Greylock Partners is getting another $1 billion to invest in startups. The long-time venture capital firm is announcing its 15th fund, bringing the total to $3.5 billion currently under management.

With 50 years of investing in the books, Greylock has backed industry leaders in the enterprise IT and consumer internet categories, including LinkedIn, Dropbox, Facebook and Airbnb. Their limited partners are betting that they will replicate some of this past success and continue to find startups that will become the next big thing.

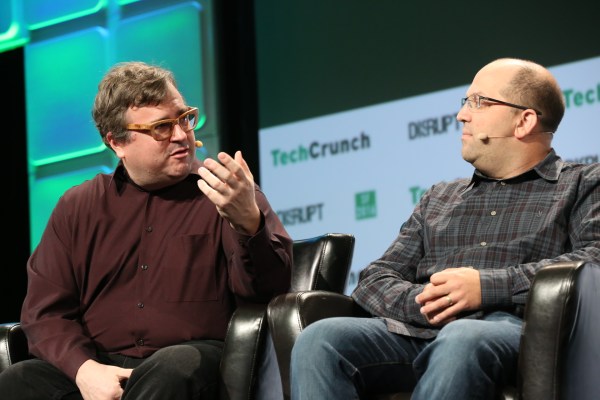

“It’s been a pretty consistent strategy,” Josh Elman, partner at Greylock, tells TechCrunch. The team is always looking for “products that make people’s lives better.”

Greylock can invest anytime from the seed round to the later stages, but they generally get involved somewhere in between. Over 95% of investments in the 14th fund were series A or B and they expect to keep this approach for fund 15.

They are looking for startups at that pivotal moment when they try to multiply “from 30 people to 1000 people,” says Elman. Greylock gets involved when teams expand “from a small early company that’s really grown large and hit some scale.” The firm has recently invested in up-and-comers like GoFundMe and musical.ly.

In addition to enterprise and consumer businesses, Greylock plans to look at “emerging” spaces like messaging, virtual reality, machine learning and robotics. Elman cited bots and voice products like the Amazon Echo as areas that he’s particularly enthusiastic about.

Yet with many liked-minded firms hoping to invest in the top startups, it can be hard to stand out from the pack. With an investment team that includes LinkedIn co-founder Reid Hoffman and former Mozilla CEO John Lilly, Greylock hopes that its track record and experience will set them apart.

Like several of the top venture firms, Greylock has in-house talent partners, who help startups find employees to build out their teams. Led by Jeff Markowitz and Dan Portillo, Greylock’s talent group looks for C-suite executives and potential hires who’ve worked in product, design or engineering.

“Greylock approaches working with companies as a true partnership – whether that’s helping with recruiting, product planning, or strategy,” said Sarah Leary, co-founder of Nextdoor. Leary, who previously worked as an associate at Greylock, believes it’s “one of the few firms where many of the partners have been in the exact same situations that we as entrepreneurs are in.”

With over 170 IPOs and 120 “profitable” acquisitions, Greylock has had numerous fruitful investments. Recent exits include Apptio, Pure Storage, Quip and TellApart.

But as with all venture capital firms, the key is to have a diverse investment portfolio, in case some of the opportunities don’t work out. Digg, Cuil and ArsDigita are amongst Greylock’s companies that didn’t pay off.

When faced with challenges, Greylock hopes its startups will turn to them for help. “We want to be somebody that they can call at any and every time of the day,” said Elman.