venture capital

Secondaries investors say some valuations are still too high

While valuations have fallen quite a bit, some sectors are still too inflated for secondaries investors to find attractive.

SoftBank sells Open Opportunity Fund to Black and Latino executives

The Japanese conglomerate is selling the Open Opportunity Fund to its chairman Paul Judge, and Marcelo Claure, who’s being appointed as vice chairman and general partner.

Black people make up 2.5% of the U.K.’s population; proper representation in venture would mean at least 2.5% of funds going to Black-led businesses.

Welcome back to The Interchange, where we take a look at the hottest fintech news of the previous week. If you want to receive The Interchange directly in your inbox every…

Against a backdrop of layoffs and continuing economic uncertainty, the announcements — particularly in such quick succession — point to a few underlying truths about the market right now.

Featured Article

Seed-stage investors react to higher hurdles for Series A funding

The hurdle for Series A funding is a lot higher than it was a year ago — and investors in seed-stage companies are having to respond. They don’t have much choice if they want their startups to survive. When the market abruptly turned in the spring of 2022, late-stage companies were the first to feel…

BoxGroup closes on $425M for two funds to back early-stage startups

Each fund is $212.5 million and will invest in pre-seed, seed and Series A companies across consumer enterprise, healthcare, financial, biotech and climate.

Playground Global closes Fund III with $410M for early-stage deep tech investments

The new fund invests across the computing, automation, infrastructure, logistics, decarbonization and engineered biology industries.

Paris-based VC firm Singular raises $435 million for its second fund

For a VC firm, the second fund is a make-or-break moment. With the initial fund, you raise money based on an investment thesis because you don’t have any track record,…

Now is a great time to brush up your pitch decks, practice your pitch, and get ready for when things kick off again next year.

Food tech roundup: VC funding declines again in Q3 amid fewer deals

Food tech investors discuss another consecutive quarter of decline in venture capital investments into areas like plant-based meat alternatives and cultivated meat.

5 secondaries investors tell us what’s hot and what’s not heading into 2024

Secondary activity is expected to return to normal in 2024. Five investors tells us where they are interested and where they are not.

Suzanne Fletcher invested in 10 companies from the new fund, so far, and plans to invest in 40 companies in total.

Why Congruent turned down over $300M from LPs for its third climate tech fund

Investors thought the firm’s initial target of $200 million was far too modest, and instead offered $600 million, a threefold oversubscription.

Seed founders should consider these factors before partnering with multistage funds

Right now, in late 2023, the IPO market is halted, and late-stage deals rarely happen because funds and entrepreneurs cannot find common ground on pricing. The seed-stage arena has become…

Summer’s secondary surge didn’t last, but 2024 should be strong

Secondary activity was inconsistent this year, but if the IPO window opens back up in 2024, secondaries should return with it.

RepeatMD recently raised a $50 million Series A round to serve the exploding med spa industry that is built on consumer beauty trends.

Benchmark, the storied venture firm, sees the AI race as still wide open

Yesterday in Helsinki, this editor interviewed four of the six general partners at Benchmark, the nearly 30-year-old Silicon Valley firm that’s known for some notable bets (Uber, Dropbox), paying each…

Tola Capital, investing in AI-enabled enterprise software, closes largest fund at $230M

Tola Capital III will invest 25 to 30 companies globally and write average check sizes of between $1 million to $4 million for seed-stage companies.

FEBE Ventures’ name stands for “For Entrepreneurs By Entrepreneurs,” and true to form, it is continuing to support seed-stage startups with the launch of its second fund. Targeting $75 million,…

Fearless Fund grant program was already ‘at risk’ before lawsuit

A leaked document shines new light on the fund’s relationship with Mastercard and the embattled grant program.

NXTP closes largest fund with $98M for early-stage B2B founders in Latin America

NXTP Fund III represents over a 2x increase from the size of its previous fund, enabling the firm to invest in between 25 and 30 companies this time around.

TC Startup Battlefield master class with Blumberg Capital: Make the most of your investors’ expertise

David Blumberg, founder and managing partner at Blumberg Ventures, explains how early-stage startups can look to their investors for help with solving problems, scaling, hiring, and strategic planning.

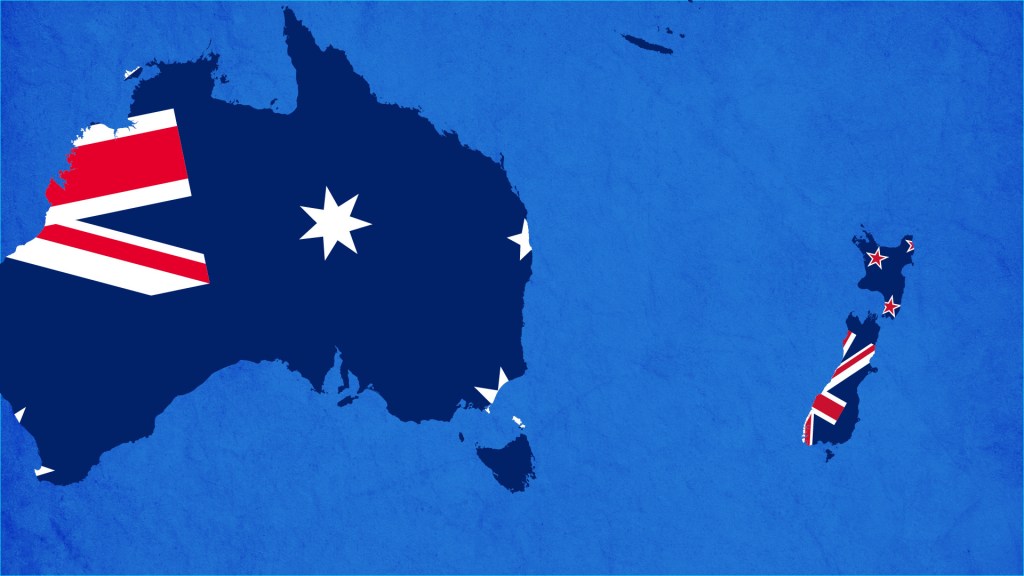

In Australia and New Zealand, a venture downturn isn’t the end. It’s time to shine.

The geographic isolation of Australia and New Zealand creates a sense of hustle, if not urgency, around raising funds and building a global product.

Investors say New Zealand has ‘all the right ingredients’ to be a startup nation

This is part of a survey of investors focused on Australia and New Zealand. The following responses are from the New Zealand investors.

Australian investors say capital limitations push founders to ‘new heights of creativity’

This is part of a survey of investors focused on Australia and New Zealand. The following responses are from the Australian investors.

Featured Article

Tiger Global chieftain Scott Shleifer transitions to advisory role after wild ride

Tiger Global Management is going through a major management change. Per a message that founder Chase Coleman sent this afternoon to investors of the 22-year-old venture- and hedge-fund outfit and obtained by TechCrunch, Coleman is taking over both the outfit’s public company investing and private equity businesses, while the longtime head of the latter, Scott…

Owning the earscape market with Lisa Bubbers and Anna Harman from Studs

Welcome back to Found, where we get to the stories behind the startups. Becca and Dom are joined by Lisa Bubbers and Anna Harman, co-founders of the ear piercing company…

Twelve Below aims to lead or co-lead pre-seed and seed financings with the goal of earning a 10% to 15% ownership stake in the core investments from the fund.

5 investors have high hopes for defense tech amid growing venture interest

It is likely not an overstatement to say that the relationship between U.S. defense and Silicon Valley is undergoing its most profound transformation since the 1950s.