investment

VC is ultimately about people, not ideas, but in the current landscape, investors aren’t sufficiently getting to know founders or their experience.

Ventures Platform announces first close of its $40M pan-African fund

Activity around African venture capital firms raising funds continues to increase as we head towards the end of the year. In the latest development, Abuja- and Lagos-based Ventures Platform is…

German revenue-based financing platform Re:cap raises $111.5M Seed round

Re:cap, a non-dilutive funding platform in a similar vein to Pipe.com and Capchase but based in Europe, has closed a Seed financing round of $111.5 million, in a mix of…

Katie Haun is splitting off from a16z to launch her own crypto fund

Katie Haun, who co-leads Andreessen Horowitz’s $2.2 billion crypto fund, is splitting off from the firm and taking a number of colleagues with her — including operating partner Rachael Horwitz…

The macro trends forcing change on the investment management industry

Power in the investment management industry is shifting to the money holders from money managers, driven by several major economic, social and political trends.

Asset management is a highly unusual and somewhat baffling industry. Here are six main examples of just how peculiar this industry is.

8 disappointing investor archetypes: How founders can stop falling for them

In the spirit of helping founders look beyond the promises of value, let’s delve into some common archetypes of investor relationships that founders experience post-investment.

Sapphire Ventures secures largest capital raise to date across two new funds

In all, Sapphire has brought in $3.7 billion in capital in the last 12 months.

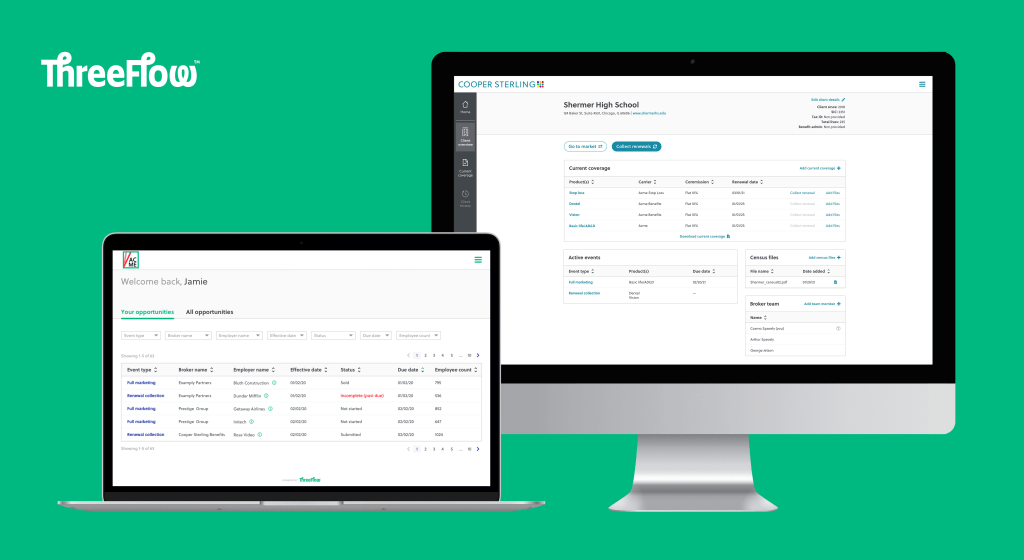

ThreeFlow raises $45M to scale its employee benefits placement software

ThreeFlow, which provides software for insurance brokers selling employee benefits, announced today that it raised $45 million in Series B funding. New investor Accel led the round alongside existing investors…

Vauban, an AngelList-like platform for VCs and angels to run and raise funds, closes $6.3m

It’s always been a slight puzzle why AngelList never really properly took off in Europe, especially when, a few years ago, there was such a dearth of funding options for…

LiveOak Venture Partners takes in $210M aimed at Texas entrepreneurs

The firm touts this fund as “the largest institutional Texas-focused, early-stage venture fund in the past decade” at a time when funding to companies within the state is at an…

Brazil’s Canary sings with closing of biggest fund with $100M in commitments

Canary’s first two funds each invested in approximately 50 companies and the firm’s expectation is to do around the same number of first checks with the third fund.

General Atlantic secures $7.8B in commitments for sixth fund

General Atlantic saw a record 21 IPOs and direct listings of portfolio companies in 2021 thus far.

Female founders are making a buzzing, venture-backed comeback

We’ll have a clearer view of 2021 when all the data trickles in after the conclusion of Q4, but it’s clear that female-founded startups are having a better year than…

We’re still just scratching the surface of the cloud’s potential

Battery Ventures’ State of the OpenCloud report provides a set of data points that pretty clearly outline the accelerated growth of cloud services in recent quarters.

Israeli venture platform OurCrowd today announced that SoftBank’s Vision Fund 2 has made a $25 million convertible equity investment into the firm. As part of this deal, OurCrowd is also…

Lessons from founders raising their first round in a bull market

In a bull market, it’s especially hard to understand people and their value systems. The pandemic does not help us engage, understand culture nor help build a human connection.

At One Ventures’ new fund is going after startups out to ‘destroy the industries that are destroying the environment’

Ultimately, the firm plans to invest in 100 companies over the next decade.

Cannabis investment jumps 82% the second half of 2021, 165% over 2020 levels

Cannabis equity fundraising is quickly hitting new highs. An analysis of Crunchbase data reveals cannabis companies are seeing larger checks from equity financing, and the number of rounds is seemingly…

Private equity is ready to take MSP consolidation to the next level

Recent sales processes have attracted as many as 30-40 private equity bidders, and these firms are looking over their shoulder, as interest in MSP acquisitions rises among other buyers.

High Alpha opens third venture studio: co-founder calls venture market ‘hot and crazy’

Among the 30 of the companies High Alpha has started, there have been seven exits so far.

Masterworks raises $110M to sell fractional shares of physical art — not NFTs

As investors look to diversify their holding amid exceptionally top-heavy traditional asset markets, more tech-enabled platforms are popping up to make the case for their alternative investment platform of choice.…

Eight Roads launches its fourth fund: $450M aimed at European/Israeli scaleups

European VC Eight Roads is launching its fourth fund of $450 million for European and Israeli tech companies, aiming for another 15-20 across a broad range of consumer, software as…

BGV closes fourth fund with $110M aimed at immigrant enterprise AI, cross-border startups

BGV’s portfolio makeup is 95% immigrant entrepreneurs and 60% outside Silicon Valley.

Index Ventures launches web app to help founders calculate employee stock options

The ability to offer stock options is utterly essential to startups. They convince talented people to join when the startup is unlikely to be capable of matching the high salaries…

Fintech is transforming the world’s oldest asset class: Farmland

While farmland is among the oldest investment classes around, the average investor hasn’t had access to farmland the way that billionaires and institutional investors have. That’s changing.

Gaia Capital Partners in Paris rebrands as Revaia, closes first €250M growth fund

Paris-based VC fund Gaia Capital Partners has change its name to Revaia and announced the final closing of its first growth fund, at €250 million. The firm said it exceeded…

LoftyInc Capital launches third fund at $10M for a more diverse portfolio of African startups

LoftyInc Capital, a pan-African VC firm, announced today that it is launching its third fund — LoftyInc Afropreneurs Fund 3 — at $10 million for tech startups in Africa. The…

‘The tortoise and the hare’ story is playing out right now in VC

The unprecedented liquidity entering the venture market in the past year has spurred trends that require VCs to adapt to an environment where startup founders have far more leverage than…

VCs need to stop engaging in self-delusion about why a valuation that is too high might be OK. Here are three common lies investors tell themselves to rationalize an undisciplined…