Step, a mobile banking service aimed at teens, announced this morning it has raised $50 million in Series B funding after growing to over 500,000 users only two months after its official launch. The round was led by Coatue, with returning investors from Stripe, Crosslink Capital, Collaborative Fund and Will Smith’s Dreamers VC. The startup also added some celeb investors to this round, including Charli D’Amelio, Justin Timberlake and The Chainsmokers, as well as big names from the world of sports, like Eli Manning, Kelvin Beachum, Larry Fitzgerald and Andre Iguodala.

This is notably Charli D’Amelio’s first startup investment, Step tells TechCrunch.

The company had partnered with the TikTok star only a few weeks ago to promote the product and talk about financial literacy across her TikTok and Instagram accounts, which have 101.9 million and 34.4 million followers, respectively. Now she will do that not only as a partner and customer, but as an investor, as well.

“As a Step partner and customer, I’ve been able to see firsthand how easy Step makes it to manage your money while providing the educational resources that today’s teens need but have largely been unable to find—myself included,” said D’Amelio, in a statement. “I’m excited to be able to use my platform to help close this gap and have made a direct investment in Step to help them develop even more useful products.”

Other celeb investors may also promote the product on social media, including The Chainsmokers, but promotional deals aren’t finalized with the full list.

Smith, however, has been investing in startups in recent years at the seed stage.

“As a person who hasn’t always had financial stability, and made many mistakes in that arena as a young man, I know the importance of financial education and having access to economic platforms that can work for everyone,” Smith said, in a statement. “While I’ve tried to instill that same mentality in my own children it was hard to find a banking platform that was intuitive and met our needs as a family. We’ve reinvested in Step because not only are their products built specifically for teens but they’ve started an important conversation around financial literacy that kids are actually engaged in.”

Other participants in the round include fintech executives from Facebook, Square, Venmo, Visa and others. To date, Step has raised over $75 million.

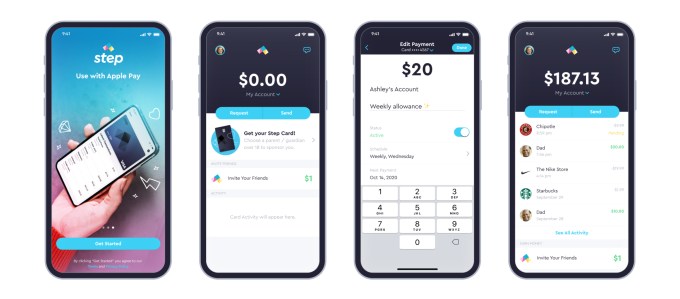

Though competing in the now-crowded space of mobile banking services, which replace traditional banks with an app on your phone, Step’s entry point to the market is different from most. It specifically targets teen users ages 13 to 18 by offering them an FDIC-insured bank account without fees, and a secured Visa card that helps them establish credit before they turn 18.

The app, meanwhile, also serves as a peer-to-peer (P2P) platform so they can send money to friends, similar to Apple Pay or Venmo.

Image Credits: Step

“I think the best way to think about it is ‘Venmo meets Chase for the next generation,’ ” explains Step founder and CEO CJ MacDonald. “You have to be 18 to be on Venmo or Cash app, and [with those] you have to have an underlying bank account attached to that to get money in or money out. And most people don’t use Venmo or Cash app to spend money — they just use it to send and receive,” he says.

Combining P2P and banking in one platform has proven so far to be fairly popular. Step says it’s now adding around 7,000 to 10,000 new accounts per day, on top of the existing 500,000-plus users it already has. Much of this has come from the organic, word-of-mouth growth offered by Step’s referral program, not paid ads. Step offers teens $3 (it used to be just $1) for every friend that signs up under their referral. The teens put the link in their Instagram bio or share it on Snapchat and soon they’ve made a decent amount of cash, even as much as $30 or $40.

In the near-term, Step plans to leverage its newly partnered celebs to help spread the word about mobile banking and financial responsibility across social media, and is hiring across the board in the face of its rapid growth. Longer-term, however, the company envisions helping teens take the next step in their financial future with new products when they turn 18.

“The average college student graduates with thousands of dollars of credit card debt. The average college student also overdrafts two or three times a year, and traditional banking overdraft fees cost $35 in most cases,” says MacDonald. “When you go to college or you turn 18, you’re going to need some level of help. So we absolutely will offer new financial products and services tailored toward that demographic,” he says.

These products may include credit cards, loans and more.

“Student loans are a big thing. Being able to extend credit to these folks. Being able to offer new products and services so they’re not paying these outrageous, predatory banking fees and high interest credit cards,” MacDonald, says, speaking to Step’s plans, “we’re really going to push the envelope and offer new types of products and services that are cost-effective,” he adds.

Step, based in San Francisco, currently has 50 employees and is hiring.