MetroMile

Daily Crunch: Mac sales down 10%, iPhones up 3% — Breaking down Apple’s quarterly numbers

Hello, friends, and welcome to Daily Crunch, bringing you the most important startup, tech and venture capital news in a single package.

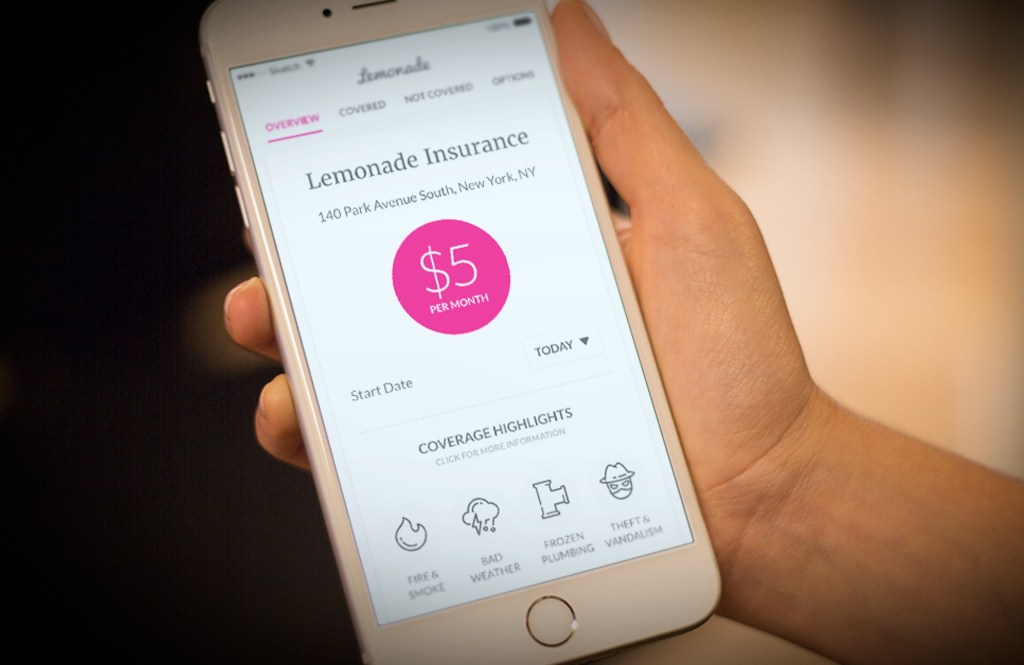

Lemonade closes on acquisition of insurtech Metromile, promptly lays off about 20% of its staff

Publicly traded Lemonade has laid off about 60 employees of Metromile, the auto insurtech company it recently acquired — adding to the volatility the technology sector has seen over the…

Featured Article

Just how wrong were those SPAC projections?

Why are companies that went public via SPACs struggling? Did they catch a headwind from changing market conditions that previously pushed them forward? You bet. But the damage is also self-inflicted.

Featured Article

Why 2022 insurtech investment could surprise you

Insurtech startups that can retain a tech multiple have a shot at keeping their valuation intact; those that don’t may struggle.

Featured Article

6 things in cybersecurity we didn’t know last year

The past 12 months in cybersecurity have been a rough ride. In cybersecurity, everything is broken — it’s just a matter of finding it — and this year felt like everything broke at once, especially toward the end of the year. But for better or worse, we end the year knowing more than we did…

As valuations soar and IPOs accelerate, the public is taking on more startup risk

We’re seeing the quality of tech companies that go public at times decline, leading to more risk available to consumer investors — not just the professionals.

Featured Article

Why have the markets spurned public neoinsurance startups?

The companies we’re examining cover auto insurance (Root, MetroMile), home and rental insurance (Hippo, Lemonade), and health insurance (Oscar Health). All are taking a whacking by the market. Why?

Featured Article

What happens when Wall Street falls out of love with your sector?

Either the neoinsurance companies’ long-term models will come to fruition thanks to large cash balances providing runway to prove their point, or Wall Street is correct — they were always overvalued.

Featured Article

A lot of cash and little love: An insurtech story

The players in the space that we can name and track are generally cash-rich and market-sentiment poor.

Volkswagen says a vendor’s security lapse exposed 3.3 million drivers’ details

Volkswagen says more than 3.3 million customers had their information exposed after one of its vendors left a cache of customer data unsecured on the internet. The car maker said…

Geico admits fraudsters stole customers’ driver’s license numbers for months

Geico, the second-largest auto insurer in the U.S., has fixed a security bug that let fraudsters steal customers’ driver’s license numbers from its website. In a data breach notice filed…

Next Insurance raises $250M, doubling its valuation to $4B in under a year

Next Insurance recently announced that it has raised a $250 million round, valuing the SMB-focused insurance provider at $4 billion. The company last raised another $250 million in September 2020,…

As more insurtech offerings loom, CEO Dan Preston discusses Metromile’s SPAC-led debut

We spoke to Metromile CEO Dan Preston about what the day meant for his company and learn more the SPAC process for our own enjoyment.

Metromile says a website bug let a hacker obtain driver license numbers

Car insurance startup Metromile said it has fixed a security flaw on its website that allowed a hacker to obtain driver license numbers. The San Francisco-based insurance startup disclosed the…

One final $100M ARR company and the startups we want to meet in 2021

As we head toward the exits of 2020, we have one more name to add to our roll call of private companies that have reached the $100 million annual recurring…

Featured Article

As Next Insurance makes its first acquisition, insurtech looks energetic

Expect to keep hearing about insurtech for quarters and quarters to come.

Did you follow all of the unicorn news from the last couple of weeks? No? Here’s a list of headlines to catch you up….

As Metromile looks to go public, insurtech funding is on the rise

Earlier this week, TechCrunch covered the latest venture round for AgentSync, a startup that helps insurance agents comply with rules and regulations. But while the product area might not keep…

The Station is a weekly newsletter dedicated to all things transportation. Sign up here — just click The Station — to receive it every weekend in your inbox. Hello and welcome…

Featured Article

Insurtech’s big year gets bigger as Metromile looks to go public

In the wake of insurtech unicorn Root’s IPO, it felt safe to say that the big transactions for the insurance technology startup space were done for the year. After all, 2020 had been a big one for the broad category, with insurtech marketplaces raising lots, rental insurance startup Lemonade going public, Root itself debuting even…

Pay-per-mile auto insurer Metromile is heading to public markets via SPAC

Metromile, the pay-per-mile auto insurer that earlier this year laid off a third of its staff due to economic uncertainties caused by COVID-19, is taking the SPAC path to the…

3 new $100M ARR club members and a call for the next generation of growth-stage startups

Time flies. It was nearly a year ago that The Exchange started keeping tabs on startups that managed to reach $100 million in annual recurring revenue, or ARR. Our goal…

No matter who wins the election, or how the transition goes — if the markets stay rich, the IPOs can flow.

Root targets $6B+ valuation in pending IPO, a boon for insurtech startups

This morning Root Insurance, a neoinsurance provider that has attracted ample private capital for its auto-insurance business, is targeting a valuation of as much as $6.34 billion in its pending…

Featured Article

As tech stocks dip, is insurtech startup Root targeting an IPO?

During the week’s news cycle one particular bit of reporting slipped under our radar: Root Insurance is tipped by Reuters to be prepping an IPO that could value the neo-insurance provider at around $6 billion. Coming after two 2020 insurtech IPOs, Root’s steps toward the public markets are not surprising. But they are good news…

Featured Article

Are insurtech startups undervalued?

On the heels of Hippo’s funding round and our exploration of how the private markets appear to be more conservative than public investors at the moment, we’re asking a new question: are a bunch of insurtech startups undervalued? Hippo — an insurtech startup focused on home insurance — put together a $150 million round at a…

Ahead of its expected IPO pricing later today, SoftBank-backed insurtech startup Lemonade has raised its expected price range. After initially targeting $23 to $26 per share in its debut, Lemonade…

Earlier today we took a look at two companies that have filed to go public, nCino and GoHealth. The pair join Lemonade in a march toward the public markets. But…

Coterie raises $8.5M to build ‘commercial insurance as a service’

Ohio-based Coterie, a startup working on in the commercial insurance space, has announced today it has raised $8.5 million Series A. The company had previously raised a little over $3…

As 5 more startups join the $100M club, are we just making a pre-IPO list?

Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between. Today we’re adding five names to the $100 million annual…