venture fund

Against a backdrop of layoffs and continuing economic uncertainty, the announcements — particularly in such quick succession — point to a few underlying truths about the market right now.

As the crypto market continues to slog through a fundraising winter, Faction Ventures, a blockchain-focused venture capital firm, is betting big on the space. The firm has launched its inaugural…

Korea Investment Partners is the latest Korean VC firm to launch a Southeast Asia fund

More South Korean investors are putting money into Southeast Korea startups, creating an “investment corridor” between the two regions. The latest one is KIPSEA. Short for Korea Investment Partners Southeast…

Israel-based early-stage VC firm TLV Partners today announced its fifth fund, unsurprisingly called Fund V. TLV Partners raised its last fund, the $220 million Fund IV, in October 2021. Including…

TechCrunch+ roundup: Summary slide showcase, video SEO strategy, how to value AI startups

If your deck doesn’t give prospective investors a clear idea of how you will put their money to work, you’re not going home with a term sheet.

5 lessons we’ve learned from building a venture fund from scratch

In an industry where your reputation and brand are the most important parts of building a firm, getting started from day zero is critical.

Iterative launches its second fund for Southeast Asia startups

Despite global headwinds, Southeast Asia’s early-stage startups are still going strong, say the founders of Iterative Capital. The Singapore-based venture capital firm, which runs a YC-style accelerator program, announced today…

Ocean-climate VC Propeller launches with $100M to fund ‘tomorrow’s narwhals’

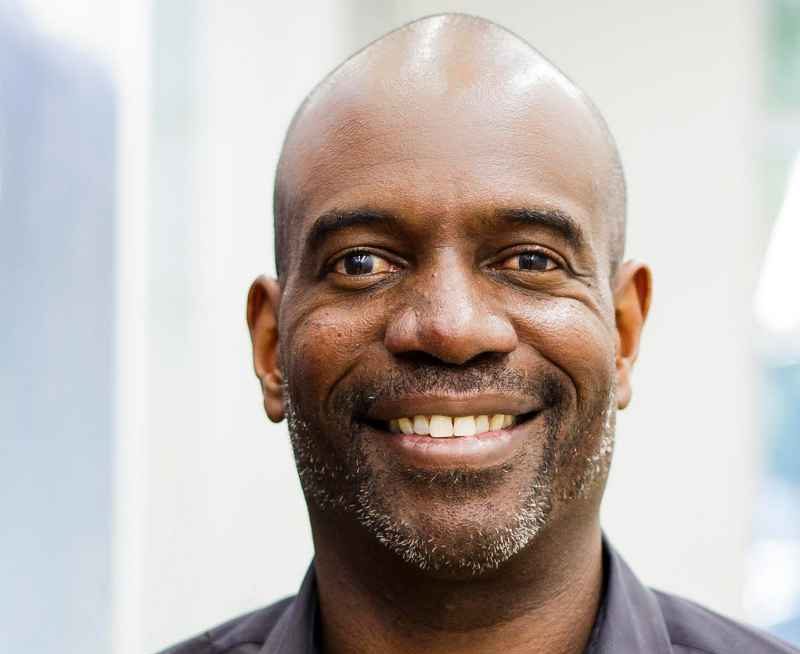

Propeller, a new climate-tech investor with a focus on the ocean, tells TechCrunch that it has hooked $100 million for its first seed fund. Co-founded by former HubSpot CEO Brian…

First Star, backer of deep tech startups like Plus One and Fyto, aims to raise as much as $40 million for its third venture fund, TechCrunch has learned. Based in…

Tech veterans Nilekani and Aggarwal’s India venture raises $227 million second fund

Fundamentum Partnership, a venture firm co-founded by Nandan Nilekani and Sanjeev Aggarwal, has raised $227 million for its second fund as the high-profile tech industry veterans double down on backing…

JourneyOne harvests a dope $10M fund to invest in cannabis tech

As the cannabis markets are maturing, we’re seeing new opportunities rise to the surface. JourneyOne Ventures told TechCrunch it’s completed the first close of a $10 million fund and has…

Bosch’s venture arm just announced its fifth fund, saying it’s on the lookout for startups with the “potential to improve quality of life and conserve natural resources.” The new $295…

This new platform is teaching emerging fund managers how to survive and thrive

More people have begun turning to venture investing as a full-time pursuit, only to discover that it’s not as easy as it looks. That realization explains the rise of Oper8r,…

NGK Spark Plugs launches $100M corporate venture fund, will seek M&A opportunities

NGK Spark Plug, one of the world’s largest manufacturers of automotive spark plugs, announced a new $100 million fund to invest in startups and find potential merger and acquisition deals.…

Kairos’ $25M venture fund will invest in ideas that help the middle class

Kairos, the organization for young entrepreneurs founded in 2008 as Kairos Society, has lifted the veil on its first venture fund that it teased earlier this year. The $25M fund…

IVP, one of the original late-stage venture capital firms, is announcing its sixteenth fund. And at $1.5 billion, it’s the largest yet. This brings the group’s total committed capital to…

A $150 million fund, The Engine, will back startups others find ‘too hard’

A fund and accelerator for advanced technology startups, The Engine, closed its debut fund at a robust $150 million this week, according to its president, CEO and managing partner, Katie…

AccelFoods fund for food and beverage innovators reaches $35 million

AccelFoods, an accelerator and fund that backs innovative food and beverage companies, has added $15 million to its second fund, according to founding partners Jordan Gaspar and Lauren Jupiter. AccelFoods…

Crunch Report | Jay Z Has Arrived

More news about Jay Z’s new venture (Arrive), robots that fix their mistakes and Y Combinator launches its MOOC. All this on Crunch Report.

Greycroft Partners, the venture firm co-founded by industry veteran Alan Patricof, is announcing their second growth equity fund. They will have about $250 million in capital to deploy, an increase…

SOSV, “the accelerator VC,” closes third fund at $150 million

Since the advent of accelerators, venture capitalists have competed to lock in deals with the best startups in a given batch. Entrepreneur turned investor Sean O’ Sullivan thought it would…

Former TechShop CEO Mark Hatch joins Network Society Ventures as General Partner

Early-stage venture firm Network Society Ventures has snagged TechShop’s former CEO and co-founder Mark Hatch as general partner. Hatch is recognized as a pioneer of the maker movement, is a current…

Starburst Ventures closes $200 million debut fund to back space tech startups

A new venture fund called Starburst Ventures has raised a $200 million debut fund to invest in early stage aerospace startups over the next three years. The fund is an…

Greylock Partners is getting another $1 billion to invest in startups. The long-time venture capital firm is announcing its 15th fund, bringing the total to $3.5 billion currently under management.…

These Utah College Students Have Millions Of Dollars To Invest In Your Startup

Twenty-one-year-old Dominic Callas is not your typical venture capitalist. The Westminster College student spends 20-30 hours a week sourcing and researching possible deals at an $18 million venture fund run…

A Step Forward? Bertelsmann & Others Back $100 Million Venture Fund For Innovative Education

Just as (mobile) technology is bringing some exciting changes to the health industry, it’s simultaneously over in the classroom trying to save education before it’s too late. I’m not sure…