Earlier this week, TechCrunch covered the latest venture round for AgentSync, a startup that helps insurance agents comply with rules and regulations. But while the product area might not keep you up tonight, the company’s growth has been incredibly impressive, scaling its annual recurring revenue (ARR) 10x in the last year and 4x since the start of the pandemic.

Little surprise, then, that the company’s latest venture deal was raised just months after its last. Investors wanted to get more money into AgentSync rapidly, boosting a larger venture-wide wager on insurtech startups that we’ve seen throughout 2020.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

But private investors aren’t the only ones getting in on the action. Public investors welcomed the Lemonade IPO earlier this year, giving the rental insurance unicorn a strong debut. Root also went public, but has lost around half of its value after a strong pricing run, comparing recent highs with its current price.

But with one success and one struggle for the sector on the scoreboard this year, Metromile is also looking to get in on the action. And, per a TechCrunch data analysis this morning and some external data work on the insurtech venture capital market, it appears that private insurtech investment is matching the attention public investors are also giving the sector.

But with one success and one struggle for the sector on the scoreboard this year, Metromile is also looking to get in on the action. And, per a TechCrunch data analysis this morning and some external data work on the insurtech venture capital market, it appears that private insurtech investment is matching the attention public investors are also giving the sector.

This morning let’s do a quick exploration of the Metromile deal and take a look at the insurtech venture capital market to better understand how much capital is going into the next generation of companies that will want to replicate the public exits of our three insurtech pioneers.

Finally, we’ll link public results and recent private deal activity to see if both sides of the market are currently aligned.

Metromile

Let’s start with Metromile’s debut. It’s going public via a SPAC, namely INSU Acquisition Corp. II. Here’s the equivalent of an S-1 from both parties, going over the economics of the blank-check company and Metromile itself.

On the economics front for the insurtech startup, we have to start with some extra work. During nearly every 2020 IPO we’ve spent lots of time examining how quickly the company in question is growing. We’re not doing that today because Metromile is not growing in GAAP terms and we need to understand why that’s the case.

In simple terms, a change to Metromile’s reinsurance setup last May led to the company ceding “a larger percentage of [its] premium than in prior periods,” which resulted “in a significant decrease in our revenues as reported under GAAP,” the company said.

Ceded premiums don’t count as revenue. Lemonade, in its recent earnings results, explained the concept well from the perspective of its own, related change to its business:

While our July 1, 2020 reinsurance contracts deliver a significant improvement in the fundamentals of our business, they also result in a significant change in GAAP revenue, as GAAP excludes all ceded premiums (and proportional reinsurance is fundamentally about ceding premium). This led to a spike in GAAP gross margin and a dip in GAAP revenue on July 1 — even though no corresponding change in the scope or profitability of our business took place at midnight on June 30.

So Lemonade has shaken up its business, cutting its revenues and tidying its economics. The impact has been sharp, with the company’s GAAP revenues falling from $17.8 million in the year-ago quarter to $10.5 million in Q3 2020.

Root has undertaken similar steps. Starting July 1, it has “transfer[ed] 70% of [ … ] premiums and related losses to reinsurers, while also gaining a 25% commission on written premium to offset some of our up-front and ongoing costs.” The result has been falling GAAP revenue and improving economics once again.

All neoinsurance companies that have provided financial results while going public have changed their reinsurance approach, making their results look a bit wonky in the short term, leaving investors to decipher what they are really worth.

What can we learn from what happened to Root and Lemonade after they made similar changes to their model? Not much, sadly.

Lemonade’s share price remains more than double its IPO price, and Root’s is off 45% from its own. So it’s a little difficult to draw a pattern.

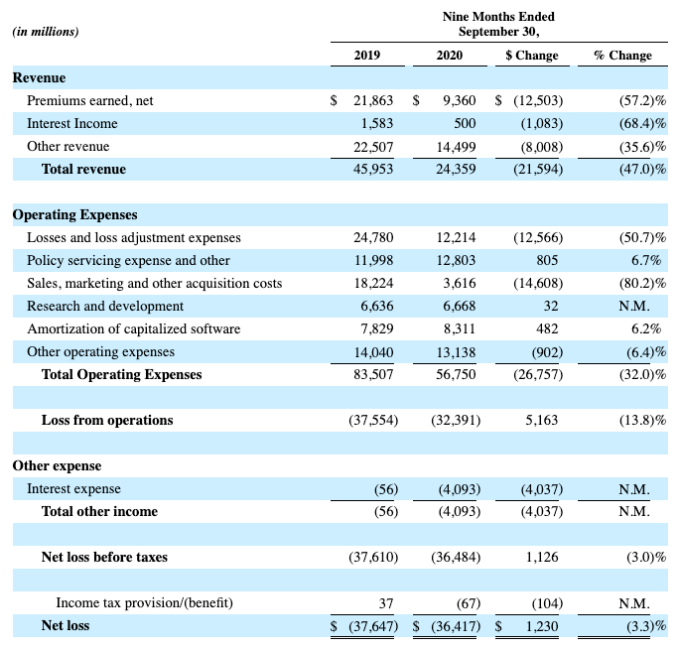

Regardless, now that we understand how ceding premiums — which Metromile does more of now than before — cuts GAAP revenues, we’re prepared to check out its recent financial results:

Image Credits: Metromile

For those of you who have better things to do than stare at income statements all day, all you need to do is observe the decline in 2020 revenues compared to 2019. Then look at the dramatic decline in “losses and loss adjustment expenses.” Crudely, Metromile has swapped out revenues to cut losses. That’s also what Lemonade and Root have done, by our understanding.

I don’t know how the market is going to react to Metromile’s stock starting to trade. But what does seem clear is that it could help tip the balance of market sentiment one way or the other: If Metromile’s auto insurance business struggles when it goes public, that would be two difficult neoinsurance IPOs, compared to one success.

That track record is not good and could limit private-market appetite for more big insurtech venture rounds.

But if Metromile does well, Root’s post-IPO struggles would look more like outliers than norms, which could boost private-market confidence in the sector.

This brings us back to startups.

Startups

We track the performance of public companies to better understand the world of startups, as where there is huge public demand and strong resulting valuations for a certain type of company, venture capitalists can boost their bets into related, private companies.

As public software valuations soared, for example, so too has the expected value of private companies of a similar ilk, driving more venture dollars into them at higher and higher prices earlier in their lives.

Insurtech’s venture results are not only born from public market performance. Indeed, Lemonade went public this year, so the period of time in which similar companies have been in the public eye has been limited. And insurtech is incredibly broad, encompassing marketplaces like The Zebra, neoinsurance companies like Metromile and AgentSync, software that assists other companies in the sector.

So a bit like with fintech, we’re looking at a chopped salad and claiming that all the bits are lettuce. This is one risk of looking at a startup category that has matured and become more diverse.

Regardless, Metromile is definitely insurtech, and if its IPO could help set public — and therefore private — sentiment, we should understand that sector a bit better than we currently do.

So, a few data points for our education. Per a dataset digging into just the insurtech space, Q3 was a good period. Four quotes from the report (full version here) will do us well.

First, the top metrics, which were both up from the prior period:

In Q3 2020, insurtech companies globally raised a whopping US$2.5 billion across 104 deals.

Second, as with other forms areas of venture investment, capital was heavily weighted toward later-stage startups:

Six megarounds drove 69% of total funding.[ … ] Overall, the number of megaround deals grew by 50% compared to Q2 2020.

Third, there was a gap in the middle of the market that could hinder some insurtech startups looking to make it into the later stages of private life:

In its crudest terms, insurtechs struggled to secure funding in the US$20 to US$50 million range, relative to the number of insurtechs looking to raise this amount of money.

And, finally, a ray of light for those looking to drop dollars into net-new companies that could yet shake up the huge insurance market:

[B]rand new entrants with very limited track records have also been successful in raising capital — 73% of those insurtechs who raised seed capital this quarter, were raising any form of capital for the very first time. Over half of those insurtechs who raised Series A capital were similarly raising capital for the very first time.

More broadly, a dig into Crunchbase data this morning from TechCrunch saw a general rise in investment into insurtech from H1 2020 through H2 2020 (of course, we lack a crystal ball).

This is the private market that Metromile is putting on its back to a modest degree as it looks to go public via its SPAC-chariot. It’s a lot of capital to captain. More as Metromile gets closer to trading.