European Investment Fund

Paris-based Breega closes €250M fund, opens Barcelona office to back Iberian startups

Paris-originated VC Breega wasn’t enormously well known in the VC world (it only closed its first fund in 2015) until, perhaps, it started attracting attention with its second €110 million…

Europe’s Revent hits $68M hard cap on its climate, health & impact-focused fund

Last year I covered the launch of Berlin-HQ’d Revent — a new European early-stage VC with an “impact” focus — as it aimed to launch a €50 million ($60 million)…

Portuguese VC Shilling tops up its Founders Fund, hitting $59M in capital to deploy

Further evidence of the booming Portuguese tech ecosystem is emerging today with the news that venture capital firm Shilling is topping up its “Founders Fund” to €52 million ($59 million),…

Eleven Ventures closes new fund at $67.6M to invest in Southeastern European startups

Bulgarian venture capital is experiencing something of a renaissance. Last year LAUNCHub Ventures raised a €70 million find aimed at Southeastern Europe, while Vitosha Venture Partners raised a €26 million…

VentureFriends raises $112M fund aimed at Southern Europe, Middle East and LatAm

Southern Europe has sometimes been seen as a little bit of a backwater in terms of venture capital funding. However, that has gradually started to change in recent years. Earlier…

Iceland’s Crowberry Capital launches $90M seed and early-stage fund aimed at Nordics

Crowberry Capital, operating in Reykjavik and Copenhagen, has launched Crowberry II: a $90 million seed and early-stage fund aimed at startups in the Nordic region. A second close — bringing…

European Investment Fund puts $30M in Fabric Ventures’ new $130M digital assets fund

It is the first European Investment Fund-backed fund mandated to invest in digital assets and blockchain technology.

iAngels raises $55 million, anchored by the European Investment Fund, for first institutional fund

iAngels, the private investment platform founded and helmed by Mor Assia and Shelly Hod Moyal, has today announced the close of its first institutional fund. The firm has raised $55.5…

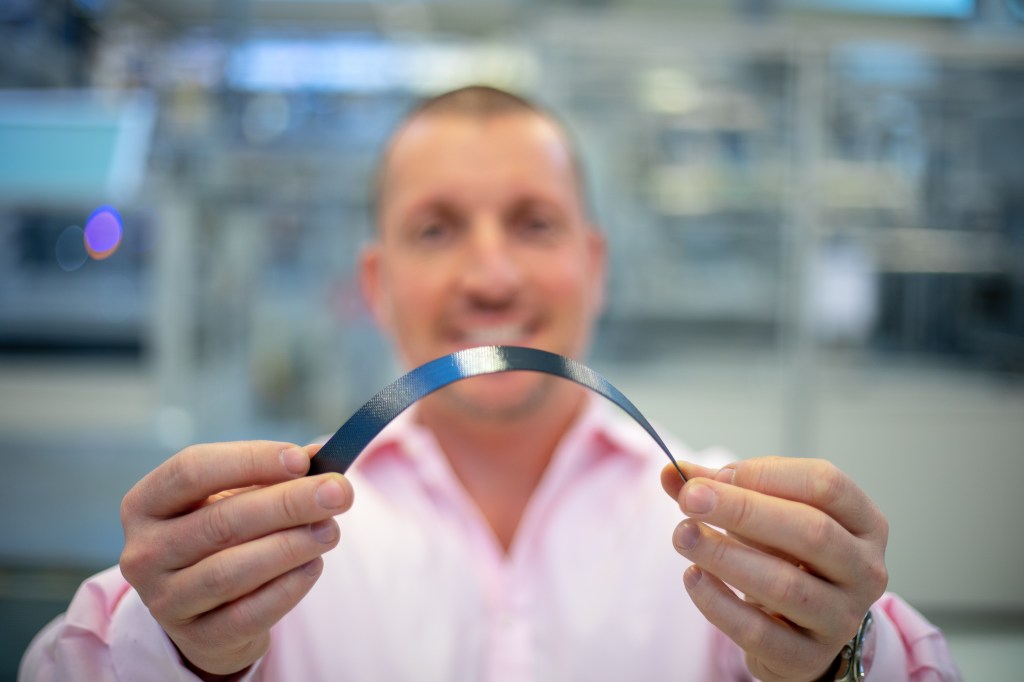

Exeger takes $38M to ramp up production of its flexible solar cells for self-powered gadgets

Sweden’s Exeger, which for over a decade has been developing flexible solar cell technology (called Powerfoyle) that it touts as efficient enough to power gadgets solely with light, has taken…

To improve accountability, Norrsken VC ties partner compensation to its portfolio’s sustainable successes

With the close of its latest investment fund, Norrsken VC is taking an unprecedented step in tying the compensation of its partners to the positive changes the firm’s portfolio companies…

Aldea Ventures creates ‘hybrid’ European €100M fund to invest both in micro VCs, plus follow-on

The historical trajectory of venture capital has been to move to earlier and earlier finding rounds in order to capture the greatest potential multiple on exit. In the U.S., we’ve…

Big data VC OpenOcean hits $111.5M for third fund, appoints Ekaterina Almasque to GP

OpenOcean, a European VC which has tended to specialise in big data-oriented startups and deep tech, has reach the €92 million ($111.5 million) mark for its third main venture fund,…

LAUNCHub Ventures heading towards a $85M fund for South Eastern European startups

LAUNCHub Ventures, an early-stage European VC which concentrates mainly on Central Eastern (CEE) and South-Eastern Europe (SEE), has completed the first closing of its new fund at €44 million ($53.5…

Portugal’s Faber reaches $24.3M for its second fund aimed at data-driven startups from Iberia

Portuguese VC Faber has hit the first close of its Faber Tech II fund at €20.5 million ($24.3 million). The fund will focus on early-stage data-driven startups starting from Southern…

Greece’s Marathon Venture Capital completes first close for Fund II, reaching $47M

Marathon Venture Capital in Athens, Greece has completed the first closing of its second fund, reaching the €40 million / $47 million mark. Backing the new fund is the European…

Berlin’s Cavalry Ventures closes €80M, backed by DACH founders and EIF

Cavalry Ventures, the Berlin-based early-stage venture fund which was the lead investor into BRYTER, has closed its second fund of €80 million, more than 3.5x the size of its maiden…

Featured Article

Hoxton Ventures’ partners assess Europe’s early-stage landscape

“We’re largely hands off with our companies, but I think almost all the founders we pick tend to do the right thing and have a broader perspective on society.”

With three unicorns under its belt, Hoxton Ventures outs ~$100M second fund

Hoxton Ventures, the London-based early-stage VC firm best known for backing British unicorns Babylon Health, Darktrace and Deliveroo, is announcing its second fund, which has closed at a little less…

Lisbon finally gets a substantial VC fund in the shape of Indico Capital Partners

Lisbon, characterized occasionally by some tech scene observers as “the warm Berlin,” has been threatening to generate more startups in the last few years, not least because it will now…

EU ties pay off, as EIF puts $74M into Dawn Capital’s $232M fund

U.K. VCs were sent a message today by the EU: Continue to invest in European companies and we’ll invest in you. That at least seems to be the takeaway from…