venture capital

A new games-focused VC in Turkey shows the industry there continues to gain steam

Turkey has gained a well-earned reputation as being a veritable cauldron of mobile games startups, leading to the rise of VCs dedicated to the sector. The latest to join this…

Seso is building software to fix farm workforces and solve agriculture’s HR woes

Migrant workers are a critical labor force for U.S. farms, but getting them here on proper H-2A visas can be complicated, and the compliance surrounding these employees is taxing for…

GGV Capital is no more, as partners announce two separate brands

The VCs who long ran GGV Capital have settled on two new brands, roughly six months after announcing they would split their U.S. and Asia operations.

Deal Dive: Iron Sheepdog is fixing short-haul trucking from the bottom up

Iron Sheepdog credits its ability to gain traction with truck brokers because it got the truckers themselves to sign on first.

Featured Article

Nine crypto VCs on why Q1 investments were so hot and how it compares to previous bull market

If the 2023 crypto venture landscape was an ice-cold pot of water, the first quarter of 2024 is the part where the bubbles start to form right before water boils, Tom Schmidt, a partner at Dragonfly Capital, said to TechCrunch. And he’s not wrong: $2.52 billion in total capital has been raised across the crypto…

Ibotta’s expansion into enterprise should set it up for a successful IPO

Ibotta’s recent partnerships with brands Exxon, Shell and Walmart helped the company reach profitability.

Matter Venture Partners raises $300M first fund to invest in ‘hard tech’

Matter Venture Partners will invest in between 15 and 20 companies with the new fund in the area of “hard tech.”

New Summit is raising a new $100 million fund to back climate tech and underrepresented fund managers

The size of the new fund suggests that it is bullish that it can convince LPs to open their wallets based its impact-focused approach.

Marissa Mayer’s startup just rolled out photo sharing and event planning apps, and the internet isn’t sure what to think

When Marissa Mayer co-founded a startup six years ago in Palo Alto, California, expectations were sky high for the former Yahoo CEO and early Google employee. When that startup, Sunshine,…

Former Nextdoor exec raises $25 million for PipeDreams, a startup rolling up HVAC companies

Dan Laufer swore off ever founding a startup again after he sold apartment rental platform RentLingo in 2021, but Laufer also couldn’t ignore the potential to solve a problem he…

Mallard Bay is building a marketplace and a vertical SaaS platform for guided fishing and hunting industries.

Featured Article

Liquid Death is just one of many VC-backed beverage startups ready to disrupt Coke and Pepsi

Some of the new venture-backed beverage startups are hoping to upend the industry by creating new drink categories.

1991 Ventures in London joins the growing list of VCs aimed at Ukrainian startups

U.K.-based limited partners Venrex and Samos Investments are this week backing the launch of a new VC primarily aimed at investing in startups led by Ukrainians inside and outside the war-torn country.…

Featured Article

Investors’ pledge to fight spyware undercut by past investments in US malware maker

On Monday, the Biden administration announced that six new countries had joined an international coalition to fight the proliferation of commercial spyware, sold by companies such as NSO Group or Intellexa. Now, some investors have announced that they too are committed to fighting spyware. But at least one of those investors, Paladin Capital Group, has…

World Fund closes first €300M climate tech fund, seeking to follow on and back hardware

After three years of efforts, World Fund has finally closed a €300 million first fund, €50 million short of its target in 2021, but still a considerable number given a…

Astera Labs’ IPO pops 72% on first day, showing that investor demand for tech with an AI twist is high

Astera Labs started its life as a public company trading at $52.56 per share, up 46% when the bell rang. The company priced its IPO last night at $36 per…

Featured Article

LACERA decreases venture capital allocation range, but experts say it doesn’t signal a trend

The Los Angeles County Employees Retirement Association (LACERA) voted to decrease its allocation range to venture capital at a March 13 meeting. The board of investments voted to decrease its allocation range to venture capital and growth equity from between 15% and 30% of the pension system’s private equity portfolio, to between 5% and 25%.…

Featured Article

Late-stage VCs may be preventing their startups from going public in 2024

While some investors are loudly bemoaning that the IPO window can’t stay shut forever, other VCs themselves are actually part of the problem. A lot of standard VC deal terms give investors the ability to block an IPO or acquisition if they didn’t think the timing or price was right, Eric Weiner, a partner at…

VC Arjun Sethi talks a big game about selling his company-picking strategies to other investors; he says they’re buying it

Arjun Sethi speaks with the confidence of someone who knows more than other people, or at least knows that sounding highly confident can shape perception. Either way, when he tells…

Welcome to TechCrunch Fintech (formerly The Interchange)! I’m filling in for Mary Ann, who is on a much deserved break. This week, we look at Griffin Bank getting its license…

VCs will get liquidity in 2024 from the secondary market, not IPOs

If you asked a bunch of VCs at the end of 2023 if the IPO market would finally open again in 2024, most of them would have said yes. We…

Ted Schlein’s 2-year-old Ballistic Ventures has already raised a second $360 million fund

After a shakeup at Kleiner Perkins a few years back, one of its star B2B investors, Ted Schlein, started his own firm. Ballistic has already closed a second fund, even…

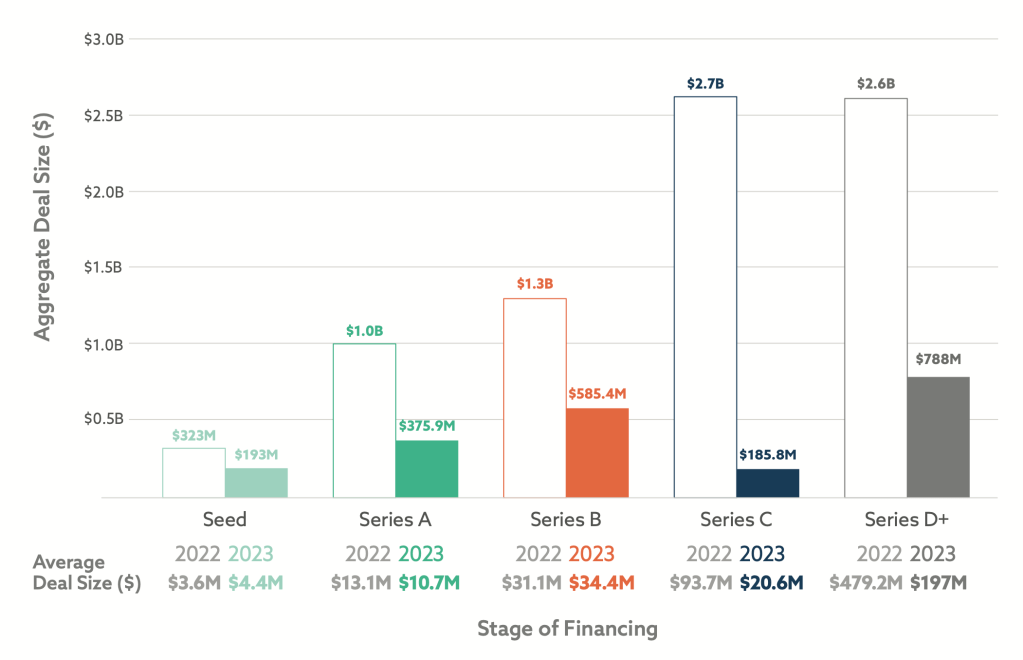

Enterprise SaaS investment makes a comeback — but not where you’d expect

When we examined venture investment amounts in enterprise SaaS startups, we were surprised at the top categories.

Inclusivity-focused VC Ada Ventures pulls in $80M for second fund

U.K.-based Ada Ventures is an unusual VC. Instead of just talking about SaaS or AI, it hunts down founders addressing inclusivity and diversity. Instead of confusing LPs with this methodology,…

Featured Article

Techstars’ $80M partnership with J.P. Morgan is on the rocks, employees say

The fate of the Advancing Cities programs — and some of the around 20 people who work at Techstars in this program — is up in the air.

Artemis Fund has a fresh $36 million to back diverse founders solving ‘big, hairy problems’

For Fund II, Artemis intends to continue leading and co-leading investments and will target around 20 new companies.

Featured Article

NFT fantasy sports startup Sorare lays off 13% of staff as web3 gaming continues to sputter

Web3-enabled fantasy sports platform Sorare laid off 22 employees based in its New York office in February. The move comes as the startup wants certain teams to be concentrated at the company’s Paris headquarters to improve communication and efficiency, a source familiar with the matter told TechCrunch. “As we plan for our next stage of…

Underscore’s Lily Lyman will break down venture relationships at TechCrunch Early Stage 2024

Venture capital is sometimes called a sales job by folks in the industry, as investors have to pitch LPs to raise their own funds and then pitch founders to pick…

New report confirms Europe’s tech investment doldrums, but there are signs of life

Europe is suffering from a big hangover after the tech investment party of the 2020-2021 period. That said, compared to pre-pandemic levels, VC investment in European startups is up, historically…

Ex-Brex exec Sam Blond is already leaving Founders Fund just 18 months after he joined

Sam Blond is leaving Founders Fund, as well as the profession of venture capitalist, just 18 months after he joined the storied Silicon Valley firm. In a tweet on Monday,…