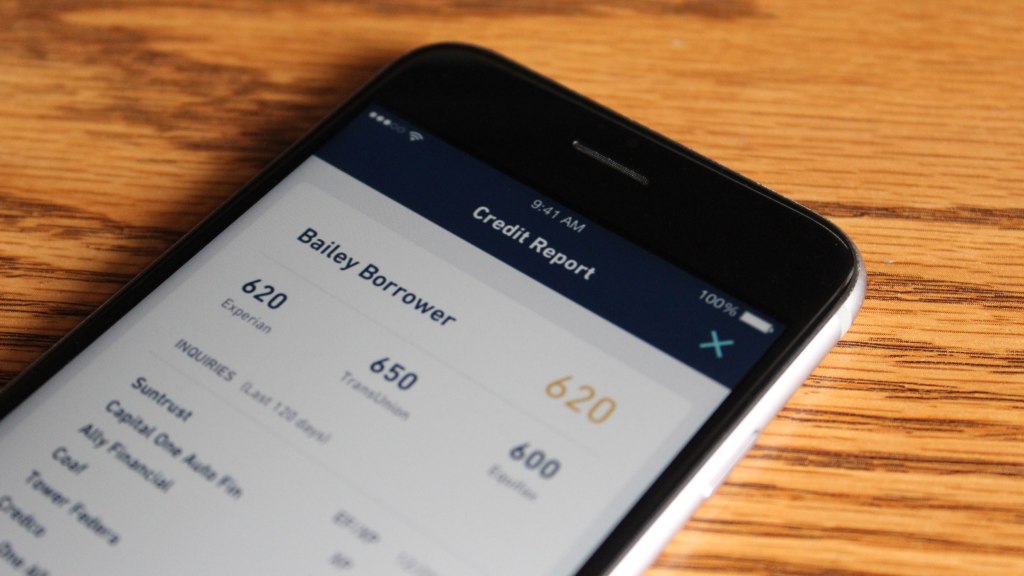

How Credit Karma, acquired amid COVID chaos, fared in its first year under Intuit

February 24, 2020, is a day Ken Lin will never forget. The Credit Karma CEO was about to announce that the company he founded 13 years earlier was about to…

In Amazon scuffle, Visa’s loss could be Affirm’s gain

Let’s look at why BNPL is becoming a more attractive payment option for big e-commerce companies like Amazon and Walmart, as well as merchant marketplaces like Square and Shopify.

Featured Article

Lessons we learned from the last week of fintech earnings

Let’s examine a series of winning fintech results from BNPL, consumer finance, proptech and corporate finance before turning to fintech’s earnings misses from Q3 2021.

Debt-as-a-service provider Sivo wants to power the next generation of lending startups

Sivo wants to do for debt what Stripe did for payments: Make it as easy to access a debt facility as plugging into an API.

Expensify CEO David Barrett discusses going public and why expense management is a $1T opportunity

“I think what is really driving this, honestly, is just liquidity for our early shareholders. We haven’t raised money in so long that our VCs basically just need liquidity.”

Featured Article

What does Zillow’s exit tell us about the health of the iBuying market?

Selling an asset at a loss is a bad idea in most areas of business, but it is a particularly bad idea in a market where sales cycles are slow, unpredictable and largely out of your control.

Once focused on mortgage banking, Blend is now going after the broader fintech market

Since it was founded in 2012, Blend has signed up some of the biggest banks in the country. Now, it’s setting its sights on the startup and fintech market, hoping…

Credit card and payments companies compete for a slice of the growing BNPL market

A year ago, the biggest players in the BNPL space were companies founded solely to offer consumers the ability to pay in installments at the point of sale. But the…

Zillow may be pulling up the welcome mat, but rival Opendoor is expanding into new markets

Zillow announced that it was hitting pause on its iBuying operations earlier this week, but rival Opendoor says it is expanding operations and plowing ahead.

Potential winners and losers line up as Plaid pushes deeper into payments

So now Plaid says it’s a payments company. It was only a matter of time, really.

When Visa announced plans to purchase Plaid for $5.3 billion in January 2020, the deal represented one of the largest acquisitions of a fintech upstart by an incumbent financial powerhouse.…

BaaS served three ways: A closer look at a rapidly evolving market

There’s no one-size-fits-all solution, but having a better understanding of how BaaS providers position themselves between banks and fintechs can help potential customers determine which model is best for them.

Featured Article

Global startups raise $158B in Q3, an all-time record

We’re beginning to see why it feels so busy out there. It is!

Banking as a service will change not just the way financial services apps are built and embedded into new platforms, but also the way in which consumers and businesses alike…

Goldman says $2.2B purchase of BNPL provider GreenSky will help expand Marcus

The acquisition is positioned to bolster the firm’s consumer business and offer new products and new ways to attract consumers to its Marcus by Goldman Sachs brand of finance products.

Better.com acquires UK-based Property Partner ahead of SPAC close

The deal could give Better a way to augment its lending business with the potential to enable fractional ownership of properties in the U.S. and other markets.

“We aren’t so easily categorized,” said Better CEO Vishal Garg.

Featured Article

All the reasons why you should launch a credit or debit card

To learn more about the pros and cons, we spoke with executives from Marqeta, Expensify and Cardless.

Featured Article

Ramp and Brex draw diverging market plans with M&A strategies

From a high level, all of the recent deal-making in corporate cards and spend management shows that it’s not enough to just help companies track what employees are expensing these days.

Why fintechs are buying up legacy financial services companies

As more fintech companies find their way to higher and higher valuations in both the private and public markets, expect to see more legacy banks and lenders be gobbled up…

Featured Article

What Square’s acquisition of Afterpay means for startups

The main takeaways? “Buy now, pay later” may be effective at driving retail conversion, but scale matters and long-term margins look slim for BNPL startups.

A requiem for The Creamery

The Creamery was not a place you went for the memories. It was located firmly at the apex of convenience and comfort — which is why it was the perfect…

Amitree raises $7 million to provide a Gmail assistant for real estate agents

Real estate tech startup Amitree is making life easier for real estate agents, which it hopes will make life even easier for the homebuyers they work with. The company has raised $7…

Mortgage technology provider Blend raised another $100 million led by Greylock

San Francisco-based Blend is simplifying the process of mortgage applications for both borrowers and lenders, but is looking to expand into other lending products. To do that the company has raised…

With $2.6 million in funding, Gabi wants to get you a better deal on insurance

Most people are overpaying for car or home insurance, but many don’t know by how much or even how to compare different plans or carriers. That’s where Gabi comes in.…

All the companies from Y Combinator’s Summer 2017 Demo Day (Day 2)

We once again braved the traffic of the 101 to bring you all the companies presenting on the second of Y Combinator’s day of demos, for what is the 25th…

Pre-owned jewelry marketplace TrueFacet now sells brand-new bling

Since launching in 2014, TrueFacet has emerged as the go-to place for fans of high-end jewelry and watches to find quality pre-owned merchandise for sale online. Now, after establishing itself as…

Biotech and artificial intelligence have emerged as the top startup trends at Y Combinator‘s 25th Demo Day. The 124 companies presenting at the entrepreneur school’s twice-yearly graduation event compose YC’s…

Payroll-secured loans are a $40 billion a year business in Brazil, but that business largely happens offline. A startup in Y Combinator called bxblue wants to change that by creating a marketplace…

Americans apply for more than 250 million new financial products each year, but the majority of those applications are completed on paper or over the phone. A startup called Original Tech wants…