investment

Real estate investing giant Fundrise breaks into venture capital

Investing in private markets has long been reserved for the ultra-rich. Thanks to tech startups, though, the process is becoming much more accessible for those who aren’t members of the…

If an early-stage startup is ready to raise money but its valuation hasn’t been established yet, a convertible note can serve as a good fundraising option.

Venture capital funding may have slowed, but VC firms have no problems raising new funds

Three firms discuss their funds and any concerns that limited partners had brought up during the fundraising stage.

Headline VC closes $950M spread across three funds for startups in US, Europe, LatAm and Asia

Venture capital fund Headline has been investing in tech startups since — get this — 1999, which might tempt headline writers, perhaps unfairly, to apply the word “dinosaur,” if the…

How to Raise First Dollars in a Difficult Market: The Venture Perspective

Raising venture capital is rarely an easy lift for startups, but 2022 is turning out to be a more challenging year than we’ve seen for some time. As venture capital…

PINA offers wealth management for Indonesia’s growing middle- to upper-class

While many of Indonesia’s investment apps are focused on hooking first-time investors with low fees and starting deposits, PINA is targeting the middle-to-upper classes with wealth management services. The app…

Sequoia Capital reportedly raising two funds, and despite slower VC environment, it’s not alone

This news comes out just over a month after the venture capital giant warned founders to expect a longer economic recovery.

Featured Article

Most startups were overvalued before 2021, and now it’s causing problems

In a normalizing market like this one, once-inflated valuations can become a big problem, particularly for founders, employees and early investors.

Featured Article

MAYA Capital closes second fund with $100M for early-stage Latin American startups

This new fund triples the firm’s assets under management and will enable the pair to invest in another 25 to 30 companies.

When it comes to sanctions, PE firms must proceed with great caution

In order to effectively mitigate sanction risks, PEs are doing due diligence on their LPs and investing in the management of compliance programs and policies at their portfolio companies.

Degreed’s co-founder is back at the company he left…with the startup he built

Edtech up-skilling platform Degreed has acquired Learn In, which creates talent resource hubs for employers to better spin up education services for their teams. While we’d nearly always cover a…

TechCrunch+ roundup: Non-dilutive biotech capital, long-term angel investing, WayRay’s $80M pitch deck

As a veteran startup worker who has been laid off during economic downturns, it’s dissonant to hear investors say this is a good time to launch a software startup. They’re…

It’s time for LPs to take more responsibility in the fight for economic equality

On an institutional level, the onus for change lies on those with the power to make it happen.

Bill Gates offers guidance on what climate technologies he’s looking to fund

Bill Gates joined us at TechCrunch Sessions: Climate 2022 to discuss his priorities in terms of investment projects and technological breakthroughs needed to help effectively address climate change.

We turned our investors into our best source of customer feedback

Next time an investor asks “How can I be helpful?” give this approach some consideration.

Project A Ventures closes its fourth fund, hitting $375M, the largest to date

Project A Ventures launched 10 years ago in Berlin when a handful of a ex-Rocket Internet players decided they’d try their own hand at this startup stuff. Since then they’ve…

Amid rising uncertainty about how financing will look for tech in the months and maybe years to come, one of the newer kids on the VC block in Europe is…

Bonfire Ventures secures $230M for two new funds targeting B2B software startups

Bonfire Ventures aims to help B2B software startups make it to Series A.

Making room at the cap table: A new plan for promoting diversity in tech

As it turns out, we don’t just have a diversity problem in tech employment. We have a diversity problem in tech investment as well.

Data intelligence startup Near, with 1.6B anonymized user IDs, lists on Nasdaq via SPAC at a $1B market cap; raises $100M

The IPO window has all but closed for technology companies in the wake of a massive downturn in the market, but an opening still remains for some, in the form…

Fortis Digital Ventures closing $100 million raise for new crypto fund

The fund aims to make blockchain investing easier through asset allocation, risk management and position sizing in crypto.

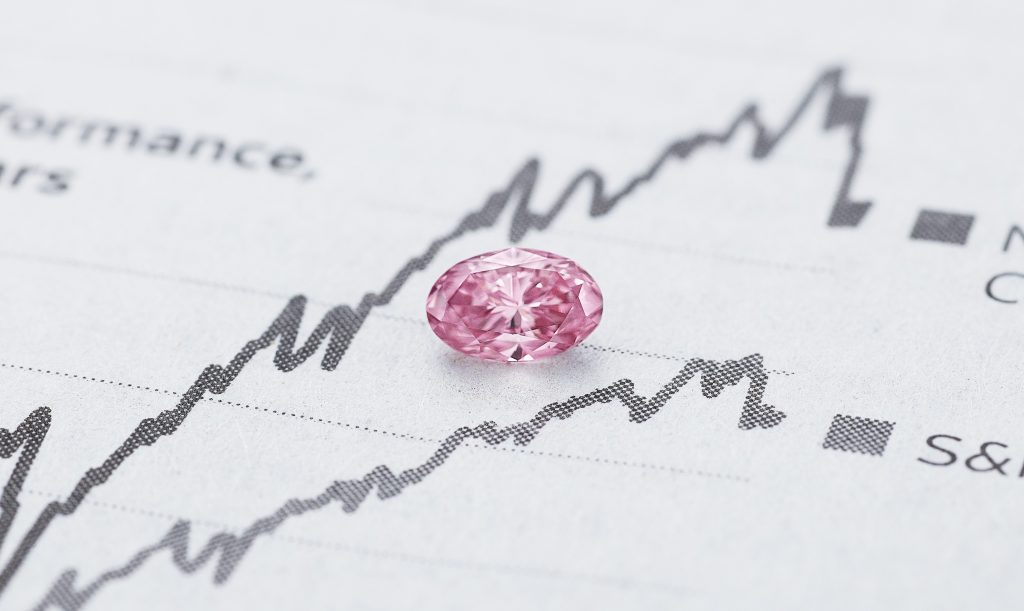

Luxus wants the crown jewel of your portfolio to be an actual diamond

A much-anticipated market downturn may finally be here, and investors have been preparing for it by diversifying their portfolios away from the traditional stock and bond holdings, and into alternative…

Robinhood aims to court users by offering attractive 1% interest rate on cash

Investing app Robinhood is on a roll with announcing new features as it looks to appeal to more customers amid dwindling transaction revenue. Less than a week after unveiling plans…

TechCrunch+ roundup: Psychedelic investor survey, 6 issues VCs look for, hiring on a budget

If you can envision a solution that solves a customer’s problem, it helps to have technical skills if you want to bring it to market. But that’s not a requirement.

Syndicate raises ‘informal’ round from over 50 partners to bring DAOs to the masses

Web3 startup Syndicate‘s goal is to demystify the DAO (decentralized autonomous organization). Its “Web3 Investment Clubs” product, which TechCrunch covered in January, lets users spin up an investment group with…

For every story I hear about a huge round that came together in two weeks, I meet 20 great founders who hustle for months and can’t raise a penny.

Tofino Capital reaches first close of $10M fund to back startups in frontier markets

Tofino Capital, a venture capital firm targeting early-stage startups in emerging markets, has launched its $10 million fund. It is announcing the first close of this fund at $5 million…

How to think like an investor: Understanding the actual cost of fundraising

Investors want you to raise enough capital to comfortably reach your financial and non-financial targets before another fundraise — raise what you expect to need plus an acceptable buffer.

TechCrunch+ roundup: The Kindbody TC-1, Glossier’s mistakes, calculating startup runway

With a focus on education that addresses the fragmentation associated with infertility care, Kindbody is growing at a remarkable pace, but it’s also helping many patients feel seen and heard…

Stenn banks $50M on a $900M valuation for a platform to finance SMBs that trade internationally

Globalization has been one of the biggest trends in e-commerce in the last decade: internet rails facilitate a much wider marketplace of would-be consumers and a selection of items for…