b2b software

Winston Chi, Butter’s founder and CEO, told TechCrunch that “most parties, including our investors and us, are making money” from the exit.

Former Xerox Ventures execs launch first fund under Myriad Venture Partners

After working together at corporate venture capital firm Xerox Ventures, Chris Fisher, Tim Chiang and Dean Mai form Myriad Venture Partners.

Garuda Ventures’ debut fund will invest in B2B-focused software companies

Garuda Capital invests in pre-seed and seed-stage startups focused on business-to-business in the areas of cloud, climate, apps and commerce.

Andy McLoughlin of Uncork Capital on the firm’s new funds, succession, and why next year could be a bloodbath (sorry, startups)

A few weeks ago, Uncork Capital shared the news that it recently closed on $400 million in capital commitments across two new funds: $200 million for a seed-stage vehicle and…

Artisanal Ventures closes $62M fund, takes ‘connected capital’ approach to investment

The firm’s strategy is to complement the biggest VC firms by building companies with them, leveraging LP expertise with executive search capabilities.

SF’s Tradeshift, a supply chain finance platform, raises $200M

Tradeshift — the late-stage startup tackling supply chain financing — has announced a $200 million funding round in equity and debt from a combination of existing and new investors, including…

SaaS in 2021: How prodigious growth changed the startup landscape permanently

Learn more about OpenView’s annual Financial & Operating Benchmarks report, which looks into numbers and best practices behind top of class SaaS performance.

Ellen DeGeneres, Portia de Rossi, Shaun White, Shawn Mendes get behind Shelf Engine

Shelf Engine’s grocery order automation technology applies AI to food order volume so that grocery customers can reduce their food waste by as much as 32%.

Featured Article

Proactive CEOs should prioritize European expansion

The best CEOs are globally ambitious, and they know that unlocking Europe’s growth potential remains a critical step on the road to IPO.

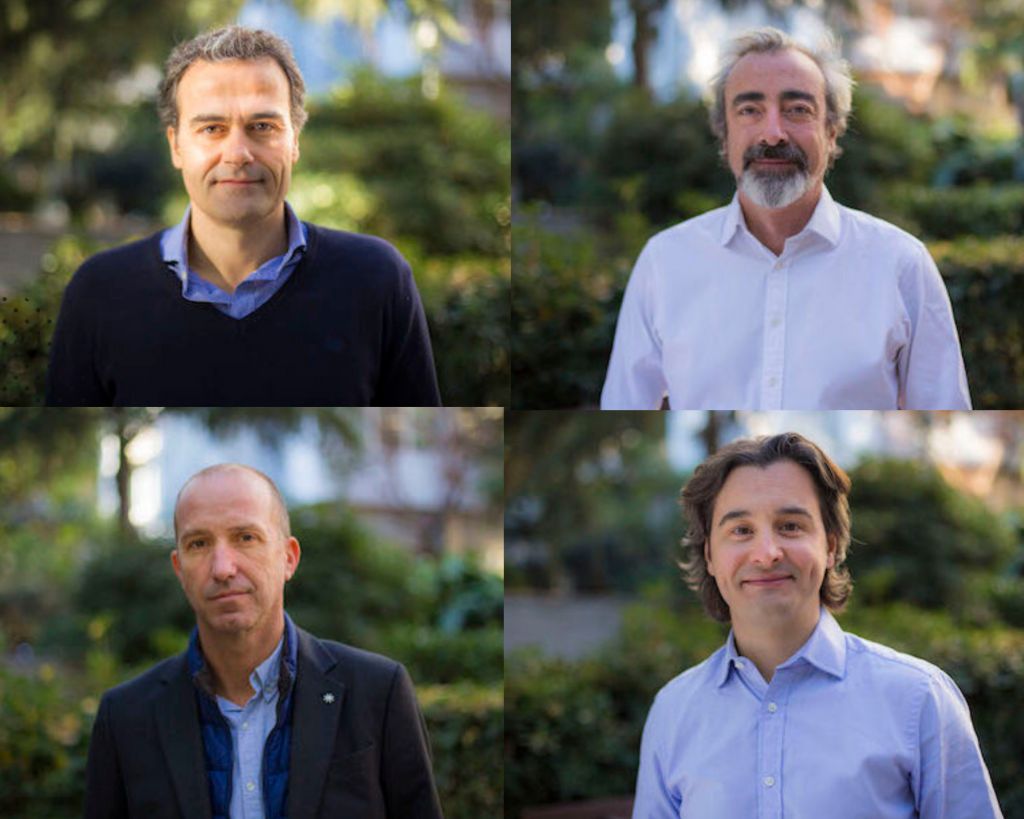

Dawn Capital closes another $400M fund to focus on B2B software

Dawn Capital, the London-based VC that focuses on B2B software, has closed its fourth and largest fund: $400 million that it plans to use to continue investing in early-stage startups.…

Nauta Capital launches fifth fund with €120M to back early-stage European B2B startups

Nauta Capital, the pan-European venture capital firm that invests in B2B technology startups at seed and Series A, is launching its fifth fund. The new vehicle has an initial close of…