Softbank

Lenskart has signed a definitive agreement to raise $500 million from the Abu Dhabi Investment Authority, they said Wednesday, at the height of the market slump as the Indian eyewear…

Upload Ventures, a SoftBank LatAm spinout, seeks to raise a $250M fund

Less than one year after Upload Ventures spun out of SoftBank’s investment arm, the Latin American–focused investment arm is seeking to raise a $250 million fund, filings show. TechCrunch reached…

As many observers question what real value blockchain can bring to video games, a conglomerate is vouching for the space. SoftBank Corp., the telecom operator arm of SoftBank Group, has…

SoftBank virtually halts new funding as it contends with persistent losses

SoftBank Group’s investment vehicles posted a loss of nearly $6 billion in the quarter that ended in December as the Japanese tech investor continues to bleed through the market downturn…

Featured Article

Dispatch from Bangalore, end of 2022 edition

In 2014, Prayank Swaroop made a pitch to the storied venture firm Accel, where he worked as an associate, about future marketplaces in India. At the time, Flipkart and Snapdeal were the only two e-commerce startups in India that had shown a semblance of scale. Swaroop made a case that as more Indians come online,…

Autonomous delivery startup Nuro lays off 20% of workforce

Nuro, the autonomous vehicle delivery startup backed by SoftBank, Google and Tiger Global Management, is laying off about 300 people, or 20% of its workforce, in an effort to preserve…

Featured Article

SoftBank writes down nearly $100 million investment in FTX

As more details emerge regarding the events that led to FTX’s bankruptcy and stunning collapse, the cryptocurrency exchange’s investors are also being scrutinized. Namely, many people are asking just how could so many high-profile investment firms pour in a collective $2 billion with apparently so little due diligence. The notorious Japanese investment conglomerate SoftBank, for…

SoftBank Vision Fund is reportedly laying off 30% of its workforce, or at least 150 employees

The Vision Fund, a venture capital arm of SoftBank, has launched a sweeping layoff process, cutting at least 30% of its workforce globally, or approximately 150 of the 500 employees,…

Daily Crunch: A closer look at Google’s remote-controlled $30 Chromecast

Hello, friends, and welcome to Daily Crunch, bringing you the most important startup, tech and venture capital news in a single package.

SoftBank cuts internal valuation of $10 billion Oyo to $2.7 billion

SoftBank, the largest investor in Oyo, has cut the Indian hotel chain’s valuation to $2.7 billion at a time when the startup is months away from going public, a source…

Its 2015 acquisition of Aldebaran didn’t go as smoothly as SoftBank hoped. At the time, the French robotics startup was best known for its Nao, which had become a fairly…

DTCP taps SoftBank as an anchor LP for its next $500-600M fund

Last week, we got a glimpse of how SoftBank is pulling away from some of its more exuberant investing of the past years, when news broke that it had sold…

SoftBank-backed Ola plans to eliminate about 200 jobs across its engineering teams over the next few days, on track to shrink its workforce by over 1,200 this year, as the…

Stockholm’s EQT Growth closes $2.2B to fund scaling European startups like Vinted, Mambu and Epidemic Sound

The days of European startups relocating to the U.S. if they want to grow (and raise money to do so) have been receding in the rearview mirror for a while…

Kenya’s HotelOnline acquires hospitality software company HotelPlus

HotelOnline, a Kenya-based Yanolja-backed travel technology scale-up that fashions itself as an e-commerce and digital marketing enabler in the hospitality industry, has acquired HotelPlus, a software provider with clients in…

COVID-19 has reshaped our lives in many ways and given rise to a plethora of services tailored to these newborn needs. Waysia, an Asian grocery delivery platform, is one such…

Have you marked down your portfolio yet? You are running out of time to hide

To mark down your portfolio or not mark down your portfolio? That is a question many venture capitalists are grappling with right now.

Gopuff to pull out of Spain as q-commerce belt tightening continues

The q-commerce belt tightening continues: U.S. category veteran Gopuff, the SoftBank-backed delivery platform juggernaut — which was being valued at $15 billionN as recently as 2020, and had been rumored…

Featured Article

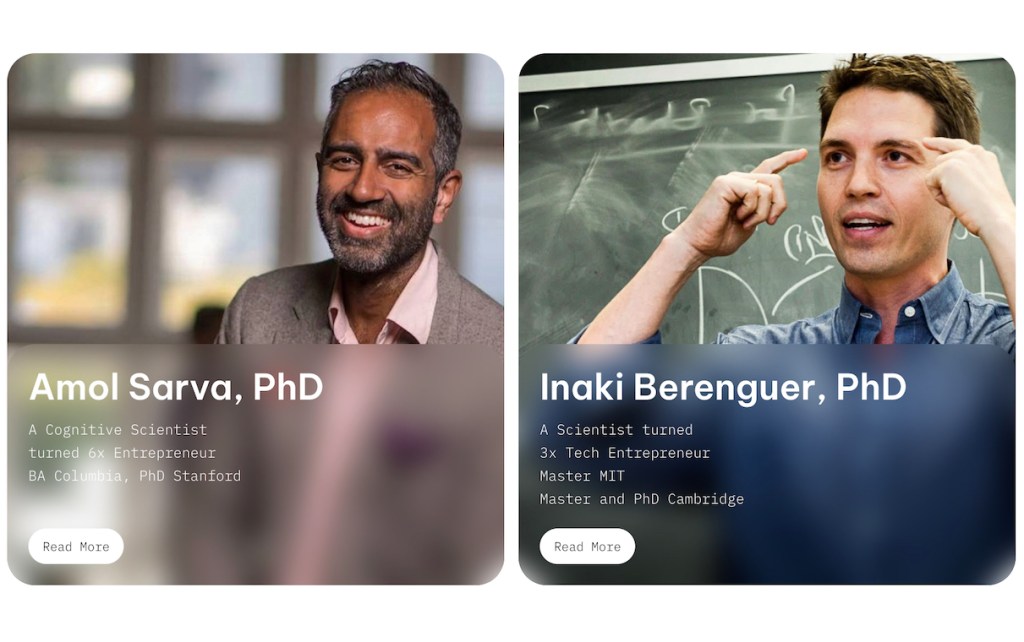

Investors detail their red (and green) flags for startups seeking venture dollars

TechCrunch sat down with several investors to hear how they’re looking at the funding environment today and what their red flags — and green flags — are for startups looking to raise another round.

This new $100M fund plans to focus on startups accelerating the science around longevity

Longevity-focused startups have been proliferating in recent years as we become more focused on our health. However, it’s not just about apps to get you in the gym. Longevity startups…

SoftBank, Sequoia China back this ERP startup enabling China’s online exporters

Thanks to cross-border e-commerce platforms, China continues to be a major exporter of consumer goods for the world in the online shopping age. It’s not just marketplaces like Amazon and…

Daily Crunch: ‘Winter may be longer’ because unicorns won’t accept down rounds, says SoftBank leader

Hello, friends, and welcome to Daily Crunch, bringing you the most important startup, tech and venture capital news in a single package.

Losses at SoftBank’s Vision Funds have consumed nearly all their historical gains

The Vision Fund was always a funded vision; today we learned just how cloudy that perspective is proving.

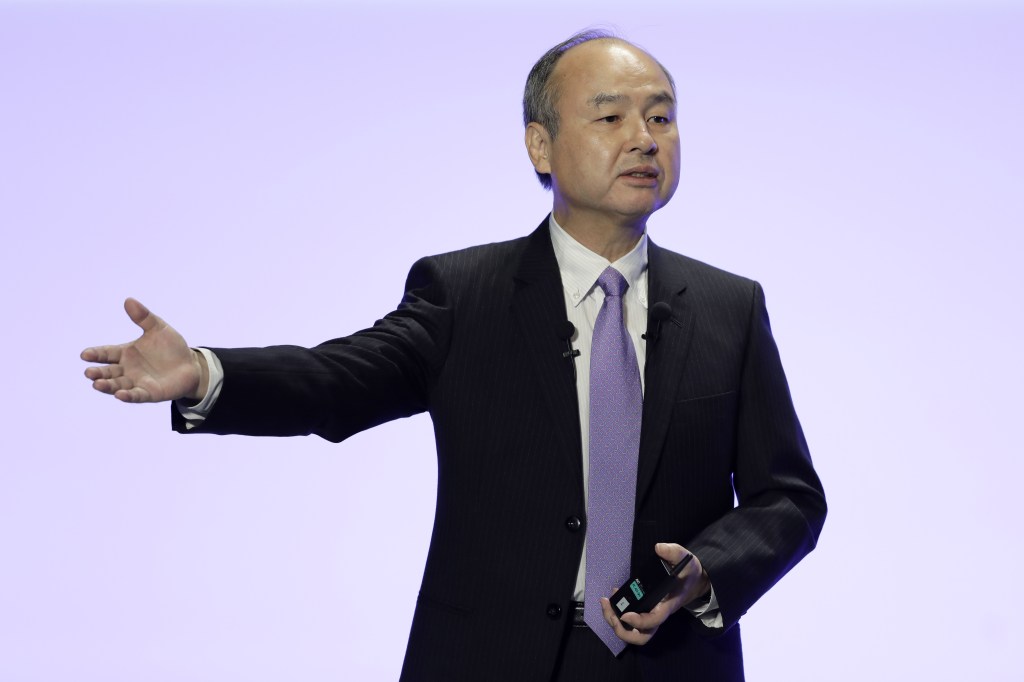

SoftBank cautions longer startup winter because unicorn founders are unwilling to cut valuations

Masayoshi Son, founder and chief executive of SoftBank Group, which reported a quarterly loss of more than $23 billion, is worried that the funding winter for startups may continue for…

Featured Article

Tech’s riskiest founders are getting a $650 million bet from Redpoint Ventures

For venture investors, noise is ironically important. Wading through constant streams of capital-seeking founders and startup pitches may be the hardest part of the job, but it’s also imperative to the success of the same job. So, what happens if energy around entrepreneurship slows? As the downturn looms, are fewer founders going to take risks?…

China’s billionaire tech boss Jack Ma plans to cede control of Ant Group, the fintech powerhouse closely affiliated with Alibaba, the e-commerce giant he founded, The Wall Street Journal reported…

China’s Jaka Robotics fueled by Saudi Arabia’s Prosperity7 in global push

Jaka Robotics, a Chinese startup that makes collaborative robots, has just pulled in a hefty Series D funding round of over $150 million from a lineup of heavyweight investors to…

China’s $1B fine on Didi could end the mobility giant’s troubled year

Didi, the Chinese ride-hailing behemoth that has undergone a year of regulatory overhaul, faces a fine of over 8 billion yuan ($1.28 billion) from the country’s authorities, The Wall Street…

Rimac begins production of its $2.5 million Nevera hypercar EV

The $2.5 million Rimac Nevera all-electric hypercar has begun rolling off the assembly line, launching on the world stage as the fastest production car and an emblem of the Croatian…

There’s perhaps more capital in the private markets than investors really want to admit.