I co-founded a software startup in December. Each month, I send out an update to our investors to keep them updated on our progress. But the past month was a bit different — our industry (retail) is going through a transformation.

Instead of just writing about our “internal” news, I wrote about the impending apocalypse in the broader world of retail. More specifically, I included some thoughts on Amazon and why their commanding lead is only going to get larger. Amazon is the most impressive company on earth, and I think it is one of the least understood. A few people suggested that I post this publicly, so here goes.

My first company, an auto parts manufacturer, sold to Amazon both as a vendor (where Amazon issues purchase orders for bulk product) and as a “Marketplace seller” (where Amazon takes a cut of a third-party sellers’ products sold on Amazon.com) — so I have some insight into Amazon’s internal operations and initiatives that aren’t often publicly discussed.

I’ve followed AWS and Amazon’s other various offerings for some time, as well, and Amazon as a company has become something of a personal obsession of mine. I have some further thoughts on Amazon and the impending retail apocalypse that I wanted to share for those who are interested in the overall future of retail.

Consensus is that we’ve hit a tipping point and the retail industry is finally seeing some major collateral damage from Amazon’s monster growth — and mainstream/non-tech news has started giving this a lot of coverage. There is a lot of discussion about whether Amazon’s advantage is sustainable or whether other retailers (namely, Walmart) will be able to mitigate Amazon’s dominance as they start to replicate Amazon’s model.

Most of the analyses I read focus on Amazon’s broad advantages — what I’ll call “bullet-point moats” — and then evaluate whether each program is replicable by a competing retailer like Walmart. The programs are well-known by most in the tech world; examples include Amazon Prime 2-day (or 1-hour) delivery, Amazon Marketplace (where third-party sellers can sell items alongside Amazon’s own listing), Amazon Go stores (Amazon’s physical, cashier-free retail locations) and Amazon’s drone program.

The truth is that each of these is feasible for a large competitor to replicate and it’s reasonable to think that Walmart could build or acquire these capabilities within the next few years. The key component to profitable 2-day (or 1-hour) delivery is the customer’s proximity to a distribution center. Walmart already has 150+ distribution centers — considerably more aggregate square footage than Amazon’s fulfillment centers — though they are optimized for restocking their (11,500!) stores via Walmart’s network of (6,000!!+) trucks.

Walmart has a proven ability to build out distribution capacity and they should be able to manage reconfiguring their network for e-commerce fulfillment without too much difficulty. And while Amazon is building out the full gamut of critical last-mile delivery solutions (drones, delivery robots and an on-demand human delivery network called Amazon Flex), there are plenty of “third-party” startups in each of these areas that could provide Walmart a reasonable degree of parity.

This all said, I believe that Amazon is the most defensible company on earth, and we haven’t even begun to grasp the scale of its dominance over competitors. Amazon’s lead will only grow over the coming decade, and I don’t think there is much that any other retailer can do to stop it.

The reason isn’t the bullet-point moats that are talked about in headlines, and it isn’t the culture of innovation or Bezos’s vision as CEO (though I do think Amazon’s culture is incredible and Bezos is the most impressive CEO out there). It’s the fact that each piece of Amazon is being built with a service-oriented architecture, and Amazon is using that architecture to successively turn every single piece of the company into a separate platform — and thus opening each piece to outside competition.

I remember reading about the common pitfalls of vertically integrated companies when I was in school. While there are usually some compelling cost savings to be had from vertical integration (either through insourcing services or acquiring suppliers/customers), the increased margins typically evaporate over time as the “supplier” gets complacent with a captive, internal “customer.”

There are great examples of this in the automotive industry, where automakers have gone through alternating periods of supplier acquisitions and subsequent divestitures as component costs skyrocketed. Divisions get fat and inefficient without external competition. Attempts to mitigate this through competitive/external bid comparison, detailed cost accountings and quotas usually just lead to increased bureaucracy with little effect on actual cost structure.

The most obvious example of Amazon’s SOA structure is Amazon Web Services (Steve Yegge wrote a great rant about the beginnings of this back in 2011). Because of the timing of Amazon’s unparalleled scaling — hypergrowth in the early 2000s, before enterprise-class SaaS was widely available — Amazon had to build their own technology infrastructure. The financial genius of turning this infrastructure into an external product (AWS) has been well-covered — the windfalls have been enormous, to the tune of a $14 billion annual run rate. But the revenue bonanza is a footnote compared to the overlooked organizational insight that Amazon discovered: By carving out an operational piece of the company as a platform, they could future-proof the company against inefficiency and technological stagnation.

In the 10+ years since AWS’s debut, Amazon has been systematically rebuilding each of its internal tools as an externally consumable service. A recent example is AWS’s Amazon Connect — a self-service, cloud-based contact center platform that is based on the same technology used in Amazon’s own call centers. Again, the “extra revenue” here is great — but the real value is in honing Amazon’s internal tools.

If Amazon Connect is a complete commercial failure, Amazon’s management will have a quantifiable indicator (revenue, or lack thereof) that suggests their internal tools are significantly lagging behind the competition. Amazon has replaced useless, time-intensive bureaucracy like internal surveys and audits with a feedback loop that generates cash when it works — and quickly identifies problems when it doesn’t. They say that money earned is a reasonable approximation of the value you’re creating for the world, and Amazon has figured out a way to measure its own value in dozens of previously invisible areas.

But this much is obvious — we all know about AWS. The incredible thing here is that this strategy — in one of the most herculean displays of effort in the history of the modern corporation — has permeated Amazon at every level. Amazon has quietly rolled out external access in nooks and crannies across their entire ecosystem, and it is this long tail of external service availability that I think will be nearly impossible to replicate.

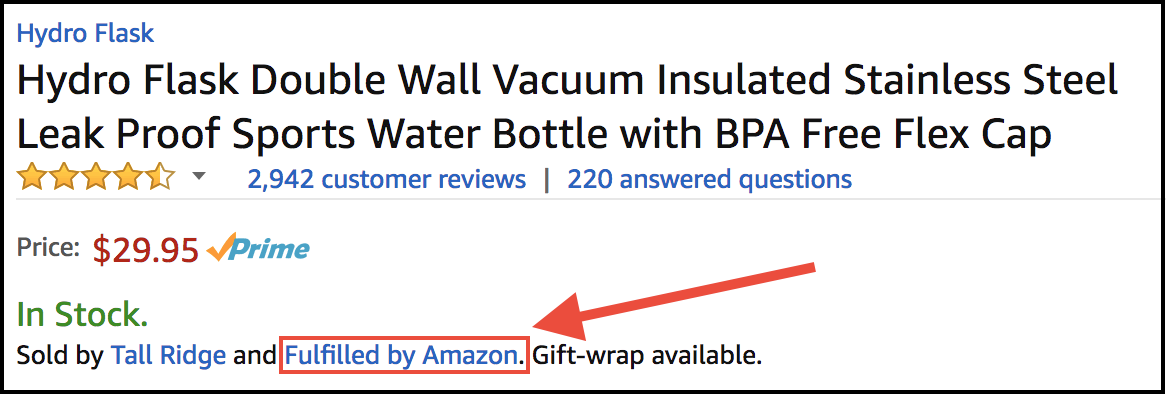

The broadest example of this is the Fulfillment By Amazon (FBA) program. If you’ve ever ordered a product from Amazon that says “Sold by {Company} and Fulfilled by Amazon,” you’ve seen FBA in action.

With FBA, Amazon allows third-party sellers to ship bulk inventory to Amazon — Amazon stores this inventory (which the seller still owns) in Amazon’s fulfillment center, ships the product to the Amazon customer when the order is placed and even handles all of the returns and customer service. The rates are incredibly competitive. And FBA isn’t limited to items sold on Amazon — sellers also can use Amazon’s “multi-channel fulfillment” option to ship non-Amazon orders to the seller’s customers. An example of this would be if Hydro Flask operated their own separate e-commerce store on Shopify — when a customer places an order on the Shopify store, Hydro Flask can send the order to FBA (you guessed it — via an external API) and FBA will ship it directly to the customer.

The benefit for Hydro Flask is obvious. They can have the product manufactured in China, and use a freight forwarder like Flexport to ship the product directly from the factory to Amazon’s warehouse — and thus avoid the headache (and overhead) of operating their own warehouse. For Amazon, the surface benefits are numerous: a) better utilization of excess capacity, b) increased shipping volume / leverage with UPS/FedEx, and c) revenue from the fulfillment services (which, combined with Marketplace commissions and “other third-party seller services,” totaled a whopping $6.4 billion in Q1 2017 — or 25 percent of Amazon’s total revenue).

But again, the enduring benefit here is the improvement that comes from opening up Amazon’s internal fulfillment operation to outside users. Fulfillment and shipping is Amazon’s largest cost center and, with a huge human component, it is the one that is most susceptible to bloat.

The level of discipline required to operate a multi-tenant, externally facing service like FBA yields tremendous benefit to the Amazon’s internal operation — this isn’t some hacked-together, homegrown tool that is hard-coded to Amazon’s own needs and thus nearly impossible to improve.

xIt is a relatively clean, abstracted, service-based interface that is “owned” by a separate team — a team with responsibilities to external customers. Bezos has imbued a sense of customer worship within Amazon (“Earth’s most customer-centric company”), and Amazon has three distinct group of customers to worship: e-commerce shoppers (Amazon.com), developers (AWS) and sellers (Amazon Marketplace/FBA).

As a side note, I think FBA will be extraordinarily difficult for another retailer to replicate. The technological and organizational complexity of commingling inventory from literally hundreds of thousands of sellers is mind-boggling — particularly when you factor in the permutations that result from different settings toggled on a seller-by-seller basis.

Their automated system for routing and splitting of inbound shipments to optimal fulfillment centers (based on capacity, historical geographic distribution of customers and who knows what else) is a nontrivial task in and of itself. Amazon has been at this for 10+ years (FBA was launched in 2006), and I think the investment in FBA is a substantial part of the reason for their failure to make a profit (or, really, their choice to not make a profit) for the large part of the last decade.

The error rate had to be tremendous to start — I personally know of several sellers who have been reimbursed for tens of thousands of dollars in inventory that Amazon lost, no questions asked. Setting aside the massive technical challenges, what other retailer has the stomach to sustain such incredible losses in a program for so many years?

It seems obvious to me that Amazon will move into small-parcel shipping (UPS/FedEx/USPS) within the next five years. They are thumbing through their income statement and picking off the largest categories to “productize” — first technology (AWS), then fulfillment (FBA), then COGS (the actual products themselves via Amazon’s various private label programs), and next shipping. They’ve already started operating their own fleet of 40 cargo planes and thousands of tractor-trailers. They’ve built out dozens of parcel-sorting centers to reduce the fees they pay to existing small parcel carriers. And it’s a natural fit for their services model — they have tremendous internal demand and their existing services customers are perfect early adopters.

The key advantage that Amazon has over any other enterprise service provider — from UPS and FedEx to Rackspace — is that they are forced to use their own services. UPS is a step removed from backlash due to lost/destroyed packages, shipping delays, terrible software and poor holiday capacity planning. Angry customers blame the retailer, and the retailer screams at UPS in turn. When Amazon is the service provider, they’re permanently dogfooding. There is nowhere for poor performance to hide. Amazon has built a feedback loop as a moat, and it is incredible to watch the flywheel start to pick up speed.

Amazon has committed to this idea at a granular level. Even when it comes to services that can’t be sold, Amazon is still making a push to expose the services externally. The perfect example of this is Amazon’s Marketplace Web Service (MWS) API — this is the set of services that Amazon Marketplace sellers can use to programmatically exchange data with Amazon. Amazon built out a service that they call the “Subscriptions API,” which gives the seller instant notification of any price change by any competitor — including Amazon itself!

Amazon is externally exposing the tools it uses to set its own prices in order to guarantee that the price listed on Amazon is as low as possible for the customer. This has spawned a whole ecosystem of third-party price-optimization tools called “repricers,” which use the MWS API to automatically respond to price changes in order to maximize sales for the Marketplace seller (the WSJ published a great piece on this back in March, aptly likening it to high-frequency trading). The beauty here is that Amazon doesn’t care if a seller undercuts Amazon’s price — Amazon takes a 12-15 percent commission on the sale regardless, and then collects FBA fees to boot.

I could go on and on with examples. I’m on the email list for updates from AWS, Amazon Marketplace, Amazon’s Vendor program and a handful of customer-facing programs — they are systemically productizing the entire company, honing what works, fixing what doesn’t and killing off everything else. All of this reminds me of a Bezos quote:

“I very frequently get the question: ‘What’s going to change in the next 10 years?’ And that is a very interesting question; it’s a very common one. I almost never get the question: ‘What’s not going to change in the next 10 years?’ And I submit to you that that second question is actually the more important of the two — because you can build a business strategy around the things that are stable in time. … [I]n our retail business, we know that customers want low prices, and I know that’s going to be true 10 years from now. They want fast delivery; they want vast selection. It’s impossible to imagine a future 10 years from now where a customer comes up and says, ‘Jeff I love Amazon; I just wish the prices were a little higher,’ [or] ‘I love Amazon; I just wish you’d deliver a little more slowly.’

Product assortment, low prices and fast delivery are the keys to Amazon winning the retail game. With Amazon Marketplace, sellers can list millions of the hottest new products far faster than Amazon’s Vendor team could ever hope to discover them. It has built out a high-frequency trading platform that guarantees price competitiveness — and delivers a guaranteed minimum 12 percent margin for Amazon. Fast delivery comes down to operational excellence and an exceptionally low cost of shipping, both of which are accomplished by opening FBA to external customers. I don’t think anyone understands The Innovator’s Dilemma better than Amazon, and they’ve implemented a systemic solution that will maintain an unbeatable advantage over competitive retailers.

So, my opinion is that Amazon is uncatchable. It took Amazon 10 years to perfect FBA. Even if Walmart could do it in 5, where will Amazon be by the time they roll it out? And I haven’t even begun to touch the surface of Amazon’s lesser-known, industry-shattering programs like Seller Fulfilled Prime and Direct Fulfillment. I’m not sure we’ll see a mass-market retailer compete successfully against Amazon within my lifetime — though I still think there is a substantial opportunity for vertical-specific retailers like Chewy.com to spin up and gain some ground in the short term.

Amazon will only be brought down by an anti-trust case (though that’s a long way off, given that they only have a small percentage of total retail volume today) or a paradigm shift in how we consume physical products — the scenario that comes to mind is widespread adoption of massively immersive VR combined with intravenous nutrition (Soylent in 20 years) and universal basic income, which would obviate the need for physical products altogether. But that’s a ways off too.

Comment