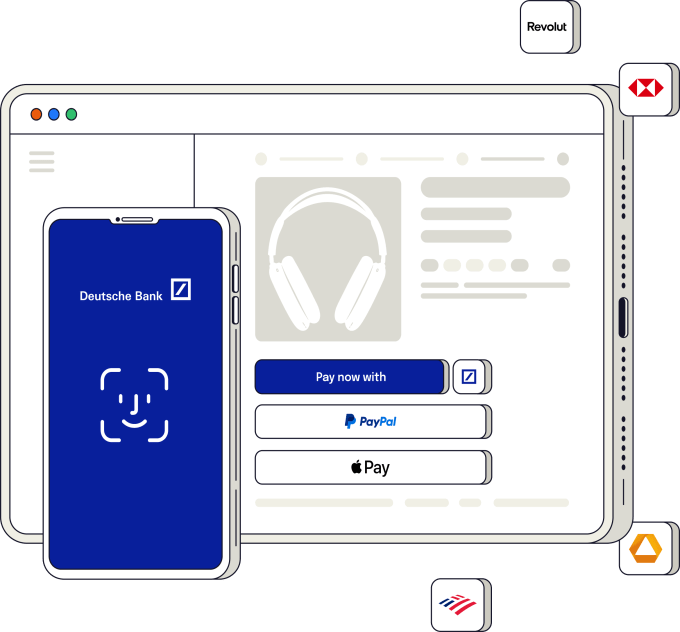

Open banking — where traditional banks open up their data with APIs to build new financial services for their customers — has the potential to be one of the payment world’s big disruptors: get it to work right, and it could supplant giant networks (and network fees) like Visa’s when it comes to taking and making payments wherever you might be. Today, a startup out of Berlin called Ivy, which has built an API to create a “network of networks” for open banking payments globally, is announcing some funding in its bid to make that a reality.

Its focus is open banking-based payments, which today are growing in individual markets — there are more than 400 open banking tech providers in Europe alone — but are largely limited to domestic transactions made on single currencies. “The key insight we had was that open banking is going global, but the technology is very domestic,” Ferdinand Dabitz, Ivy’s CEO, said in an interview. “Interoperability is key from the consumer perspective. We believe that 10 years from now there will be a single point of contact in open banking, just as Visa has created for card payments. So even if it’s not global now, a global network is what has to be built.”

The company has raised $20 million in a Series A round of funding that will be using both to expand its banking deals into more geographies, and to continue picking up more merchant customers in those markets to build out its business, which includes not only tools for merchants to integrate open banking payment account options at check-out, but also “smart routing” (to remember users’ info if they opt in and to choose bank data connections for maximum transaction speed), risk management, instant payouts and payment links.

Valar Ventures, the big fintech investor, is leading this round, which is coming only five weeks after Ivy made public a $7.7 million seed round led by Creandum. (A series of big-name individual investors, full of fintech founders and execs, also participated.)

Dabitz, who co-founded the company with Peter Mosebjane Lieck (CRO), Joshua Becker (CPO) and Simon Wimmer (CTO), said the Series A was only raised after the seed was closed, so this was a fast turnaround.

Is that a signal that tides are shifting again in the world of fundraising, which has dried up in so many ways since 2021? Possibly, but possibly not: Dabitz tells me that there are a couple of very big deals that Ivy has yet to announce with major payment service providers that it will be partnering with to power their own open banking offerings.

He declined, several times, to name which providers these are, but the basic thing to know is that PSPs’ businesses these days are largely focused around card payments and so building open banking is not only a distraction but potentially cannibalizing in other ways. On the other hand, giving that option to customers, and trying out the technology, are importing for hedging business. Hence, partnerships — deals that represent potentially very big revenue funnels for a company like Ivy. Hence, the interest from an investor like Valar, which will in any case want to spread its own bets widely.

And given some of the deals we’ve seen among open banking startups already — Sweden’s Tink was acquired by Visa for $2 billion in 2021; TrueLayer was last valued at over $1 billion; and just a couple of months ago U.K.’s Volt raised at a $350+ million valuation — there is definite opportunity for the right teams and technology.

(Andrew McCormack, one of the co-founders and a general partner at Valar, led this round, but it’s notable too that another co-founder at Valar is Peter Thiel — one of the co-founders of PSP giant PayPal.)

All of the above speaks to activity, but other aspects of fundraising are still relatively conservative at the moment: I understand from sources that the deal was done at a valuation of $80-$90 million.

The company itself is still relatively small. Dabitz says that Ivy currently has some 5,000 banks across 50 geographies, covering a footprint of 500 million bank accounts in total, integrated with its platform. The platform currently services EMEA, Southeast Asia, the U.S. and soon Latin American markets that are getting open banking off the ground. Customers include online merchants in marketplaces, e-commerce, travel and fintech. (Apple reseller Mactrade is one of its bigger customers.)

Banks are signed on to Ivy for free and they are not technically its customers — merchants who integrate its API are: they pay fees to Ivy on a sliding scale dependent on the volume of transactions. Dabitz does not disclose the number of merchants it has, nor how many transactions have been made on its platform, nor the percentages it charges, except to say that it works out to be less expensive than taking card payments.

The lower fees are one of the main selling points for integrating open banking services. But it still leaves a big question on the table: How enthusiastic will customers be to use open banking as a real alternative, or even replacement, for cards?

The answer to that question is the one that a lot of open banking companies, and other financial services business, are watching keenly. For now, there are only some 60 geographies globally that have rolled out or implemented open banking regulations — Pix in Brazil, UPI in India, FedNow in the U.S. and Open Banking in the U.K. are some of the bigger standards out there already — although how they are being implemented by banks and merchants, and used by consumers, vary widely.

It remains a big area, though, while Ivy believes that building more than just a functional API with other financial tools wrapped around it is what will help drive business, that potential of disrupting the current status quo is what will keep investors interested.

“Ivy is building for account-to-account what Visa and Mastercard have built for cards: a single, global point of access for merchants and consumers,” Valar’s McCormack said in a statement. “Driven by a powerful payments platform and sophisticated smart routing that drives conversion and success rates for businesses. The market demand for Ivy’s solution is extremely impressive.

Comment