fdic

First Citizens is acquiring $72B in deposits and loans from Silicon Valley Bridge Bank

First Citizens has agreed to buy Silicon Valley Bank, the California lender whose collapse sent shockwaves through the financial sector.

A lot has happened with SVB, and unless it’s your job to edit the news, it’s possible you missed a slice of the saga, if not the entire story. Here’s…

An auction for the remaining assets of the failed Silicon Valley Bank is reportedly underway, with final bids due this afternoon and a result potentially arriving late Sunday, according to…

Investor Mark Suster says a “handful” of bad actors in VC destroyed Silicon Valley Bank

Yesterday at around noon in Los Angeles, investor Mark Suster of the venture firm Upfront Ventures began urging “calm” on Twitter. Silicon Valley Bank had bungled its messaging on Wednesday…

The party’s over: Tips for tracking and reporting monthly startup expenses and revenue

With more VC funds wanting to see where every dollar is spent, it is essential CEOs understand how to accurately track and report monthly expenses and revenue.

Robinhood aims to court users by offering attractive 1% interest rate on cash

Investing app Robinhood is on a roll with announcing new features as it looks to appeal to more customers amid dwindling transaction revenue. Less than a week after unveiling plans…

Daily Crunch: Elon Musk unveils three-pronged strategy to fund his $43B Twitter purchase

Hello friends and welcome to Daily Crunch, bringing you the most important startup, tech and venture capital news in a single package.

Columbus-based Tribevest bags $3M for its collaborative investing platform

Tribevest founder Travis Smith went on a fishing trip with his brothers in 2008 that he says they couldn’t afford. It was then that he realized their “good jobs with…

Novo, the SMB neobank, nabs $90M at a $700M valuation

Novo, the startup building a new kind of banking service from the ground up for small and medium businesses, has closed a significant round of funding to take the next…

The late Harvard Business School professor Clayton Christensen found that in many sectors, low-end disruptors take hold at the bottom of the market and then work up to satisfy more…

With the finance world now leveraging tech to conduct business, financial services regulators are also developing new tech to monitor markets, supervise institutions and for administration.

In its first funding in 7 years, profitable fintech Lower raises $100M Series A led by Accel

Lower, an Ohio-based home finance platform, announced today it has raised $100 million in a Series A funding round led by Accel. This round is notable for a number of…

Synctera, which aims to serve as a matchmaker for community banks and fintechs, has raised $33 million in a Series A round of funding led by Fin VC. The raise…

SoFi acquires community bank Golden Pacific Bancorp to speed up its national bank charter process

SoFi, more formally known as Social Finance, announced today that it has agreed to acquire Golden Pacific Bancorp (GPB) for about $22.3 million. The dollar amount is not staggering. What…

Square’s bank arm launches as fintech aims ‘to operate more nimbly’

Known for its innovations in the payments sector, Square officially now has a bank. Nearly one year after receiving conditional approval, Square said Monday afternoon that its industrial bank, Square…

Mike Cagney is right now testing the boundaries of the US banking system

Founder Mike Cagney is always pushing the envelope, and investors love him for it. Not long after sexual harassment allegations prompted him to leave SoFi, the personal finance company that…

Teen banking service Step raises $50M, adds TikTok star Charli D’Amelio to investor list

Step, a mobile banking service aimed at teens, announced this morning it has raised $50 million in Series B funding after growing to over 500,000 users only two months after…

Betterment adds checking and savings products

Betterment, the New York-based automated advisory service for wealth management, is adding FDIC-insured checking and savings account services through partnerships with several banks. “It’s the culmination of something we’ve been…

The intersection of small business, tech and our financial system is more important than ever

Let’s focus on preserving jobs and providing relief to our economy’s beating heart — small businesses.

Featured Article

Recommendations for fintech startups navigating the procurement process

Payments and lending spring to mind as “classic” fintechs, but other models like regtech, compliance, human resources and marketing are on the ascent.

Money-transfer startup Remitly launches Passbook, a neobank aimed at immigrants

Last summer, the Seattle-based startup Remitly closed a $135 million round to go beyond money-transfer services into a wider range of financial products catering to its primarily-immigrant customer base. Today,…

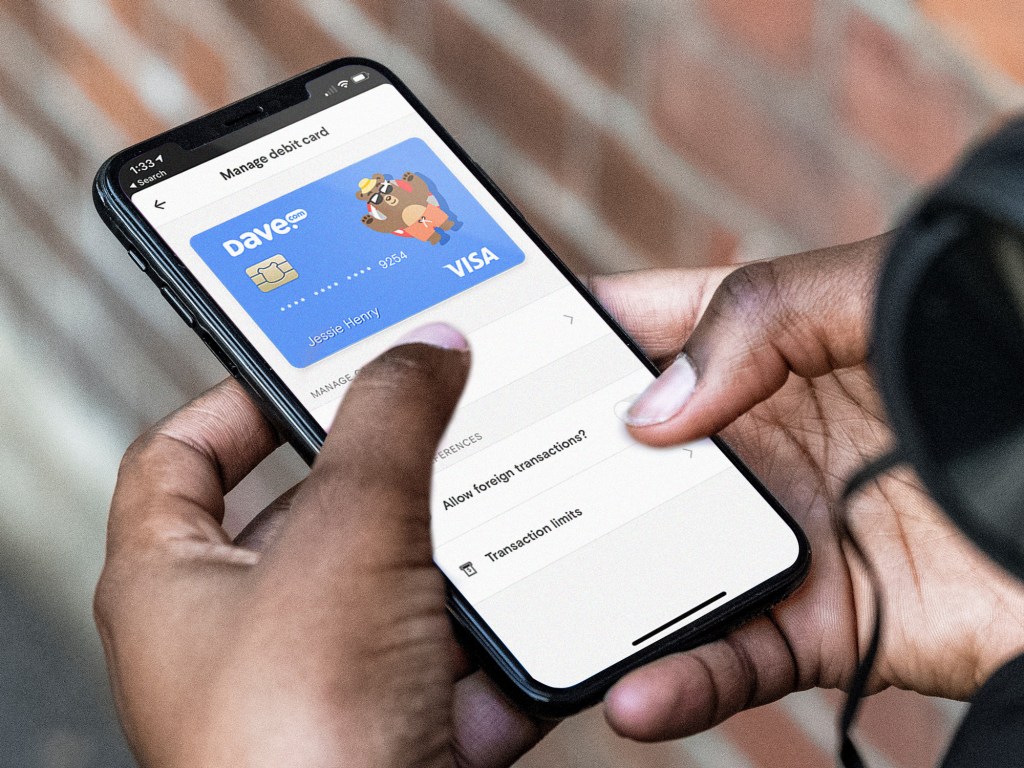

Upstart banking company Dave is now worth $1 billion, as Norwest puts in $50 million

Two years after the Los Angeles-based fintech startup Dave launched with a suite of money management tools to save consumers from overdraft fees, the company is now worth $1 billion…

Mitzvah-minded unicorn Cross River is on holy mission to foster bank-fintech harmony

“Then I took your ancestor Abraham from the other side of the Euphrates River and led him through the entire land of Canaan. I multiplied his descendants, and gave him…

Robinhood lacked proper insurance so will change checking & savings feature

Robinhood will rename and revamp its upcoming checking and banking features after encountering problems with its insurance. The company published a blog post this evening explaining “We plan to work…

Nigeria’s Piggybank.ng raises $1.1M, announces group investment product

Seeking to tap into Africa’s informal savings groups the Nigerian investment startup Piggybank.ng closed $1.1M in seed funding and announced a new product — Smart Target, which offers a more secure and…