NVCA

Featured Article

Putting numbers on the global venture slowdown

Total venture funding in 2022 amounted to $415.1 billion, 35% less than in 2021.

A new PitchBook report warns of an ongoing economic downturn. If you don’t want to be disappointed, you may not want to put high hopes on seed activity.

Why the decline in startup funding totals if U.S. venture capitalists’ accounts are straining at the seams?

Featured Article

Don’t worry about VCs’ returns if you can exit your startup early

There are many reasons to stick it out at your startup, but if you’re worried about your investors when faced with an exit, here’s why you shouldn’t be.

The corporate venture comeback: What startups considering CVC need to know

Corporates generally aren’t hard to find because of their bigger presence, but founders have to take care to perform due diligence around which corporate best suits their needs

I have been thinking a lot about silos, or the lack thereof, within startupland. There’s sometimes an artificial wall that is put up between companies at different stages of growth,…

Female founders are making a buzzing, venture-backed comeback

We’ll have a clearer view of 2021 when all the data trickles in after the conclusion of Q4, but it’s clear that female-founded startups are having a better year than…

Funding in an uncertain market: using venture debt to bridge the gap

Now more than ever, companies should examine all sources of capital and ensure they are sufficiently funded to emerge from this period stronger than they entered it.

Like many industries with a high concentration of wealth — and the careers that help professionals accumulate it — investment firms have a severe dearth of diversity in their ranks.

Featured Article

As VCs favor B2B startups, B2C upstarts’ venture activity falls

The Q2 2020 venture capital market did not bring a catastrophic slowdown to either the global private investment scene or the U.S.’s own VC scene. But inside the rosier-than-anticipated private capital results of the second quarter, there were pockets of weakness, and strength, that we should understand as we look to the rest of 2020 and…

Featured Article

Don’t apply for a PPP loan unless your affiliation issues are resolved

Because the terms of the PPP are so compelling, it simply has to be looked at as a financing source.

Proposed amendments to the Volcker Rule could be a lifeline for venture firms hit by market downturn

In the wake of the financial crisis, Congress passed regulations limiting the types of investments that banks could make into private equity and venture capital funds. As cash strapped investors…

Are January layoffs just a few post-WeWork jitters? TechCrunch has found itself writing about layoffs at a few notable tech companies this week — and not just SoftBank-backed ones. The…

Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between. Today we’re digging into the Q4 venture capital market — specifically unpacking…

Featured Article

Getting a seat at the VC table

We are witnessing the greatest paradigm shift in power since the advent of the venture capital industry.

It’s another week, and another bevy of hits on Chinese tech by the U.S. government. Let’s get up to speed, plus a request for startup lawyer recommendations. TechCrunch is experimenting…

A new foreign investment bill will impact venture capital and the US startup ecosystem

President Trump’s time in office has been punctuated by rising tension with China on a host of economic issues. He’s received bipartisan criticism for the impact of tariffs on Chinese…

Finally, legislation to support startups

On any given day in our nation’s capital, you’ll find many lawmakers touting the benefits of entrepreneurship. Unfortunately, this enthusiasm is all too often forgotten when it comes to our…

Both Trump and Clinton are taking on carried interest, so why aren’t investors nervous?

During every U.S. presidential election season, at least one candidate vows to repeal carried interest deductions. Meanwhile, venture capitalists do their part and argue against it. The issue is near and…

The next new thing: Women VCs

Few — though not most — see what’s coming next, too, and that’s women VCs, taking their place alongside men, in equal, or nearly equal, numbers. In fact, we’d argue…

What bubble? VCs spent $12 billion on startups in first quarter

Venture capitalists will tell you that a lackluster IPO market and struggling tech stocks mean that they are being more cautious, but the data suggests otherwise. Apart from last year,…

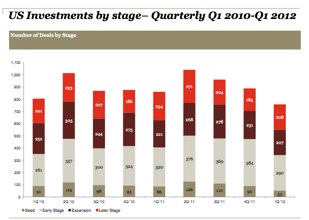

VCs Invested $5.8B In 758 Deals In Q1 2012, Total Dollars And Deals Both Down From Last Quarter

Venture capitalists invested $5.8 billion in 758 deals in the first quarter of 2012, according to a MoneyTree Report from PricewaterhouseCoopers LLP and the National Venture Capital Association (NVCA). The…

Dow Jones Says Q1 2012 U.S. Venture Fundraising Up 5 Percent, NVCA Reports 35 Percent Decrease

Thanks to big raises from venture firms like Andreessen Horowitz, U.S. venture capital fund-raising increased to $7 billion across 47 funds in the first quarter of 2012, which is a…

Report: Number Of VC Funds Raising Money At 16-Year Low (There's A But)

According to Thomson Reuters and the National Venture Capital Association, United States-based venture capital funds have raised $2.7 billion in the second quarter of 2011, a 28 percent increase by…

Venture Dollars Drop 31 Percent In Third Quarter, Led By Decline In CleanTech Fundings

For all the hair-pulling that too much venture money is being thrown at startups, the third quarter actually saw a 31 percent sequential drop in venture dollars invested in the…

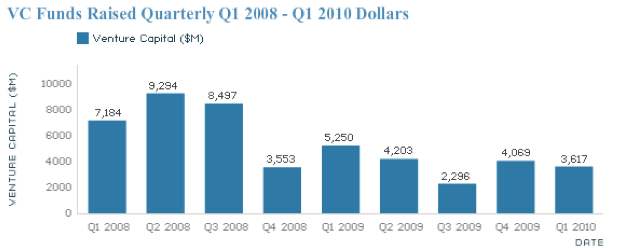

New Money Going To Venture Funds Down 31 Percent In First Quarter

Venture capital firms are having their own problems raising new money from limited partners. Capital inflows in the first quarter were down 31 percent annually to $3.6 billion in the…

Ten-Year Venture Capital Returns Continue To Slide

Ten-year returns for Venture Capital firms continue to slide downwards for the 5 and 10-year periods ending on September 30, 2009 according to the Cambridge Associates U.S. Venture Capital Index,…

More Data Points to Uptick In Third Quarter Venture Funding

More venture dollars went into startups in the third quarter than the two previous quarters of the year, but was still down 33 percent from a year ago, according to…

Venture Funds Raise Only $1.6 Billion In Third Quarter. Most Of That Went To Vinod Khosla.

More evidence that venture exits and fund raising are related. We already know that venture exits were anemic in the third quarter of 2009, and now the National Venture Capital…