Credit Karma, the free online credit monitoring startup founded back in 2008, is today announcing $30 million in Series B financing, in a round led by new investors Ribbit Capital and Susquehanna Growth Equity, with participation from existing investor Felicis Ventures. The company has now grown its user base to 10 million, and increased revenue by over 4,000 percent since its Series A in 2009. In addition, Credit Karma is launching a new platform called Insight today, offering a real-time view into users’ overall financial health.

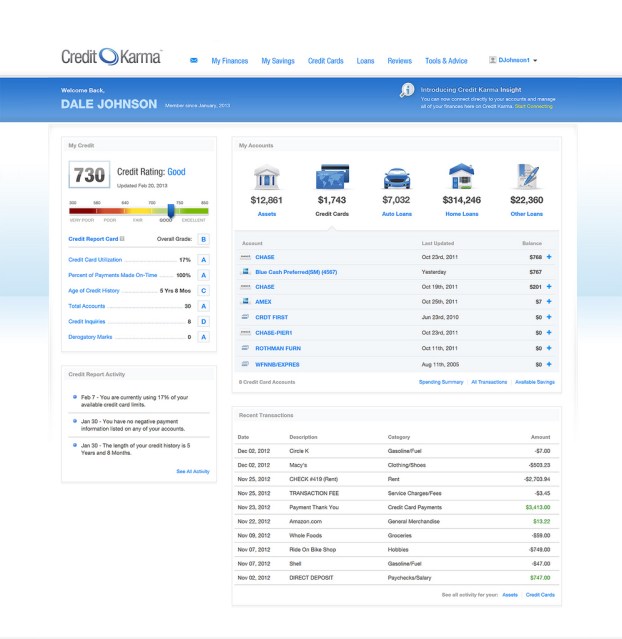

Founder and CEO Ken Lin describes the Insight service as a way to look at all your finances in one place, for free. “Now you’ll be able to look at your credit scores, all of your accounts, all of your assets, and the transactional information that comes along with it,” he says. “It’s an upgraded feature set that we thought was necessary.”

It also broadens Credit Karma’s focus from one of being a place to track your credit scores, to one which is more competitive with other financial software-as-a-service companies, like Intuit’s Mint or ReadyforZero.

Lin says that the problem was that users would log into their Credit Karma account to view credit information, but would then still have to log into their bank account or Etrade account, for instance, for other information about their finances. With all this data centralized, the idea is that Credit Karma will be able to better understand its users’ financial situation, and alert them to other products or services which are a better fit for their needs.

In addition, as more users transition to the new feature set, Credit Karma will have the ability to do anonymized, aggregate data comparisons across its platform.

“It might be interesting for you to know how the 19 percent you’re paying on your American Express card compares to other consumers with the same credit score,” Lin offers as an example. “Unbeknownst to most consumers, other people are paying either higher or lower, because there isn’t much transparency in the financial services space,” he says. With Credit Karma’s Insight, he hopes to change that. This comparison feature, to be clear, wouldn’t be just for credit cards, but for any loan products, including also mortgages, auto loans, home equity loans, student loans, and more.

Of course, in order to make these comparisons, Credit Karma first needs users to connect their other financial accounts to its service. To entice them to do so, it’s offering a variety of financial tools, like spending alerts, bill reminders, and a “my spending” section which shows where money is going, in addition to its credit scores and credit monitoring service.

The final result is something which feels a lot like Mint. With a glance, you can see your overall financial picture. However, Lin clarifies that something like Mint would only be a feature set of the product Credit Karma is working to now become – and, unlike Mint, this service won’t ever build tools for household expense budgeting.

“The large round is a function of where we think this business is going,” Lin says of Credit Karma’s expansion. “We’re really focused on creating a platform that’s a lot more than credit scores, and our new product Insight, which is more account aggregation. Our goal is to be a centralized platform where consumers can access all their financial services information.”

The new investors were chosen for their operational know-how, not just their dollars, Lin adds. Susquehanna backs PaySimple, e.g., while Ribbit’s Micky Malka co-founded Lemon wallet.

Going forward, Credit Karma will grow its now 60-person team, primarily hiring on the technical side of things, with plans to reach a headcount of 100 by the end of the year. It will also invest in new data centers and more robust infrastructure.

Credit Karma Insight launches today for all new users, while current members will gain access to the features upon their next login.