entrepreneurship

This venture firm in India is offering fast funding to early-stage startups in a time of uncertainty

As investors get cautious about dealmaking in India amid the coronavirus outbreak and their appetite to fund early stage startups begins to evaporate, one venture capital fund is stepping up…

UK investors band together to survey Angels on their strategy during COVID-19

A number of UK entrepreneurs have banded together to survey Angels about their investment strategy. The initiative comes in the wake of the UK government’s “Future Fund” for startups, which…

The peacetime CEO/wartime CEO framework is clearly valuable — it forces us to dissect the behavioral shifts necessary to survive in a crisis. That being said, it needs to evolve.

Featured Article

What the new VC show-and-tell means for signaling risk

A month ago, we asked several venture capitalists if they planned to change the way they invest or lead rounds during COVID-19 — most said no, but they noted that valuations were coming down and founders in their portfolio companies were responding to the crisis. Northzone’s Paul Murphy predicted fewer FOMO rounds because investors will…

Tech for good during COVID-19: Sky-high gifts, extra help and chips

When Roger Lee, the co-founder of Human Interest, heard that San Francisco imposed shelter-in-place orders, he started blogging about layoff news and posting crowdsourced lists of employees who were laid…

If you are thinking about starting a company, look beyond your inner circle.

The coronavirus pandemic, however, is having an outsized impact on Latin America’s startup activity compared to other regions, judging by Q1 2020 activity numbers.

This morning, let’s talk about SaaS growth, retention, and burn metrics in the new era.

Indie.vc founder Bryce Roberts: Profitability is ‘more achievable than a Series A round’

“If you have to ask people for permission to exist, and the more you rely on those people for yourself to exist, the more risk and exposure you have.”

Featured Article

Pandemic forces fundraising founders to accept ‘discounts across the board’

Startup founders who are fundraising in this climate should expect venture investors to take a huge chunk out of their valuation expectations. “What we’re seeing across the board is discounts,” says Mike Janke, co-founder of early-stage cybersecurity investment firm Datatribe. Investors are still committing to new deals, he says, but they’re adding new terms and…

Finnish VC Icebreaker launches second fund to continue backing ‘pre-founders’ and pre-seed startups

Icebreaker.vc, the Finnish venture capital firm that backs “pre-founders” and pre-seed to seed-stage startups, has launched a second fund, with a first close of €50 million. That’s already significantly larger…

Startups Weekly: Investors are keeping terms friendly — instead they say ‘no’ more often

[Editor’s note: Want to get this free weekly recap of TechCrunch news that startups can use by email? Subscribe here.] Multiple liquidation preferences, full-ratchet anti-dilution clauses and pay-to-play provisions are some of…

Pandemic reset leads investors to focus on resilience, adaptability

For the vast majority of startup founders who were planning their capital raise in Q1 2020, the COVID-19 blow was so dramatic and sweeping, we cannot see all its effects…

Featured Article

Digging into Europe’s Q1 venture results

Despite COVID-19, China’s broad shuttering and an aged bull market deep, Europe’s venture capital activity in Q1 2020 was mostly fine.

Featured Article

Green shoots for software companies

Looking for good news despite all the market gloom

NextView Ventures is launching a remote accelerator for startups

Over the weekend, Silicon Valley leader Marc Andreessen broke his usual silence and gave some advice to Silicon Valley: It’s time to build. The famed investor urged CEOs, entrepreneurs and…

Stripe raises new funding, Uber acknowledges financial uncertainty and a controversial facial recognition startup accidentally exposes its source code. Here’s your Daily Crunch for April 17, 2020. 1. Stripe raises…

Changing policy, Y Combinator cuts its pro rata stake and makes investments case-by-case

In a message posted to its internal communications channel earlier this week, the massive startup accelerator Y Combinator said it will change the terms of its own PPP (the YC…

Earlier today a grip of new data presented a sharply negative picture of the American economy. And this afternoon, news broke that a trio of well-known, heavily-backed unicorns were cutting…

Featured Article

Punitive liquidation preferences return to VC — don’t do it

Boards of directors considering these types of financings need to understand that they are creating misalignments and raising serious fiduciary duty issues.

You can easily read optimism in the stock market. Ask around the private markets, however, and you’ll hear a very different narrative.

Pinpoint releases dashboard to bring visibility to software engineering operations

As companies look for better ways to understand how different departments work at a granular level, engineering has traditionally been a black box of siloed data. Pinpoint, an Austin-based startup,…

VC activity goes upside down as seed deals fall and mega-rounds rise

We’re talking about three trends this morning: The sharp decline in Q1 U.S. seed rounds, how mega-rounds ($100 million and larger funding events) are holding up the sky for domestic…

Featured Article

Silicon Valley restructuring veteran says his firm is winding down up to 3 startups a day

Marty Pichinson gets called a lot of things: Silicon Valley’s undertaker, its terminator, a grave digger. These aren’t meant as slights; Pichinson is the founder of Sherwood Partners, a restructuring firm that Bay Area venture firms frequently turn to when they need someone to help sell off the assets of startups they have funded. The…

Frank raises $5M more in its quest to get students max financial aid

Frank, a New York-based student-facing startup, has raised $5 million in what the company described as an “interim strategic round” that Chegg, a public edtech company, took part in. According…

Index raises $1.2B growth fund and $800M to invest in emerging startups

It’s not quite business as usual in the world of business, but in tech, there is still a significant amount of money being raised and invested, both to help sustain…

Deliveroo, Graphcore and other big UK startups say they’re being cut out of COVID-19 lending relief

The U.K. government, like a number of other countries around the world such as the U.S., has stepped up its pace in providing relief in the form of loans for…

Silicon Valley Bank only started processing stimulus loan applications today

In a sign of just how broken the process is for startups looking to receive stimulus dollars, Silicon Valley Bank, the bank that claims “more innovative startups bank with us…

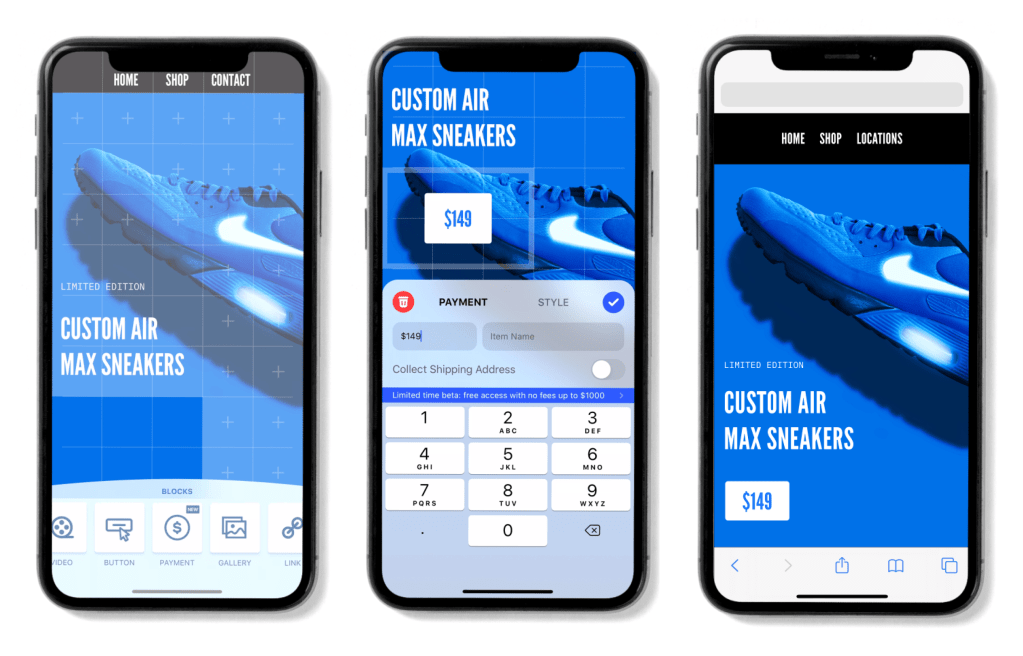

Mobile website builder Universe raises $10M from GV as it ventures into commerce

A startup that has framed itself as an Instagram for websites is now squaring up against Shopify as it nabs new funding from Google’s venture capital arm. Brooklyn-based Universe has…

New Media Ventures creates rapid-response fund for political startups in the COVID-19 era

The decade-old New Media Ventures investment fund, which backs startup businesses and non-profits developing technologies to improve access to government, said it is raising a “Crisis Innovation Fund” aiming to…