After the D.C. Circuit Court of Appeals ruled in favor of digital asset management firm Grayscale in a lawsuit against the U.S. Securities and Exchange Commission (SEC) in regards to a bitcoin spot exchange traded fund (ETF), the firm’s chief legal officer Craig Salm expects the regulator to approve the ETF.

“It’s a matter of when, not a matter of if,” bitcoin spot ETFs will be approved in the U.S., Salm told me on TechCrunch’s Chain Reaction podcast.

The new verdict was in response to Grayscale’s lawsuit against the SEC, which denied the firm’s application to convert its Grayscale Bitcoin Trust (GBTC) into an ETF on June 29, 2022. The court ruled 3-0 in favor of Grayscale, which currently owns 3.4% of outstanding bitcoin “worth tens of billions of dollars,” according to the legal filing.

“[The ruling] is a huge win for us, our shareholders and really the whole crypto community. Right now, we’re focused on finishing those final steps to get this conversion to happen,” Salm said. “I don’t think we should wait any longer to let that happen, especially now that we have this paving of the road to an ETF conversion.”

The exact timeline is difficult to predict, as the ruling is subject to a 45-day review period, Salm noted. But if there’s no “rehearing,” then it will be smooth sailing for the company. Bloomberg ETF analysts increased their odds from 65% to 75% that the SEC will approve a bitcoin spot ETF this year and are betting on odds of 95% by the end of 2024.

“My view is that this should happen as soon as possible because we have investors today. GBTC represents nearly a million investors across all 50 states,” Salm said. “But because the product is not an ETF today, it is trading at a discount.”

On August 30, GBTC traded at a 19.5% discount to the value of its underlying coin, according to YCharts data. Narrowing that discount through a conversion of GBTC into an ETF would represent “billions of dollars of value being returned to shareholders,” Salm said.

As for the actual crypto asset, bitcoin’s price rose over 7% on the week after the ruling was announced, but has since retracted to a 4% gain during the past seven days.

Grayscale getting an approval to launch a bitcoin ETF could also boost demand for cryptocurrencies in general. Institutional investors being able to offer (and use) a bitcoin spot ETF in a regulated manner could open the door to traditional financial players, who may have not been able to purchase the cryptocurrency so far due to regulatory constraints, among other reasons.

Sure, not every big firm or individual investor will buy bitcoin, but even a small percentage of the trillions of dollars in the financial market will have a massive effect on the supply and demand for bitcoin trading, potentially bolstering its value.

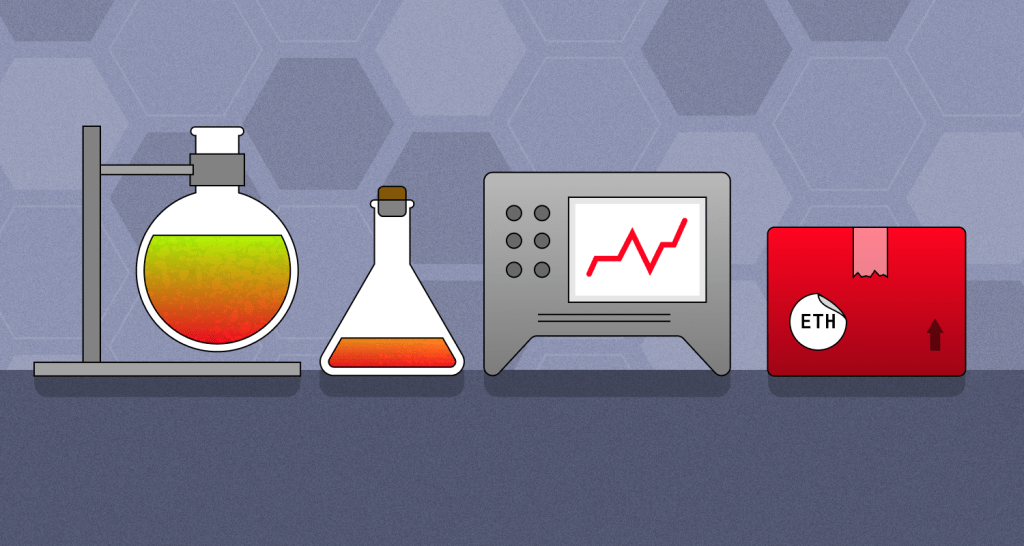

https://techcrunch.com/2023/08/17/bitcoin-spot-etf-crypto-demand/

To that point, over the years, ETF wrappers have proven to be a great way for investors to access any asset class, whether it’s bonds, commodities, securities or cryptocurrencies, Salm said. “It opens up the universe of investors that can invest.”

“There are a lot of investors that are more regulated, more institutional, that really need that ETF wrapper [around crypto assets] in their brokerage account with all their other investments if they’re going to make an investment into bitcoin.”

New investors who buy bitcoin through an ETF — if it gets approved — will create a network effect, Salm believes. “The more people who use [bitcoin], the more usable it becomes, the more valuable and the healthier the whole ecosystem becomes. ”

While the crypto community, particularly the companies that have applied to form bitcoin spot ETFs, are hopeful this will open the door to traditional investors, there’s no guarantee that we’ll see these ETFs being approved across the board. However, it seems likely that at least more than one will see the light of day soon enough if things work out in the crypto industry’s favor.

This story was inspired by an episode of TechCrunch’s podcast, Chain Reaction. Subscribe to Chain Reaction on Apple Podcasts, Spotify or your favorite pod platform to hear more stories and tips from the entrepreneurs building today’s most innovative companies.

Connect with us:

- On X, formerly known as Twitter, here.

- Via email: chainreaction@techcrunch.com