revenue-based financing

Lighter Capital raises $130M credit facility to ignite revenue-based financing for startups

Lighter Capital designed its revenue-based financing model for SaaS, technology services, subscription services and digital media companies that already have revenue and are growing.

QED leads $7M round into startup that offers financing to SaaS businesses across US-South Asia corridor

There are a number of companies in the U.S. that offer revenue-based financing to SaaS companies, including Capchase, Pipe, Founderpath and Arc. But the options for South Asian companies are…

TechCrunch+ roundup: H-1B worker advice, managing remote teams, pitch deck teardown

“The American dream is still really important to immigrants. They still want what America represents and they’re going to reevaluate their relationship with Big Tech and the nature of work.”

Revenue-based financing: A new playbook for startup fundraising

While venture capital remains the most popular avenue for startups, founders should take advantage of all the financing options available to them.

FlapKap provides revenue-based financing to e-commerce brands in MENA, gets $3.6M seed funding

Recent research suggests that the e-commerce market in Saudi Arabia, UAE and Egypt account for a combined $21.4 billion and is projected to grow by more than 50% to $33.3…

How Untapped Global plans to bring the revenue financing model to African startups

In the developed world, almost anyone can get financing for, say, a car lease. But in an emerging economy like South Africa, the only people who own cars or can…

‘Climate entrepreneurs deserve fast capital’: Enduring Planet unwraps a new fintech platform

Enduring Planet, a new fintech firm that exclusively funds climate entrepreneurs, is taking the wraps of its first product after securing $5 million in debt and equity financing. The company…

French startup Silvr has raised a $20.6 million (€18 million) Series A funding round and has opened a $128 million (€112 million) debt line for its activities. Silvr wants to…

Featured Article

Startups have more options than ever to lower their reliance on venture capital

The capital market for startups has perhaps never been more attractive than it is today. Not only are venture capitalists raising more capital than ever, but new methods of financing startup activity are maturing. The result is a capital market that is increasingly competitive for startup attention, and business, which may lead to better prices…

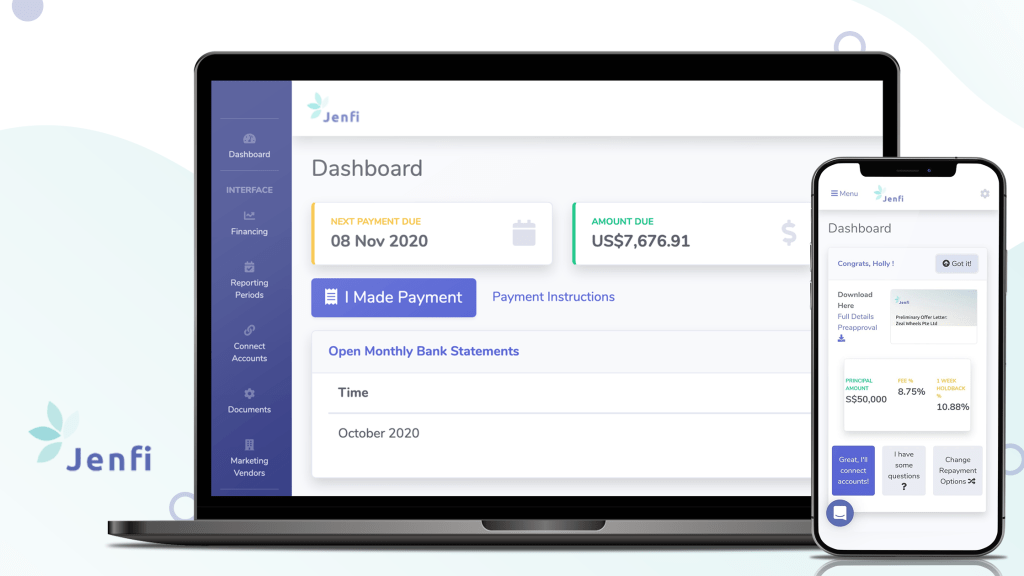

Revenue-based financing startup Jenfi raises $6.3M to focus on high-growth Southeast Asian companies

Many Southeast Asian digital businesses run into obstacles when seeking early-stage growth financing. They might not want to sell equity in their company, but often struggle to secure working capital…

Revenue-based financing: The next step for private equity and early-stage investment

One of the most prominent and popular new models for investors is revenue-based investing (RBI).

Lighter Capital secures $100M to grow its equity-free financing business

Lighter Capital announced today that it has secured access to $100 million to lend to growing startups. The firm is best-known for its work with revenue-based financing, in which expanding…

San Diego-based Founders First Capital Partners gets $100 million for revenue-based fund

Founders First Capital Partners, an accelerator and investment firm that provides revenue-based financing to businesses led by “underrepresented entrepreneurs” operating in underserved markets, has received a $100 million commitment to…

Should you raise equity venture capital or revenue-based investing VC?

Most founders who are raising capital look first to traditional equity VCs. But should they? Or should they look to one of the new wave of revenue-based investors?

Why are revenue-based VCs investing in so many women and underrepresented founders?

A new wave of revenue-based investors are emerging who are using creative investing structures with some of the upside of traditional VC, but some of the downside protection of debt.

You’re working on launching a new VC fund; congratulations! I’ve been a traditional equity VC for 8 years, and I’m now researching revenue-vased investing and other new approaches to VC.…

So you’re interested in raising capital from a Revenue-Based Investor VC. Which VCs are comfortable using this approach? A new wave of Revenue-Based Investors (“RBI”) are emerging…

Revenue-based investing: A new option for founders who care about control

Does the traditional VC financing model make sense for all companies? Absolutely not. VC Josh Kopelman makes the analogy of jet fuel vs. motorcycle fuel. VCs sell jet fuel which…

Startups Weekly: There’s an alternative to raising VC and it’s called revenue-based financing

In this week’s newsletter: Amazon takes a bite of Deliveroo and Away packs on $100M