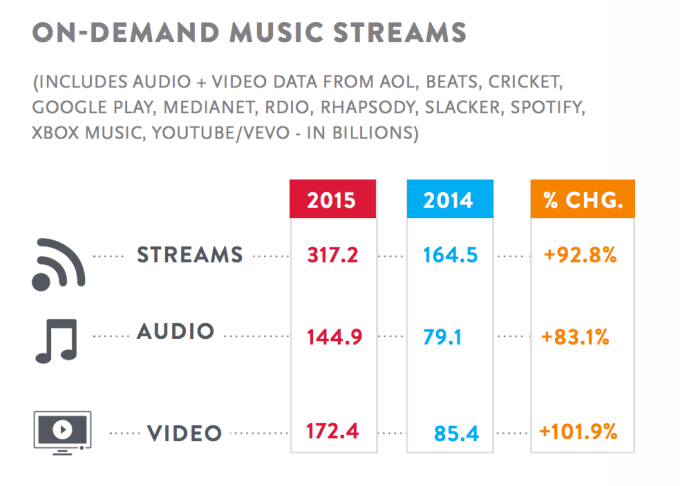

2015 was a good year for streaming services, according to Nielsen’s year-end Music report out now. In 2015, on-demand streaming services grew to 317 billion streams – that’s a doubling from 2014, which saw 164.5 billion songs streamed, Nielsen report states.

Also interesting is how the shift to streaming is impacting album sales. Though album sales were still down by 6 percent in 2015, the decline was not as bad as the year prior when they had dropped by 11 percent.

In addition, sales of vinyl grew in 2015. Sales were up 30 percent, and accounted for almost 9 percent of physical album sales.

Of course, streaming services supplant a number of traditional album sales, which is why overall sales continue to drop.

In 2015, digital track sales were also down thanks to streaming’s rise, dropping 12.5 percent to 964.8 million units in 2015 – a decline from 2014’s 1.1 billion units.

Digital album sales didn’t fare as badly, though. Last year, they declined only 2.9 percent to 103.3 million, down from 106.5 million in 2014.

The good news is that “stream equivalent” albums grew. According to Billboard, the increase in songs streamed in 2015 can be translated into 211.5 million stream equivalent albums. (Its methodology involves 1,500 song streams equaling one album.)

That’s an increase of 109.7 million from 2014, or nearly 93 percent higher year-over-year.

It’s worth noting that when Nielsen tracked music streaming over the course of the year, it wasn’t only focused audio services like Spotify. Instead, the measurement firm looked at a variety of both audio and video services, including AOL, Beats (now owned by Apple), Cricket, Google Play, Medianet, Rdio (now acquired by Pandora), Rhapsody, Slacker, Xbox Music, YouTube, and VEVO.

While overall, streaming was up year-over-year to 317.2 billion streams, video streams grew more. In 2015, music video grew 101.9 percent to 172.4 billion streams, while audio streams grew 83.1 percent to 144.9 billion streams.

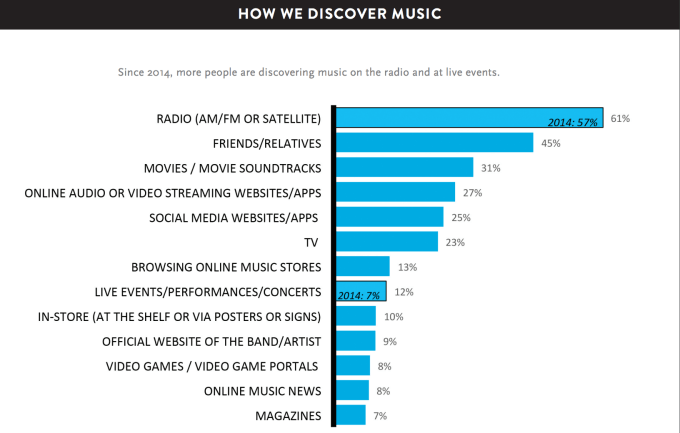

However, despite the rise of streaming, these services have not yet overtaken radio as the number one way people are discovering new music. Instead, 61 percent report hearing songs first on AM, FM or satellite radio; 45 percent say it’s word-of-mouth that leads to discovery; 31 percent hear songs in movies or in soundtracks; and then streaming clocks in at fourth place, with 27 percent saying they learned of new songs from streaming websites or apps.

In addition to the various streaming metrics, Nielsen’s report also looked at music consumption as whole.

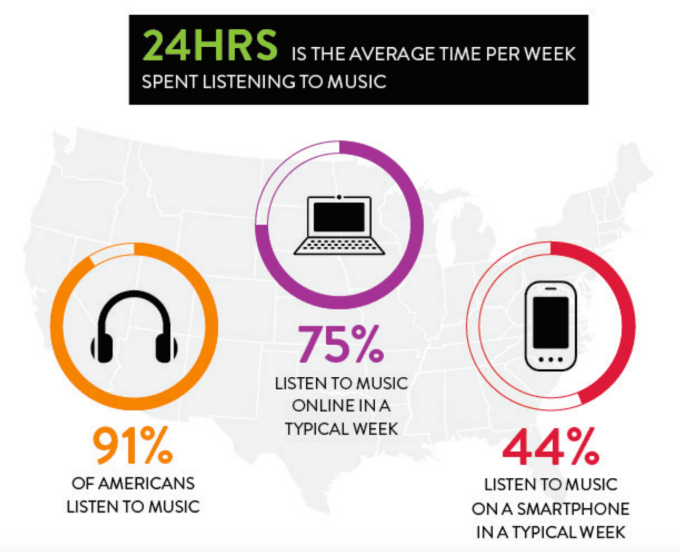

In the U.S., consumers spend 24 hours per week on average listening to music. And of the 91 percent of Americans who listen to music, 75 percent report listening to music online every week, while 44 percent listen on smartphones.

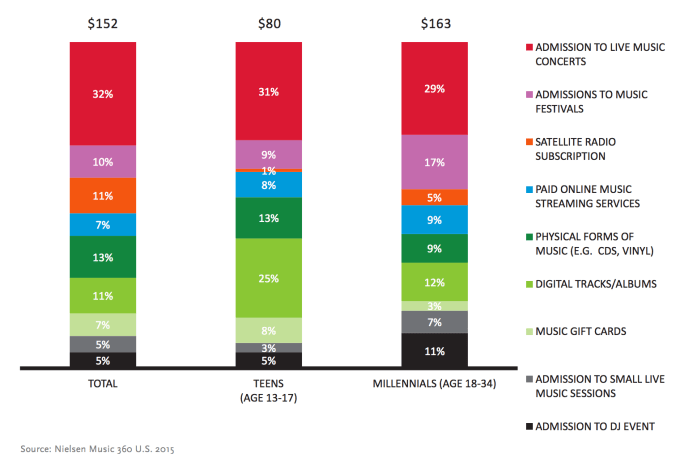

Meanwhile, when it comes to spending on music, live music like concerts (32%) and music festivals (10%) still eat up nearly the majority of spend. Satellite radio accounts for another 11 percent of spending, while paid streaming registers at only 7 percent – behind physical sales (13%) and digital downloads (11%).

Paid streaming’s share is a bit higher, however, with teens and millennials (age 18-34), where it sits at 8 percent and 9 percent, respectively.

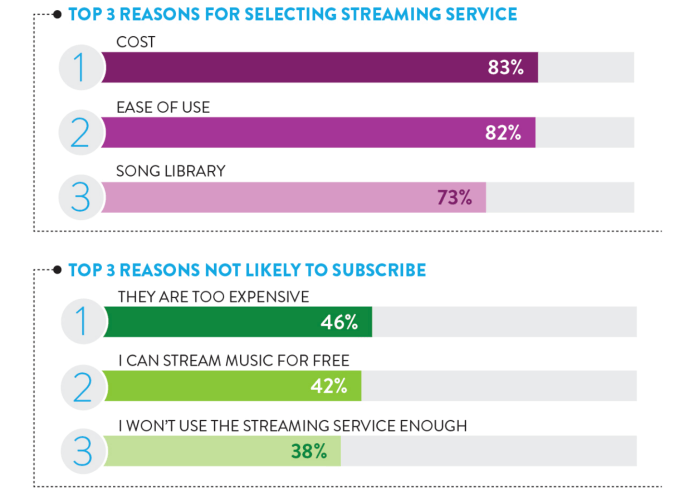

When asked why consumers chose to subscribe to a paid service, or opt not to, it appears that cost was a big reason. 83 percent said price of the service was their top factor in their decision to sign up, though ease-of-use and song library were also hugely important.

And when deciding not to subscribe to a service, again cost was the main issue, with 46 percent saying that they wouldn’t subscribe if a service was too expensive. Another notable factor is that many consumers find they can stream music for free, and don’t see the benefit of paying.

That speaks to streaming services’ need to offer more than just an on-demand catalog. They should also be a place where users can learn about new music and artists, like Spotify offers with its “Discover Weekly” playlist and Apple Music provides through its “Beats 1” radio. Streaming services may also need to focus on allowing fans to better connect with artists, buy concert tickets or merchandise, and offer online communities or other music-related content.

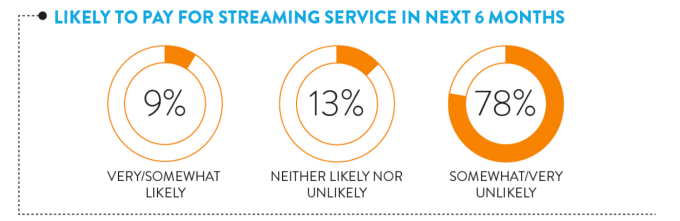

And it seems that many consumer still need convincing – 78 percent said they were unlikely to pay for a streaming service in the next 6 months, versus just 9 percent who said they probably would.

A good bit of Nielsen’s report also focused on Adele’s success in 2015. With over 7.4 million year-to-date album sales in just six weeks’ time, Adele and her album “25” were one of the biggest music stories of the year. But notably, Adele and other major stars like Taylor Swift are defining a new category of artists – those who are large enough to eschew streaming services. Adele didn’t make her album available to on-demand streaming services this year, including Spotify, Apple Music or Deezer.

The move followed that of Swift, who withheld “1989” from streaming services, until later releasing it on Apple Music – but only after she used her clout to get Apple to pay artists during Apple Music’s free trial period.

Nielsen’s full report is available online.