Apple’s $3 billion acquisition of Beats Electronics, a possible IPO from Spotify and a review of music licensing rules by the Justice Department are some of the big developments that have put the streaming music industry into the spotlight of late, but also highlighted some of the complexities of it. Now, a company that has developed a platform to help artists and songwriters to collect royalties on streamed music more easily is announcing a massive round of funding to capitalise on that.

Kobalt Music Group has raised $140 million, with investors including London’s Balderton Capital (formerly Benchmark Europe), Michael Dell’s private investment firm MSD Capital (whose $25 million portion of the $140 million was announced in March, and includes the stake of founding investor Spark Ventures), and a number of other prominent investors that Kobalt is currently not making public.

“Not making public” is the operative phrase here: New York-based, UK-registered Kobalt has kept a relatively low profile since first opening for business in 2001. That means there has been little disclosure of just how much money it had raised in that time. In actual fact, the total figure is $250 million, according to Willard Ahdritz, the Swedish CEO and founder of the company.

(While he will not say what Kobalt’s current valuation is, I’m guessing that it is now north of the $250 million valuation the company had when it announced the investment from MSD. The company is not disclosing current revenues but in fiscal 2013 sales were $175 million, up 40% on the year before, with losses growing 30% to $7.4 million.)

The low profile has also translated into relatively little fanfare about what the company has been doing up to now.

Currently Kobalt collects royalties on behalf of some 2,000 high-profile names like Paul McCartney, Disney, Dr. Luke, Max Martin, Dave Grohl, Maroon 5 and Skrillex. It has also made moves to acquire IP of its own, on which Kobalt also collects royalties: notable additions here include the all the rights to Steve Winwood’s catalog. All together, today Kobalt oversees rights for some 600,000 songs, including “45 of the world’s top 100 albums,” in Ahdritz’s words.

Within that, Kobalt’s specialty is to act like a kind of aggregator: by Ahdritz’s estimation there are about 500,000 places today where a song might get played online, with “billions of micro transactions” resulting from that. Publishers or rights organisations like ASCAP that strike blanket licensing deals, usually only with the biggest players, will most likely not be able to recover royalties with much accuracy across them.

Kobalt combats this with technology it has built to detect song plays more accurately — with the ability to sniff out metadata not just from the original tracks but from tracks that have sampled them or repurposed elsewhere — and then works out the accounting behind that. It offers some of the resulting royalties as advances to the artists (hence part of the reason for huge round of funding, as a finance vehicle), and then pays out the rest as it collects the fees.

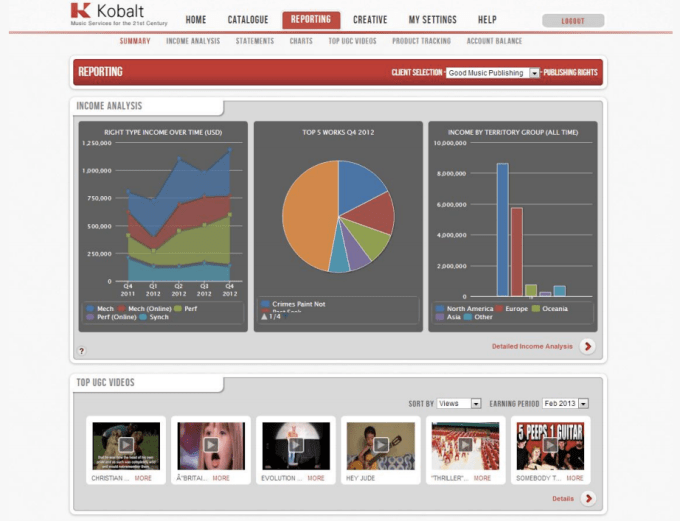

It also offers a dashboard for its users to track how their music is being played, and where — providing analytics that could potentially be useful for a number of other purposes.

To attract more musicians to its platform — and as a testament of its more efficient system — Kobalt’s commission on those royalty collections is between 6% and 15%, a big drop on the 50% commissions that incumbent publishers typically take.

Kobalt today already integrates with a number of platforms like YouTube globally and Spotify in Europe but in an industry where, even with the consolidation that we’ve seen, there is a lot of ground yet to be covered. For example, Kobalt’s services do not cover Pandora, Soundcloud or Deezer, just to name three. So that is partly where the new investment will go as well — to make new business deals.

The Justice Department’s review of how digital music licenses can be arranged — spurred initially by a lawsuit between Pandora and ASCAP but potentially affecting many more tech companies, music publishers and artists — therefore presents an interesting opportunity for Kobalt to step in and offer its services directly to more people to do the job of collecting fees on their behalf.

Image: Flickr