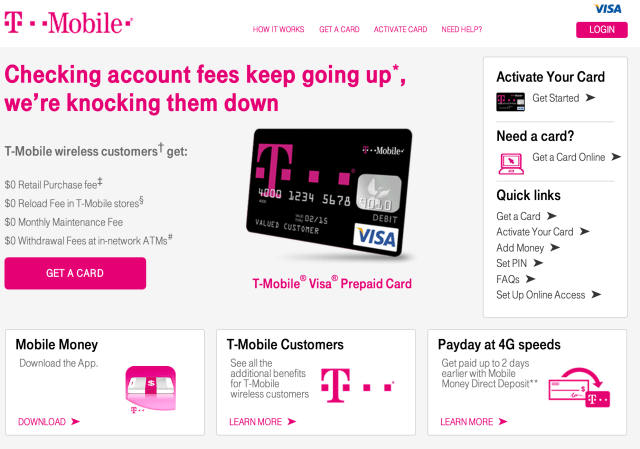

Now T-Mobile is joining this fray as well, and its visibility could help boost the presence of other alternative mobile banking services already in existence. While there are several prepaid payment card options on the market, what makes T-Mobile’s service appealing is not just the reduced fees (versus traditional banks), but also the combination of a payment card and mobile application, where the app is not an afterthought, but rather a core part of the experience.

This puts T-Mobile’s service in competition with similar efforts, like that from Amex’s Serve or Simple (formerly BankSimple), as a couple of the more high-profile efforts in this space which we’ll analyze.

Here’s how they compare. (Note that because T-Mobile’s Mobile Money app has only just launched, it’s too soon to have a review of the mobile software itself.)

Simple

Though TechCrunch readers may be familiar with Simple, by nature of being early adopters themselves, this online and mobile “un-bank” is still a small drop in the bucket when compared with the traditional banks it’s trying to disrupt. Founded in 2009, the startup offers a modern front-end to bank accounts held in the FDIC-backed Bancorp Bank (which also issues T-Mobile’s card), but to date, Simple only has some 55,000+ customers.

To some extent, this is because Simple remains invite-only, but scoring an invite is not that difficult – if you were serious about switching your accounts over and made the plea, you’d probably luck out. If not, you could always ask another Simple customer, who each get 10 invites to share.

Simple doesn’t charge the same kind of fees a traditional bank does, including the dreaded overdraft fee, but instead makes money off interest margin, which it shares with Bancorp, and merchant service fees.

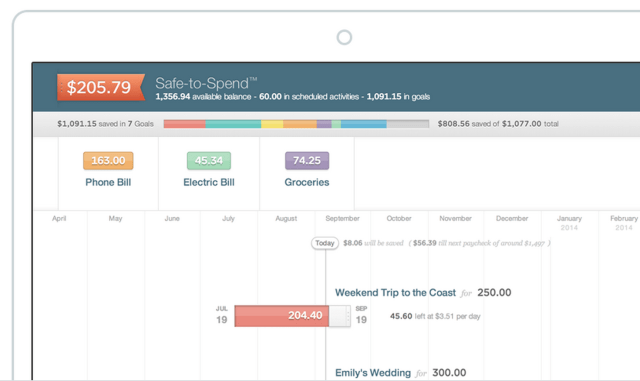

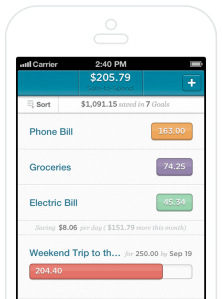

What makes Simple stand apart is its easy-to-use interface, better customer service, and an appeal to a higher-end customer base less dependent on cash, and more interested in well-designed money management tools.

Serve

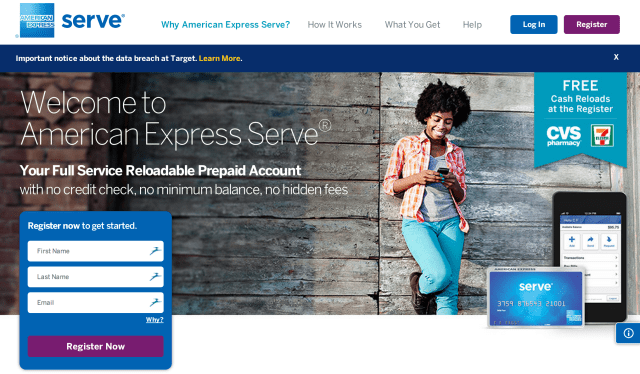

Meanwhile, Amex Serve is American Express’ “un-banking” alternative which also offers a prepaid account, which can be reloaded with cash from CVS and 7-Eleven stores across the U.S. Of course, Simple and Serve accounts can also be linked to your “real” bank account, if you’re too nervous to give it up for good.

Serve is actually more like T-Mobile’s option than Simple, which fails to address the needs of those who still deal in cash – think service industry professionals, those doing odd jobs or under-the-table work, anyone who takes in tips, etc. (Simple customers in need of depositing cash have to first convert it to a money order, then deposit that with the Simple mobile app. That’s a major hassle.)

The use cases for a Serve account are similar to that of T-Mobile Money – meaning, it’s for those needing a prepaid account with mobile access, bill pay, and an easy way to transfer money to other family members. Serve also offers a few value-add features, like a roadside assistance hotline, purchase protection, and other benefits reserved for Amex cardholders.

Reloads

Meanwhile, both Serve and T-Mobile have partnerships with reload networks for handing cash deposits. Serve works with MoneyPak and Vanilla Reload, while T-Mobile works with Reloadit, MoneyGram and Visa ReadyLink. For some users, these selections will matter in the sense that they may want to choose something that’s available at the local retailers they frequent, but for those just switching to a prepaid account for the convenience of easier, mobile banking, they are less of a concern.

Transfers

All three, T-Mobile, Simple and Serve, offer standard banking services: you can pay at point-of-sale or online, pay bills, use ATMs, get cash back, and add and transfer money. All also have way to transfer funds from person to person, too. Simple’s money transfer service is actually real-time, when recipients are also Simple users, but this is rarely the case.

Serve lets you transfer money into sub-accounts (great for older kids, or not-so-thrifty spouses), or to non-Serve members. But then they have to register for Serve to accept the funds. Meanwhile, T-Mobile’s service lets you send money to other T-Mobile card holders – but you’ll need to know their phone number and last four digits of their card number, so it’s clearly designed with families in mind.

ATM Access

ATM access is something T-Mobile is touting as a huge benefit, claiming 42,000 in-network ATMs in the U.S. That means no ATM fees at a lot of places. However, Simple actually has more locations, with 55,000 Allpoint ATMs, the country’s largest surcharge-free network. Meanwhile, Serve offers only 22,000 MoneyPass ATMs in its network.

Other Fees

The fee structures between the three services are fairly competitive. For those with concerns in a specific area, it’s worth noting who charges what for which options. But at the end of the day, the decision to move to one of these services or other un-banks options is a personal one, and one that may be less about the pennies saved and more so about the convenience each provides.

The fee structures between the three services are fairly competitive. For those with concerns in a specific area, it’s worth noting who charges what for which options. But at the end of the day, the decision to move to one of these services or other un-banks options is a personal one, and one that may be less about the pennies saved and more so about the convenience each provides.

For those still heavily involved with cash, Simple is a poor choice for now. For T-Mobile customers, it makes more sense to choose the carrier’s option over Serve, given the benefits. (Same goes for Boost Mobile customers, perhaps.)

But those ready for the next step up from struggling between paychecks may find Simple more useful – it lets you analyze your spending, set savings goals and manage budgets. It’s mainly going after the higher-end customer who wants to “replace their bank,” with more human and caring customer service.

Who To Choose?

T-Mobile will get the headlines today for its “revolutionary” new service, but what it’s offering is neither a first in terms of carriers getting into mobile money management, nor is it remarkably different from competitors. But in an era when everything is shifting to mobile at such a rapid pace that entire markets – like PCs, Windows, BlackBerry, etc. – are in decline, it makes sense for T-Mobile to try its hand with Mobile Money.

Comment