If you follow mainstream tech media, you could be forgiven for thinking that venture capital is a founders’ market today after two years of record round sizes and outcomes.

There is some truth to this: VC had its biggest year in 2021, more than doubling from 2020, which was already a record year for investments. Almost 400 new companies surpassed a $1 billion valuation in 2021, increasing total unicorn count by 69% in just a year.

Stories abound of massive rounds materializing quickly for companies at even the earliest stages. Wing VC, which tracks financings by Silicon Valley’s most “elite” VC funds, reports that the median Series A financing by these firms grew by 38%, and corresponding pre-money valuation by 71%, both off previous record highs recorded in 2020.

But hidden under the headlines is another story: Higher valuations are accompanied by a much larger variance among companies. As Hustle Fund’s Elizabeth Yin tweeted recently, round sizes and valuations haven’t grown for all companies across the board; rather, they have bifurcated.

This tracks with my experience investing in companies founded by women, most of whom were first-time founders and disconnected from mainstream VC. For every story I hear about a huge round that came together in two weeks, I meet 20 great founders who hustle for months and can’t raise a penny.

A fund known for leading huge rounds in pre-revenue, pre-launch, pre-everything companies told a founder in my portfolio that they want to see her reach $1M+ annualized revenue before considering her pre-seed.

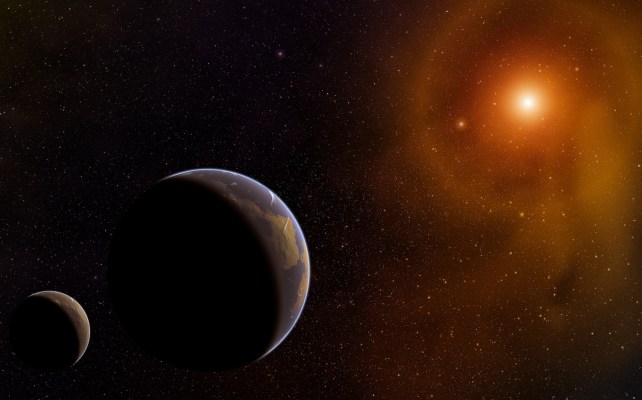

The experience among founders varies so greatly, they might as well be living on different planets. Founders who are experienced, pedigreed, smooth or well connected — or some combination of these — live in a planet of big, buzzy, competitive early rounds, which we’ll call “Planet Flush.”

Founders who are outsiders, don’t generally fit the pattern and are not connected to sources of capital live in a planet where fundraising is extremely difficult and unlikely, necessitating very scrappy execution to even get a chance to grow. Let’s call this one “Planet Scrappy.”

At the risk of stating the obvious, investor behavior is completely different in Planet Flush and Planet Scrappy. In Planet Flush, at the earliest stages when there’s no tangible traction to evaluate, investors are comfortable making a bet on the size of the market and the perceived caliber of the founders.

Social signal plays a big part here: The more the founders can drum up investor demand, the more competitive the round will get, resulting in high valuations and low-diligence investing. It’s just like trying to buy a house in Seattle or Silicon Valley these days — demand is so high, home buyers routinely make all-cash offers way above asking price and forgo all rights to inspection.

Compare that to rounds in Planet Scrappy: Founders here don’t match the “high caliber” pattern that mainstream VCs look for, which is inevitably rife with confirmation bias. They don’t have existing investor relationships, nobody to vouch for them and provide that social signal.

If they want to build a company, they have to hustle for every penny. Many of these founders never get to raise pre-traction at all. Data from our 2019 founder survey illustrates this point — 71% of startups in our community were generating revenue prior to raising seed funding, compared to 54% among all startups. And despite the higher traction, their average seed round was 33% smaller.

As a company starts to execute, investors in Planet Flush do eventually switch from betting solely on the market, team and social signal, and begin looking at the results and the speed at which they achieve them.

Series A used to be the first inflection point between team/market and execution/traction in the form of “milestones” that a company needed to reach to secure a Series A — say, $1 million in ARR for SaaS companies. In the past couple of years, with investor demand so high in Planet Flush, this inflection point has moved farther, prompting a Silicon Valley VC I recently caught up with to declare that “Series B is the new Series A.” What they meant was, it’s the first time anyone does diligence.

Meanwhile in Planet Scrappy, Series A level diligence happens at the pre-seed stage. The same VC fund known for leading huge rounds in pre-revenue, pre-launch, pre-everything companies told a founder in my portfolio that they want to see her reach $1 million+ annualized revenue before considering her pre-seed.

Another founder I’m talking to bootstrapped her SaaS company to $2 million ARR and 70%+ margins, only to have mainstream VCs ask to see her at $5 million in annual revenue before considering her Series A. I chatted with this founder the same week we learned that Fast had raised hundreds of millions of VC off hundreds of thousands in revenue.

Of course, the divide between these two planets is not strictly about gender. I know multiple women founders who live in Planet Flush, and plenty of non-women who live in Planet Scrappy. There is more going on here than gender bias.

What interests me in this tale of two planets is that Planet Flush is where the bubbles happen. In Planet Flush, investors themselves create signal for companies, make decisions disconnected from fundamentals and throw so much money to win rounds that companies never learn to be lean.

Meanwhile, founders in Planet Scrappy have their heads down serving customers and finding product-market fit. So while Planet Flush is experiencing a cool down in 2022, with round sizes and valuations finally dropping, and investors and companies going back to fundamentals, over here in Planet Scrappy, we’ve been investing in fundamentals all along.

I am bullish on Planet Scrappy for the long haul. Planet Flush gets most of the cash and most of the headlines, but the companies that live there don’t have the monopoly on opportunity, talent, ambition and ability to execute. I believe that Planet Scrappy is what venture capital looked like for everyone 40 to 50 years ago, when the first true VC fortunes were made.

My old boss and HBS Professor Clayton Christensen — of “disruptive innovation” fame — used to paraphrase a quote attributed to Walter Gretzky, father of hockey great Wayne Gretsky: “Don’t skate to where the puck is. Skate to where the puck is going.”

Today, the puck is in Planet Flush. Planet Scrappy is where the puck is going. I know which way I’m skating. And you?