As the United States entered its first wave of COVID-19 lockdowns, there were wide expectations in startup land that a reckoning had arrived. But the expected comeuppance of high-burn, high-growth startups fueled by cheap capital provided by venture capitalists raising ever-larger funds, failed to arrive.

Instead, the very opposite came to pass.

Layoffs happened swiftly and aggressively during the early months of the pandemic era. But by the middle of Q2, venture activity had warmed and third quarter dealmaking felt swift and competitive, with some investors describing it as the hottest summer in recent years.

But somewhat lost amongst the splashy megarounds and high-interest IPOs that can dominate the news cycle were seed-stage startups. The raw little companies that represent the grist that will shape itself into the next set of giants.

TechCrunch explored what happened in seed investing to uncover what was missed amidst the storm and fury of late-stage startup activity. According to a TechCrunch analysis of PitchBook data and a survey of venture capitalists, a few trends became clear.

First, the pattern of rising seed-check sizes seen in prior years continued despite the tumultuous business climate. Second, more expensive and larger seed deals were not only caused by excessive capital present in the private markets. Instead, COVID-19 shook up which startups were considered attractive by private investors. And the changeup did not necessarily raise their number.

Let’s dig into the data and see what it can teach us about this wild year. Then we’ll hear from Eniac Ventures’ Nihal Mehta, Freestyle’s Jenny Lefcourt, Pear VC’s Mar Hershenson and Contrary Capital’s Eric Tarczynski about what they saw in 2020 while writing a chunk of the checks that our data encompasses.

The American seed market in 2020

If you didn’t think much about seed in 2020, you’re not alone. Late, huge rounds consumed most of the media’s oxygen, leaving smaller startups to compete for scraps of attention. There was so much late-stage activity — around 90 $100 million or larger rounds in Q3, for example — it was difficult for smaller investments to command attention.

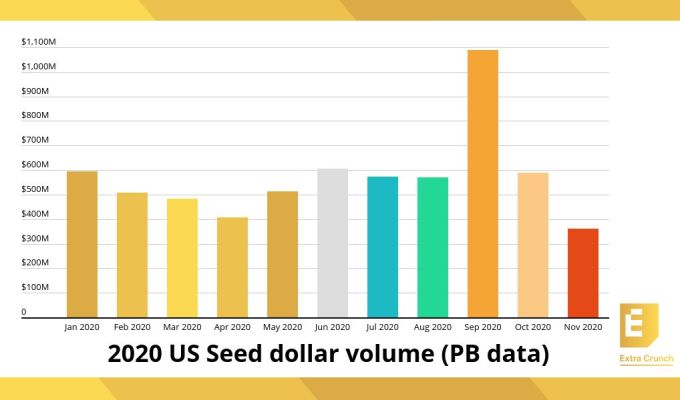

But despite living in the background, the dollars invested into seed-stage startups in the United States had an up-and-down year that was fascinating:

Seed dollar volume fell as Q1 progressed, reaching a 2020 nadir in April, the start of Q2. But as May arrived, the pace at which investors put money into seed-stage startups accelerated, recovering to January levels — which is to say, pre-pandemic — by June. The COVID dip, for seed, then, was a short-term affair.

Reforged dollar volume continued during the summer. Then an epic September result in terms of seed dollars invested in the month turned Q3 into a madhouse when compared to the preceding two quarters of the year.

U.S.-based seed-stage companies raised $1.58 billion in Q1. That number fell to $1.53 billion in Q2, the period’s late recovery falling just short of the first quarter’s front-loaded tally. Then Q3 2020 saw $2.23 billion in total capital invested into domestic seed-stage startups, a nearly 46% gain from one quarter to the next.

That sharp gain is the boom that we’ll hear startup investors discuss shortly.

But before we move on from data to humans, what should we make of Q4? Seed data is infamously laggy, so don’t read too much into the small November data point. And, of course, we’re still in December so we don’t have data for the month yet. But October, the first month of Q4, was effectively tied for the second-best month of the year in terms of seed dollars invested.

The fourth quarter started well. We’ll have to wait for the rest of the data to know more.

Our seed data is interesting, but the reasons behind the huge change from April’s dismal results to September’s capital geyser is even more interesting. It’s a story of how COVID-19 shook up the entire startup market, shifting the limelight and leaving some companies in the dark.

We’ll start by addressing outliers, which can sometimes dominate chatter but aren’t necessarily indicative of the entire scene. But even the outliers marched to the new beat of the 2020 drum.

Outliers

The median 2020 seed deal started in January worth $2 million, but that figure fell to $1.7 million in April before rebounding to $2.97 million in October. Perhaps unsurprisingly, median deal size correlated this year with how much money was flowing into seed startups.

The rising median seed check size was influenced by some outside rounds that came with stupendous valuations.

We saw Clubhouse raise $10 million at a $100 million valuation while still in beta, and Pave, a Y Combinator startup, landed a $75 million post-money valuation ahead of Demo Day. Notably, both those rounds were led by the spendy Andreessen Horowitz, a Silicon Valley investment firm that closed some money of its own this year.

But more than the outliers and how they have pushed the numbers one way or another, there were enough seed deals every month that the extremely large ones probably only had some impact. Instead, the investors we spoke to said the largest seed deals they completed in 2020 were between $4.5 million and $5 million. Those checks were in turn sometimes coupled with valuations heading toward $15 to $20 million on a post-money basis.

Founders don’t need to be full-time to start raising venture capital

That polling is calmer than what a16z’s deals might lead you to believe, but the rising median deal size does underscore an active, competitive seed market.

Let’s narrow our gaze and dig into how so many deals got larger in 2020. As we’ll learn from our investor posse that we corralled for this piece, the combination of ample, cheap money and a global pandemic shaking up how the human race lives and works was more than enough to ignite a seed scramble that VCs are scrambling to keep up with.

The new why

Jenny Lefcourt of Freestyle said investors started paying a premium for companies that were thriving during COVID-19 or were positioned to thrive post-pandemic. Perhaps as a result of this, Freestyle’s median deal size and valuations “have increased without question,” she said in an email to TechCrunch.

But merely finding a startup that is well-positioned for 2020 and beyond was not the whole game. Competition amongst venture capitalists for the right to put capital into startups that were doing well pre-pandemic and even better during (as well as those that turned from swine to pearls) has been fierce as well.

“I think seed prices are being driven up by the larger [venture] firms playing earlier and feeling like they cannot afford to miss the next DoorDash,” Lefcourt said. “I think the larger firms have so much capital to put to work and feel they are better off ‘burning’ some [cash] at seed for the upside of being in the right [startups] where they can double, triple, 10x down on their winners.”

The theme of more capital than suitable startups was echoed by Eric Tarczynski, the founder and managing partner of Contrary Capital. “There’s the exact same amount of institutional capital chasing a much smaller subset of companies [and] sectors deemed winners in COVID,” he said.

The investor’s point underscores how the pandemic erased the market for startups in certain sectors, such as hospitality, travel and restaurants — while driving a boom in other categories, such as digital health, fintech and edtech. It creates a bottleneck effect, lifting up the winners and eradicating the losers; even more, the pandemic may have narrowed the slice of startups that are considered worthy to graduate to their next funding round.

“In many ways [the changed startup market] made it more efficient for seed founders to raise capital. On the other hand, [the post-COVID-19 seed investing market] made it extraordinarily difficult to raise capital if you were struggling or not in a ‘chosen’ space,” Tarczynski told TechCrunch.

Mar Hershenson, co-founder of Pear VC, said that in the long term, the market should expect to see a lot of “seed death,” where early-stage startups die in clumps — and some super-winners: startups slingshotted into orbit by the pandemic.

Hershenson’s views fall in line with the fact that most startups fail and is a healthy reminder that a boom in seed investing won’t sort itself into hard outcomes for years to come.

But something that is having an impact today is a regression to seed investing conservatism. Early-stage investors are ratcheting down perceived risk in their investing patterns. This is why the COVID-accelerated startup categories are enjoying a seed boom — investors are betting on today’s obvious success over what could be tomorrow’s transformative tech that has yet to bloom.

But revanchism to seed investing conservatism is also changing the face of who gets access to capital.

Nihal Mehta, one of the founding partners of Eniac Ventures, said “more capital piling into deals that are viewed as high quality by traditional metrics, [such as] known or successful serial founders starting a company in a similar or adjacent space.”

“This was amplified by the fact that because you can’t meet in person, investors felt way more comfortable investing in ‘proven’ entrepreneurs that had pre-existing connections to their social circle,” Mehta added.

As COVID-19 era drags on, VCs look beyond Zoom calls for due diligence and sourcing

The result of this is reversion to older investing patterns is not neutral. Inner circles in venture capital often scream white and male, though, and as Mehta pointed out, this is “likely a net negative” to diversity in thought in funded startups.

The data agrees. After years of slow progress, the diversity of fundraising in 2020 took a step backward, which could have long-term ramifications. Let’s look into it.

Hurdles and the future

PitchBook data shows that female founders raised $13.75 billion across 1,702 deals this year, representing 23.3% of total VC financing activity. That result is down from 23.8% the year prior, indicating the first dip in over a decade.

Furthermore, PitchBook’s data details that funding for female founders has fell 31% during the first three quarters in 2020, compared to the same time period last year.

Early on in the pandemic, investors and founders predicted a drop in funding for underrepresented groups, including female founders, as risk tolerance went down. Like clockwork, this is precisely what happened. Slow structural change, pervasive gender bias and childcare responsibilities also hurt funding totals and the drive to raise funding in the first place.

Seed’s impressive recovery makes the decline in funding for female founders even more disappointing.

Venture capital as an asset class has survived the pandemic’s stress test. Of the investors polled, all are either thinking about or planning to raise money in the next year to keep up with the demand for seed-stage checks (or declined to comment for obvious and fair reasons). So, while we know that the rest of the decade will bring more deals and more dollars, let’s hope that the money is going toward a more diverse pool of startups.

We aren’t hopeless. Promising vaccine news could change which sectors are venture-attractive, crushing the winners and turning the faucets back on for pandemic-specific losers. In-person meetings could bring back the opportunity to invest in a more diverse group of founders. The steady drumbeat of the democratization of venture capital means more money could get into more diverse hands, leading down to a network effect that lifts up the underrepresented.

None of us could have expected a year quite like 2020 and the same goes for the year ahead. Onward and upward.

Comment