Now that Intuit is discontinuing its personal finance app Mint in January, some startups say they are already seeing a bump in new customers.

One of these is Monarch Money, a subscription-based money manager app co-founded by Val Agostino, Jon Sutherland and Ozzie Osman, with the goal of helping customers create financial goals and a path to achieve them. My colleague Mary Ann Azevedo reported on the company in 2021 when Monarch raised $4.8 million in seed funding.

Osman said via email that “since the news broke we’re getting twice the number of users and it’s all coming from this.” The app’s Google Play store page shows over 10,000 downloads lifetime, however Osman declined to get more specific on the exact number.

He did respond that Nov. 1 “was our biggest day in terms of new users since we launched the app” in January 2021. That included the time when it moved from waitlist to public and following assorted announcements.

In a blog post following Intuit’s news, Monarch’s CEO Agostino called the moment “bittersweet.” That’s because there’s some history there: Agostino was the first product manager on the original team that built Mint. He headed up the product team through the acquisition by Intuit that closed in 2010.

Then Intuit purchased Credit Karma in 2020. Agostino noted in his blog that Credit Karma “has an estimated user base of 130 million U.S. users,” larger than Mint’s 3.6 million monthly active users reported in 2021, according to Bloomberg. At the time of Credit Karma’s purchase, my colleague Ingrid Lunden noted that when Credit Karma launched its financial planning tool in 2013, it drew a direct comparison to Mint.

Following the Credit Karma acquisition, Fast Company reported that Mint’s development seemed to slow down. Agostino made a similar observation in his blog post, noting that “if you’re Intuit, it doesn’t make sense to keep investing in both of these consumer platforms, so I’m not surprised they’re shutting Mint down and consolidating on Credit Karma.”

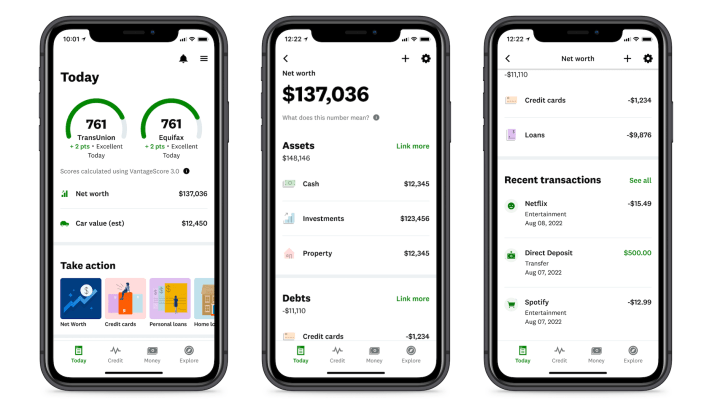

“When we started Monarch, my goal was to ‘fix’ many of the things I felt were broken at Mint,” Agostino told TechCrunch via email. “The biggest was the business model. A free personal finance app is simply not a viable business due to the high costs required for financial data aggregation. Moreover, users sign up for these apps with the hopes of improving their financial life. When an app is ad-supported, the needs of the advertisers are prioritized over the needs of the users, ultimately defeating the whole purpose.”

Meanwhile, when Intuit told customers earlier this week that Mint would be incorporated into Credit Karma, customers took to Reddit and social media to ponder what they will do instead and ask for recommendations for other apps.

Jess Manno responded to Intuit’s tweet with “ok but can I transfer my data from mint? I don’t wanna lose track of all my progress.”

Agostino told TechCrunch that Monarch does provide the ability to import Mint data so that users can try out Monarch and still “preserve their financial history.”

And Shawn Adrian, co-founder of spend tracking app Cheddar, tweeted that he had previously worked at a personal finance startup called Wesabe in 2008, and that “it was actually hard to compete with Mint.” TechCrunch spoke to Wesabe’s co-founder Marc Hedlund about that very topic in 2010.

Adrian said via direct message that “Intuit must be absolutely banking cash to view our largest competitor, Mint, as a languishing side project. That said, we’ve seen a huge influx of beta signups since the news, so I for one am thrilled.”