African financial institutions typically scale their solutions using a mix of local and foreign tech. Appzone is one of the standout local fintech software providers for banks and fintechs, providing better pricing and flexibility.

For over a decade, the Nigeria-based Appzone has functioned as an enabler (at payment rails and core infrastructure) within banking and payments, building custom software and software-as-a-service products for over 18 commercial banks and more than 450 microfinance banks across Africa, including Ghana and Kenya.

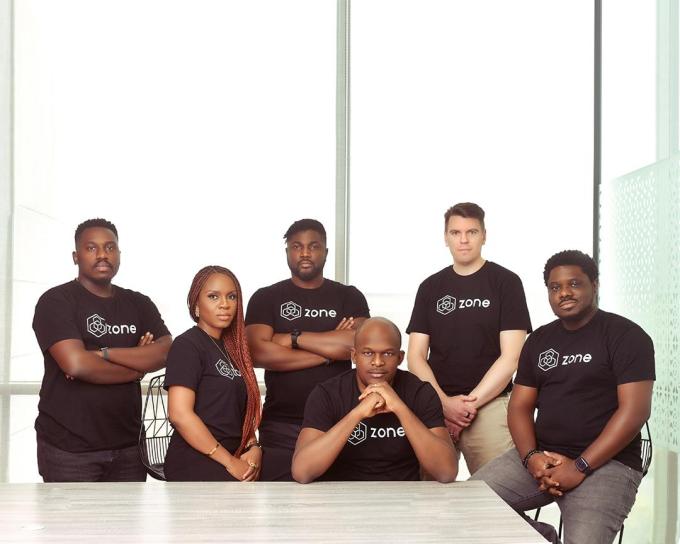

In 2022, the fintech software provider, founded by Emeka Emetarom, Obi Emetarom and Wale Onawunmi, decided to self-innovate by delving into blockchain technology and integrating it with legacy banking and payment systems. As such, it rebranded to Zone, a licensed blockchain-enabled payment infrastructure company–and carved out its original banking-as-a-service business into a separate standalone company, Qore. Today, Zone, its blockchain network that enables payments and acceptance of digital currencies, is announcing that it has raised $8.5 million in a seed round.

Zone’s concept is straightforward: It recognizes that Africa’s current payment infrastructure may not be suitable for transitioning to a cashless future (which may take some time). Therefore, the fintech is developing an interoperable payment infrastructure using blockchain technology — known for its ability to scale infinitely — to connect banks and fintech companies, facilitating transaction flow without intermediaries.

Nigerian fintech Appzone raises $10M for expansion and proprietary technology

In an interview with TechCrunch, CEO Obi Emetarom says Zone is Africa’s first regulated blockchain network for payments and has already signed up over 15 of the continent’s largest banks. It is currently processing domestic transactions for seven of these banks through ATM channels, one of several payment channels through which transactions originate in Nigeria, including POS, fund transfer, web and direct debit.

According to the chief executive, eight banks are at various stages of implementation as onboarding processes can take up to six months due to internal procedures such as setting up staging environments, testing and obtaining management approvals.

Zone, before its launch, obtained a switching license from the Central Bank of Nigeria (CBN), the country’s apex bank, tapping into Nigeria’s central switch (Nigeria Inter-Bank Settlement System), which is responsible for the interoperability between various players in the country’s financial system and the swift movement of money between bank accounts.

Since the central switch primarily handles fund transfer switching, a few fintechs, like Moniepoint and OPay, have used direct card routing (DCR) to establish direct connections with card issuers, leading to faster transactions with fewer failures for POS transactions, which is Zone’s next focus.

“We’re launching and rolling out some new use cases this year. The ATM use case didn’t incorporate fintechs because they don’t deploy ATMs,” said Emetarom. “But with the POS, that brings a use case fintechs are very familiar with – and for that, we are also integrating some of the big fintechs in the country.”

Emetarom explains that Zone aims to empower banks and fintechs to replicate the achievements of OPay and Moniepoint without the necessity for individual integrations. He said that Zone already has these integrations in place and operates as a licensed switch, thus avoiding the risk of violating regulatory guidelines. The blockchain architecture, he added, is such that when a fintech connects to the Zone network, it is provided with a gateway that serves as the environment through which its transactions are sent directly to the bank, to the issuer for authorization, and back.

“The bank or fintech becomes a switch because they now have something in their environment that connects them to all the destinations they need to reach rather than going through a third-party switch,” the CEO notes. “So the reliability goes up significantly because we dont have any scenario where they have to rely on a middle intermediary and the fintech has control over their switch because it’s sitting in their environment on their servers or the cloud.”

Emetarom stated that reconciliation and instant settlement are other imminent applications of Zone’s blockchain technology.

For instance, when a transaction fails and a customer is debited, a lengthy reconciliation process follows before a refund is issued, often taking days or weeks. Zone’s decentralized architecture will allow for automatic reconciliation and adjustment when discrepancies occur, leading to immediate refunds for customers without needing them to report the issue. In addition, its blockchain technology should provide transparency, allowing the terminal and the issuer complete visibility into the transaction status.

Similarly, merchants experience settlement delays when they receive funds. With Zone’s instant settlement feature, funds are delivered to the merchant’s bank immediately after the transaction, addressing liquidity challenges and ensuring smoother operations.

“Decentralized routing improves reliability and scalability and provides automated reconciliation to solve chargeback fraud. With Zone, we can harmonize transaction processing and the settlement system, which will be supported by a settlement token,” said the CEO, adding that these functionalities will be rolled out pending approval from the CBN.

The payments switch and financial network landscape in Africa typically rely on bank consortiums for infrastructure ownership. Private initiatives have seen mixed success, with few gaining significant traction outside traditional banking; Zone, being one of them, stands out due to its founders who are veterans of the banking industry, a live processing client base, and central bank licensing.

So far, Zone has processed transactions at more than 6,000 ATMs for more than 10 million cardholders. Within three months of launching the ATM use case, the fintech processed over $1 million.

This traction has garnered excitement among its investors. Flourish Ventures, a global fintech-focused fund, and TLcom Capital, a pan-African venture capital fund, co-led the funding round, which Zone says will assist it in launching additional functionalities and broadening its network coverage to other payment channels, thereby catering to a wider range of clients. In addition, the company, which doesn’t charge implementation fees, hopes to reduce the time it takes to onboard its clients (fintechs and banks) in the coming months.

TLcom Capital’s Ido Sum said Zone’s blockchain technology solves a critical payments system challenge and can potentially drive down costs for hundreds of millions of consumers and businesses that rely on digital payments in Africa daily, hence his firm’s backing.

“For the first time in Africa, Zone’s technology enables direct communication between participants in the payment ecosystem. We believe this is a fundamental leap that will allow customers to experience a completely new standard of reliability, speed, and cost efficiency at ATMs, POS machines, and online,” added Ameya Upadhyay, a partner at Flourish Ventures. “We are excited by the potential for Zone’s technology to be replicated across borders to advance payment innovation globally.”

Comment