Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

This morning we’re hunting up “green shoots” for software companies. Green shoots is financial slang for positive signals that could point to an economic recovery — or good news amidst a greater pullback. You can even use the term sarcastically, perhaps noting that unemployment claims, while still elevated to historic levels, are falling on a week-over-week basis: Only 2.5 million jobs lost last week! #greenshoots

You get the idea. But today we’re not joking. At the end trading yesterday, the Bessemer cloud index had recovered to around a 10% decline, in total, since the start of the COVID-19 era. Given that the same basket of cloud and SaaS companies was down as much as 37.9% at its 2020 low, its recovery has been little short of monstrous.

But there’s a bit more to dig into. This morning we’ve parsed a set of recent, fascinating survey data from Stifel, a wealth management and investment banking concern. The firm’s technology group asked a few hundred “tech executives, entrepreneurs, and investors” what they are seeing in the market regarding churn. There’s good news for software companies in the mix.

And we’ve pulled a grip of new data from Crunchbase to understand what we know about April’s venture capital market so far. It’s not bad news!

So, some positive vibes today, even if the markets are down. Let’s go!

Green Shoots

How bad SaaS churn will get during the present market downturn is not clear. TechCrunch has covered the issue, asking venture capitalists and doing various surveys of founders about what they are seeing in the market. The results are cautionary, with one survey indicating that three-quarters of founders expecting to see their net retention rates falling “by at least 3% and up to 20+.” That wasn’t a great sign.

However, in the name of green shoots, some data from Stifel helps paint a slightly different picture. Its survey was broken down into an investor portion (PE/VC) and an operator section (executives/entrepreneurs), so we have two slightly different data sets to parse.

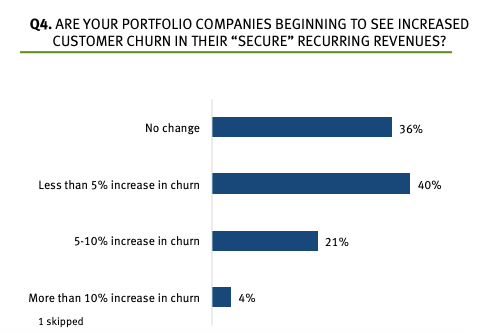

Here’s what the investors said regarding churn increases that are being seen (charts shared with permission):

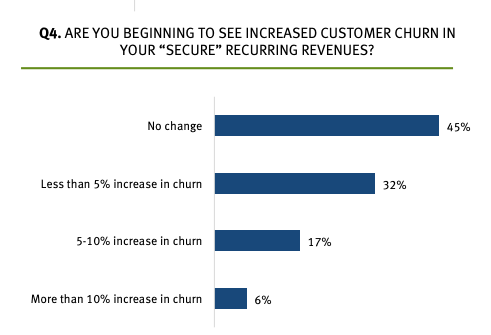

And here’s what the operators had to say about the same question:

Operators are a bit more optimistic than investors, but as 77% of investors and 87% of operators are anticipating less than 5% more churn due to COVID-19, the discrepancy isn’t too big. Instead, the general positive tilt of the responses stands out. (More churn is not good, mind, but revenue loss not being as bad as we might have expected given other data counts as a green shoot.)

The same dataset does include slightly more ominous data points. For example, 62% of investors surveyed expected a downturn impact period of greater than six months for their portfolio companies. That was true of just 46% of operators questioned. Also, only 21% of investors expected a “V” shaped recovery (the best possible result) along with a similarly modest 27% of operators.

What about new capital?

If churn for startups comes in under expectations, it could bode well for SaaS growth, and thus software valuations. Which would be good for venture capital activity, right? Well, let’s take a look.

Regular readers know this, but please keep in mind that venture capital data is laggy, with rounds often being announced weeks and months after they are closed. This is why it’s hard to trust very recent venture capital data as, well, it’s not all there. Imagine our surprise this morning, then, when we ran a Crunchbase search for rounds in companies marked SaaS and software in the first three weeks of April, focusing only on equity rounds and excluding post-IPO activity.

We found out that things looked pretty ok, at least when dollars were concerned. Here’s the data:

- Crunchbase for SaaS+software startups, April 1-21, equity only, no post-IPO equity:

- 2019: 375 rounds, $2.67 billion

- 2020: 165 rounds, $2.97 billion

The round count decline was to be expected, due to both data lag and the fact that we’ve seen round counts drop in venture capital more broadly. However, when we take into account that 2020 is ahead of 2019 in dollar terms, the picture is rosier. Presume that more rounds come in over the next month or two, padding 2020’s count, bringing it closer to 2019’s own. Those same additions will push the dollars-raised tally for 2020 even higher.

The first three weeks of Q2 2020 in regards to SaaS and software venture capital activity look pretty good? There’s some nuance to the data, namely that the largest two rounds in the period in 2019 were worth $300 million ($150 million apiece for SambaNova Systems and Klaviyo), while the same rounds were worth $830 million in 2020 ($600 million for Stripe, $230 million for 4Paradigm). So some big rounds are in the mix in 2020, distorting the tallies.

But money is money and investment is investment; even more, the Stripe round appears to be a response to the company delaying its IPO due to COVID-19, so it definitely counts if we are looking for the impact of the pandemic on venture totals.

You can look at the above data in a more critical light, but as we’re hunting for positives today it’s worth keeping in mind what the world looks like through more rosed-tinted blinders. After all, until March of this year, the venture capital and startup worlds was only a place for optimists. Taking this more positive slant on the data is a reminder of what the world felt like in February.

As more data rolls in, we’ll keep picking it apart. What happens to software startups is a big deal for VCs, given the scale of the bet that private investors have made on growth-oriented software upstarts. (Email me if you have numbers to share, as always.)