Chain Reaction has been nominated for a Webby award in the Best Technology Podcast category. Please take a few moments to vote here. Voting closes today, April 20.

Welcome back to Chain Reaction.

Coinbase, the second-largest crypto exchange in the world, has received its digital asset business license from the Bermuda Monetary Authority, Bermuda Premier David Burt tweeted Wednesday night. Coinbase will open an offshore derivatives exchange there “as soon as next week,” according to a person close to the company, Fortune reported.

This is the behemoth exchange’s latest expansion to grow internationally and expand its footprint, Coinbase shared in a series of tweets.

Aside from the Bahamas, Coinbase has expanded in Abu Dhabi, Canada, Brazil and Singapore. It’s more than halfway through its eight-week international expansion drive, the company shared in a post.

“As we have said previously, our approach globally will be consistent with our approach in the United States,” according to the company.

These growth efforts point to the company’s attempt to expand its international business amid U.S. regulators cracking down on the crypto industry.

Last month, Coinbase was issued a Wells Notice from the U.S. Securities and Exchange Commission. Per a Coinbase SEC filing, the government agency’s staff has “advised the Company that it made a ‘preliminary determination’ to recommend that the SEC file an enforcement action against the Company alleging violations of the federal securities law.”

Coinbase CEO Brian Armstrong has been an outspoken advocate for creating crypto regulation guidelines, but he’s criticized the U.S. regulators for regulating by enforcement.

“Regulators should come up with the rules, tell everybody the rules and we follow them,” Armstrong said during a Twitter Spaces in March. “The current laws are not clear and we would like to get more clarity.”

This week in web3

As the SEC charges Bittrex, there’s little evidence that it’s relaxing its regulatory posture

The Securities and Exchange Commission announced Monday that it’s charging Bittrex, a crypto exchange, “for operating an unregistered national securities exchange, broker and clearing agency,” among other things. In recent weeks we’ve seen the SEC take on Coinbase and Tron, not to mention Binance taking fire from a different American government agency (the CFTC). Suffice it to say that after lagging behind the crypto market’s growth, government regulators are stepping up to the plate.

Despite regulatory concerns, the US is far from losing its venture crown (TC+)

Coinbase is open to leaving the United States in the wake of a regulatory dispute with the government. A tone shift of that magnitude could have an impact on where the future of tech is being built and the opportunity of the global venture market ahead. But the Coinbase news doesn’t exist in a vacuum.

Digital identities might be the best way to prove who you are online (TC+)

One of the biggest drivers for digital identity is to be able to verify who you are and that what you’re saying is real amid the extreme (and somewhat scary) growth of artificial intelligence technology. While there’s a lot of hype around owning your own digital identity, there is a lot of growth that needs to happen to expand the sector and protect people.

So you want funding for your NFT project? (TC+)

The NFT market may be down from its 2021 peak, but founders, builders and collectors alike are still flooding into the space. And many are looking for fresh capital. Despite NFTs being a part of the web3 world, traditional business mechanics are unavoidable for founders in the post-boom market.

Decentralized finance may be the answer to banking’s payment rails problem (TC+)

Aging payment rails is not a new problem for the U.S. banking infrastructure, but Silicon Valley Bank’s collapse put it in the spotlight, especially for payment companies that had their payment rails with the bank. Some fintech founders say decentralized finance rails built on the blockchain could be a better answer.

The latest pod

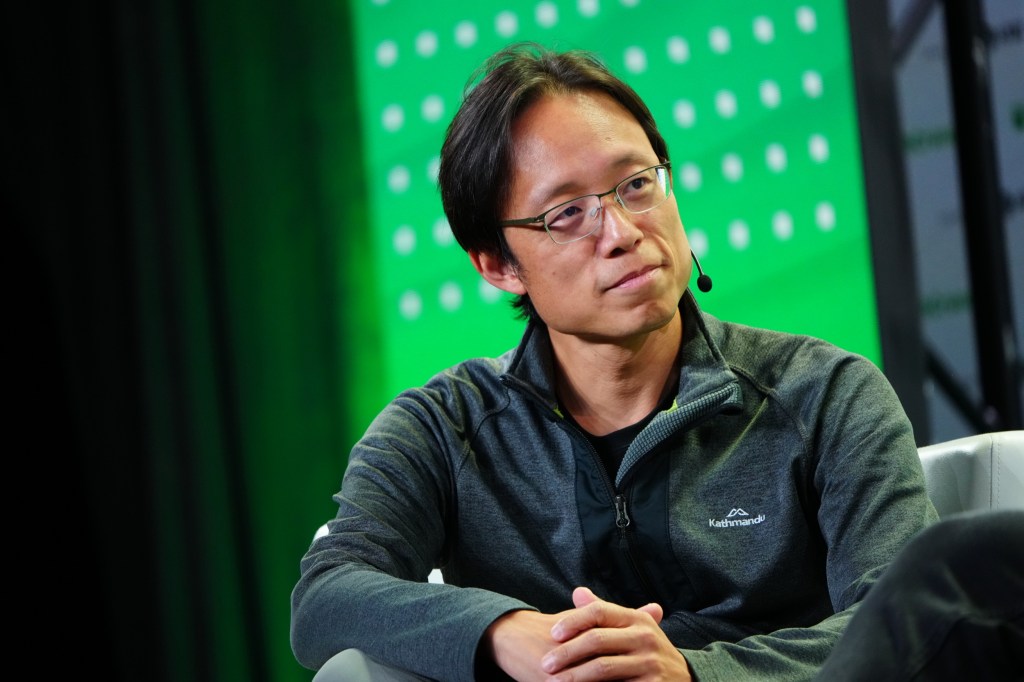

For this week’s episode, Jacquelyn interviewed Jesse Pollak, the lead for Base and head of protocols at Coinbase. Base is an Ethereum-focused layer 2 blockchain launched by Coinbase in February of this year.

Pollak previously led all retail engineering at Coinbase, including building Coinbase, Coinbase Pro and Coinbase Wallet. In a past life, Pollak started Clef, a 2FA mobile app and was an engineer at BuzzFeed.

A number of crypto businesses, platforms, marketplaces and infrastructure firms have committed to building on Base. Those that plan to be involved include Blockdaemon, Chainlink, Etherscan, Quicknode, Aave, Animoca Brands, Dune, Nansen, Magic Eden, Pyth, Rainbow Wallet, Ribbon Finance, The Graph, Wormhole and Gelato, to name a handful.

Of course, we talked a lot about Base and where it’s headed in the future, as well as how regulation could affect the blockchain and the timeline for its Mainnet launch; Pollak shared it’s aiming for 2023.

We also dove into:

- Decentralizing Base

- Developers growing internationally

- Coinbase’s role in Base

- Advice for developers

Subscribe to Chain Reaction on Apple Podcasts, Spotify or your favorite pod platform to keep up with the latest episodes, and please leave us a review if you like what you hear!

Follow the money

- Bitcoin financial services firm Unchained Capital raised $60 million in a Series B

- Karate Combat raised $18 million in funding for crypto-mixed martial arts

- Open sourced blockchain platform EOS Network Foundation raised $45 million

- Yoz Labs raised $3.5 million to build out web3 notifications

- Swaap Finance raised $4.5 million to build a DeFi market making protocol

This list was compiled with information from Messari as well as TechCrunch’s own reporting.

To get a roundup of TechCrunch’s biggest and most important crypto stories delivered to your inbox every Thursday at 12 p.m. PT, subscribe here.

Follow me on Twitter @Jacqmelinek for breaking crypto news, memes and more.