Finerio Connect, a Mexico City-based fintech startup, raised $6.5 million in new funding to continue development on its open finance platform providing access to personalized financial products and services.

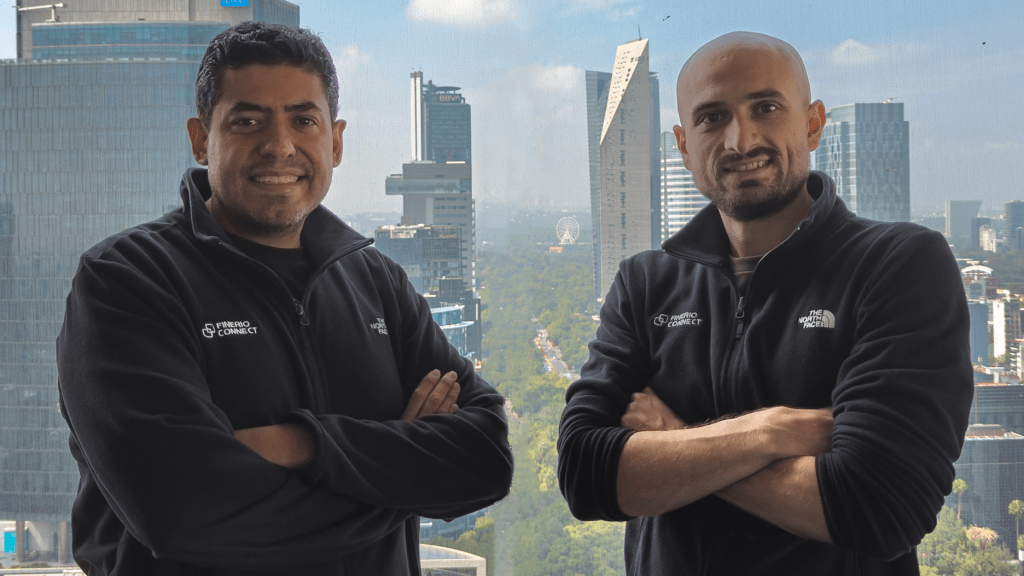

Nick Grassi and José Luis López, both co-CEOs, started the company in 2018 with the vision of enabling the compliant sharing and consumption of financial data and data analytics across Latin America.

Prior to that, Grassi, an American, moved to Mexico on a Fulbright Scholarship. As part of that, he began working at Deloitte Consulting Mexico, where he met Lopez.

“This was around 2016, and we were tasked with starting the early fintech practice, and the industry itself was just getting started,” Grassi told TechCrunch. “We were helping a lot of different companies — banks, payment processors and insurance companies — figure out what the fintech wave might mean for them.”

Grassi and Lopez got to thinking about platforms, like Mint, where you could control your personal finances. The pair eventually created their own automated personal finance manager with Finerio Connect and launched it at TechCrunch Disrupt’s Startup Battlefield Latin America in 2018.

https://techcrunch.com/unified-video/finerio-at-startup-battlefield-latin-america-2018/

Knowing when to pivot

Shortly after the launch, Finerio was the fourth most downloaded fintech app that year, according to Grassi. In Mexico, the company gained about 250,000 users after one year.

Around that time, Mexico’s fintech law came out. It was one of the first countries in Latin America to regulate the industry. It’s widely known that Mexicans distrust banks, which is why an estimated 70% of the population of adults in Latin America are currently unbanked or underserved. One of the key provisions in the new law was related to transparency.

Grassi said the law hasn’t advanced much in the past five years. However, he and Lopez saw early signs of a move toward regulation around open banking, which both Brazil and Colombia were also doing. At the same time, the company was getting inbound requests by insurers, foreign banks and other fintechs asking Finerio to open up its technology.

“It became apparent to us that there was a need, so in 2020, we decided to pivot the company to business-to-business to be able to connect bank accounts, process data and analyze it to create a personal finance experience in a white label,” Grassi said.

That’s been the company’s focus ever since. It not only provides financial data aggregation and categorization, but also collaborates with regulators and financial institutions to implement and monetize that aggregation and the delivery of it in compliance with regulations.

8 Latin American VCs share why they’re brimming with optimism about the region’s startups

Open banking initiatives

Today, Finerio works with over 120 financial institutions and fintechs. Last year, the company launched an API hub with Visa and OzoneAPI and began piloting it in several countries. The hub offers products and services, including digital payments, credit and personal finance management. It also provides a place for financial institutions to comply with new open banking regulations.

In the past 18 months, usage of the API grew 700%, Grassi said. Finerio is also poised to reach another 40 financial institutions in the next year. The company charges customers a minimum usage fee and then a variable fee on top which is dependent on how much data the customer is consuming. In the past year, Finerio had over $1 million in annual recurring revenue.

The new $6.5 million in equity financing was led by Third Prime with participation from strategic investors Visa, Bancolombia Ventures and Krealo, Credicorp’s venture capital arm. Alaya Capital, Gaingels, Plug and Play and Winklevoss Capital also joined in with a group of angel investors associated with Guiabolso, Dock and ClassPass. Previously, the company had raised around $3.2 million SAFE notes.

“We believe that government support of open banking initiatives across LatAm, together with the enormous population of underserved consumers, creates a tremendous opportunity to create value for investors and to meaningfully increase the financial well-being of historically disadvantaged consumers,” Mike Kim, general partner at Third Prime, said in a written statement.

Meanwhile, Grassi has already deployed some of the funds into making some key hires, including chief technology officer José Santacruz López, who held that previous role at Kushki. The company will also be expanding its API hub in two additional countries and grow usage overall.

“We’re talking about getting multiple banks onto the same standard by creating what we are calling ‘the HTML of open banking,’” Grassi said. “It’s quite a complex product, but we’re getting a lot of interest and running a couple of pilots. Our goal is to take time to convert those from pilots into customers.”

Latin America’s Q3 2023 venture results show glimmers of light

Comment