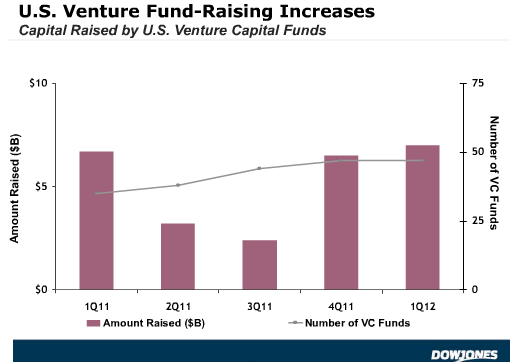

Thanks to big raises from venture firms like Andreessen Horowitz, U.S. venture capital fund-raising increased to $7 billion across 47 funds in the first quarter of 2012, which is a 5% increase in capital raised and a 34% increase in fund closings from the same period last year according to Dow Jones.

The report says that 23 early-stage funds raised $1.6 billion, which is a 35% increase in fund closings and nearly triple the amount of capital raised during the first quarter of last year. Dow Jones says that just three early-stage funds accounted for 79% of the total, and 12 funds targeting $50 million or less in fundraising held final closings during the first quarter.

TechStars’ David Cohen recently raised $28 million for a new fund, and SoftTech VC also raised $55 million.

Multi-stage fund-raising was strong for the quarter, with 17 funds raising $5 billion, a 13% increase in fund closings and 19% increase in capital raised. In early January, Andreessen Horowitz raised $1.5 billion for its Fund III. Dow Jones says that Andreessen Horowitz and Tiger Global Management, which raised $1.5 billion in March, accounted for more than half of the capital raised. In the past quarter, Charles River Ventures also raised $375 million for a new fund, as Bain Capital Ventures raised $600 million.

Capital committed to later-stage funds fell 77% to $449 million despite seven funds holding closings in the first quarter, compared to three in the same period last year.

“A few big firms continue to have no trouble raising large funds, as limited partners are sticking with what they see as safe bets when making their venture allocations,” said Zoran Basich, editor of Dow Jones VentureWire. “But small firms are also finding some receptive LPs interested in investing in niche spaces, such as education, or specific geographic areas.”

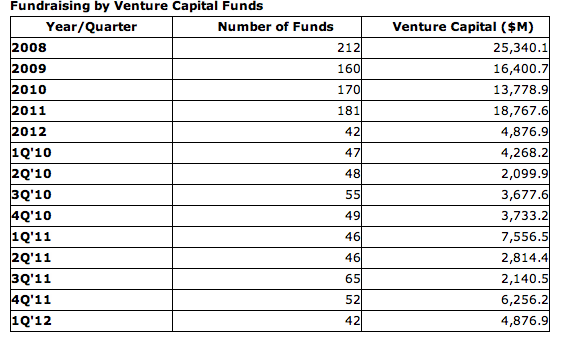

Thomson Reuters and the National Venture Capital Association (NVCA) have a different set of data that actually show a decrease in the amount raised by U.S. venture firms in Q1. Forty-two U.S. venture capital funds raised $4.9 billion in the first quarter of 2012, according to the report. This is a 35 percent decrease by dollar commitments and a 9 percent decline by number of funds compared to the first quarter of 2011, which saw 46 funds raise $7.6 billion during the period.

NVCA says the top five funds accounted for nearly 75 percent of total fundraising this quarter as the number of funds raising money during the quarter fell to its lowest levels since the third quarter of 2009, when 36 venture capital funds saw new capital commitments.

What accounts for the discrepancy? Perhaps NVCA isn’t accounting for early-stage funds, as Dow Jones is (which could account for the difference in number of VC funds raised). Also, NVCA says that classifications are based on the headquarter location of the fund, not the location of venture capital firm.

Additionally, the NVCA says there were 31 follow-on funds and 11 new funds raised in the first quarter of 2012, a ratio of 2.8-to-1 of follow-on to new funds.

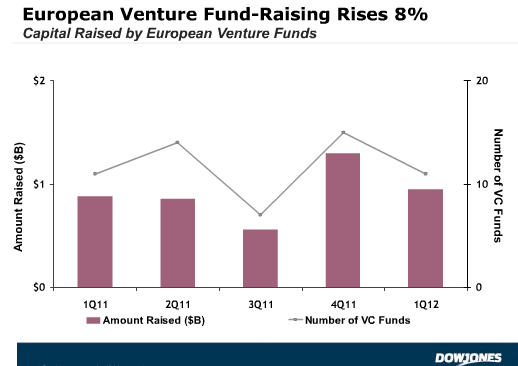

In terms of outside the U.S., Dow Jones reports that European venture funds raised $954 million for 11 funds, an 8% increase in capital raised with the same number of fund closings compared to the first quarter of last year. In Europe, early-stage funds garnered most of the capital, raising $769 million across eight funds, an 8% decline in capital committed from the same period last year. Capital committed to multi-stage funds more than doubled to $105 million for two funds.