deep tech

SOSV founder says climate investing is a ‘war effort’ as firm closes $306M fund

SOSV’s new fund makes it one of the largest pools of deep tech venture capital to be raised in recent years.

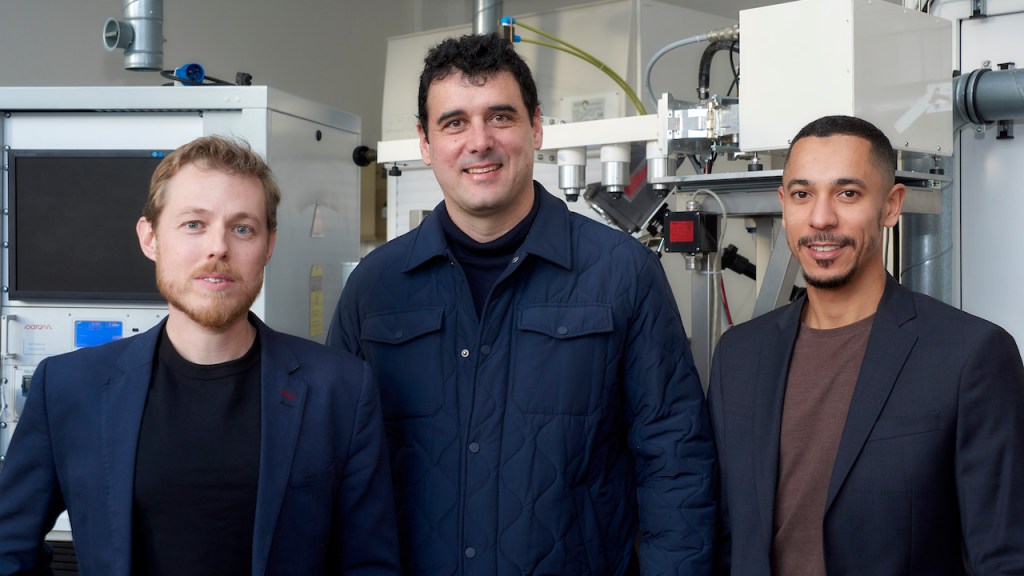

French deep tech spinout Diamfab crystallizes hopes for diamond semiconductors to support green transition

Its long-term goal is to make more efficient semiconductors with a lower carbon footprint, while supporting what its CEO refers to as “the electrification of society,” starting with transportation.

With backing from NATO Innovation Fund, OTB Ventures will invest $185M into European deep tech

OTB Ventures’ new $185 million fund for deep tech in Europe will mostly be deployed at the Series A stage; but up to 10% could be allocated to seed funding,…

As European dynamism gathers momentum, Elaia and partners double down with new deep tech fund

Elaia’s third deep tech seed fund, DTS3, is double the size of the two previous funds, and signals the momentum that is forming around an emerging concept: European dynamism.

Compete or cooperate? Five deep tech investors opt for shared gain over sharp elbows

The collaborative, known as Venx, allows Boston VCs to share offices, pitch meetings, and insights.

Playground Global closes Fund III with $410M for early-stage deep tech investments

The new fund invests across the computing, automation, infrastructure, logistics, decarbonization and engineered biology industries.

Choosing the right deep tech fund manager: 4 essential questions for investors and founders

To master deep tech investing, a VC fund manager must understand market opportunities that are growing in size and at a rate that cannot be ignored.

Deep tech startups must use these 4 techniques when fundraising

It is imperative to show that investors’ money will go into a product that genuinely has the power to change the world.

Featured Article

Deep tech exits: Not just science fiction anymore

Many earth-changing deep tech solutions are being commercialized, and successful exits continue to increase in number and size.

Bee Partners closes fourth fund to add more capital for pre-seed founders in deep tech

The San Francisco-based venture capital firm invests in companies focused on artificial intelligence, machine learning, robotics and frontier technologies.

How to fundraise when your deep tech startup sounds like sci-fi

Your pitch may well be the first time a VC has even heard of a concept, so how can they possibly work out how to invest in your idea when…

Paris-based VC firm HCVC just announced the final closing of its second fund, simply called “Fund II.” And the team has managed to raise $75 million (€69 million) so that…

TechCrunch+ Roundup: Prompt engineering, web3 gaming survey, how to spend $10K on paid ads

TechCrunch Disrupt 2023 ended yesterday, and out of all the events I’ve attended since working here, this one was my favorite.

How deep tech founders can secure early-stage fundraising in a downturn

Deep tech companies, especially in the early stages in difficult funding environments, should focus first and foremost on closing the deal.

Main Sequence hits first close of $450M AUD for its third deep tech fund

Main Sequence, an Australian venture capital firm, said Wednesday it has raised the $450 million AUD (approximately $303 million) first close of its third fund. The venture capital firm, founded…

Featured Article

Deep tech in Latin America and the Caribbean is set to skyrocket

While the prospect of new factories and more jobs is good news for Mexico, the country and its Latin American and Caribbean (LAC) peers can harbor higher hopes when it comes to deep tech, a new report posits.

TechCrunch+ roundup: Deep tech tips for SaaS VCs, toxic fundraising, student visa startup options

If someone said “startup” while we were playing a word association game, I’d respond with “fundraising.” (I bet you would, too.)

Software investors must (re)learn these 3 ideas before getting into deep tech

Traditional VCs are still stuck with their now low-margin businesses, unable to move forward and invest in the next big thing: deep tech.

TechCrunch+ roundup: Deep tech fundraising, negative trade secrets, 3 metrics investors love

You can’t create a magic plan to save your startup — there are simply too many factors outside of your control.

As realizing big exits becomes difficult, deep tech startups transforming entire industries offer some of the only paths to “10x exits.”

How we pivoted our deep tech startup to become a SaaS company

Pivoting from hardware to SaaS was the right move for our electric motor design startup, but the process wasn’t precisely linear.

Featured Article

Fairmat raises $35M to recycle carbon fiber composite into a new material

French startup Fairmat closed a $35 million Series A funding round (€34 million) last month. It wants to turn carbon fiber composite that is no longer in use into a new material that can be used in new products. Temasek and CNP (Compagnie Nationale à Portefeuille) are leading the round, with Pictet Group, Singular, the…

First Star, backer of deep tech startups like Plus One and Fyto, aims to raise as much as $40 million for its third venture fund, TechCrunch has learned. Based in…

Cantos launches its third fund, ploughing $50M into near-frontier startups

Hard tech is hard, but when there are major breakthroughs, that can come with outsize returns and enormous opportunities. Cantos just closed its third fund to invest in science-forward companies…

BAI Capital targets China’s globalizing startups with fresh $700M fund

BAI Capital, the storied China-focused venture investment firm that was formerly known as Bertelsmann Asia Investments, has raised $700 million to back Chinese companies that are part of the country’s…

Featured Article

Robotics scene continues to be bullish, but layoffs are looming

“In an economic downturn, the customers will be less willing to be experimental, so they’re thinking about cutting costs and then economics just becomes so much more important.”

Sequoia Capital’s China affiliate has pulled in $9 billion in fresh capital to back the country’s tech companies across all stages, The Information first reported. The raise arrived at a…

Here’s why climate tech may avoid repeating clean tech’s failures

Climate tech is more than just a rebrand of clean tech — it offers founders and investors new tools to make profits and slash carbon.

Deep tech has become a hot topic in Europe. One of the key arguments: European countries have great universities and talent. But how can academic talent translate into startups?

Deal-flow newsletter PreSeed Now to introduce future UK crown jewels to investors

Launching today, deal-flow newsletter PreSeed Now will present early-stage startups from around the U.K. to investors twice a week, with one in-depth profile per issue.