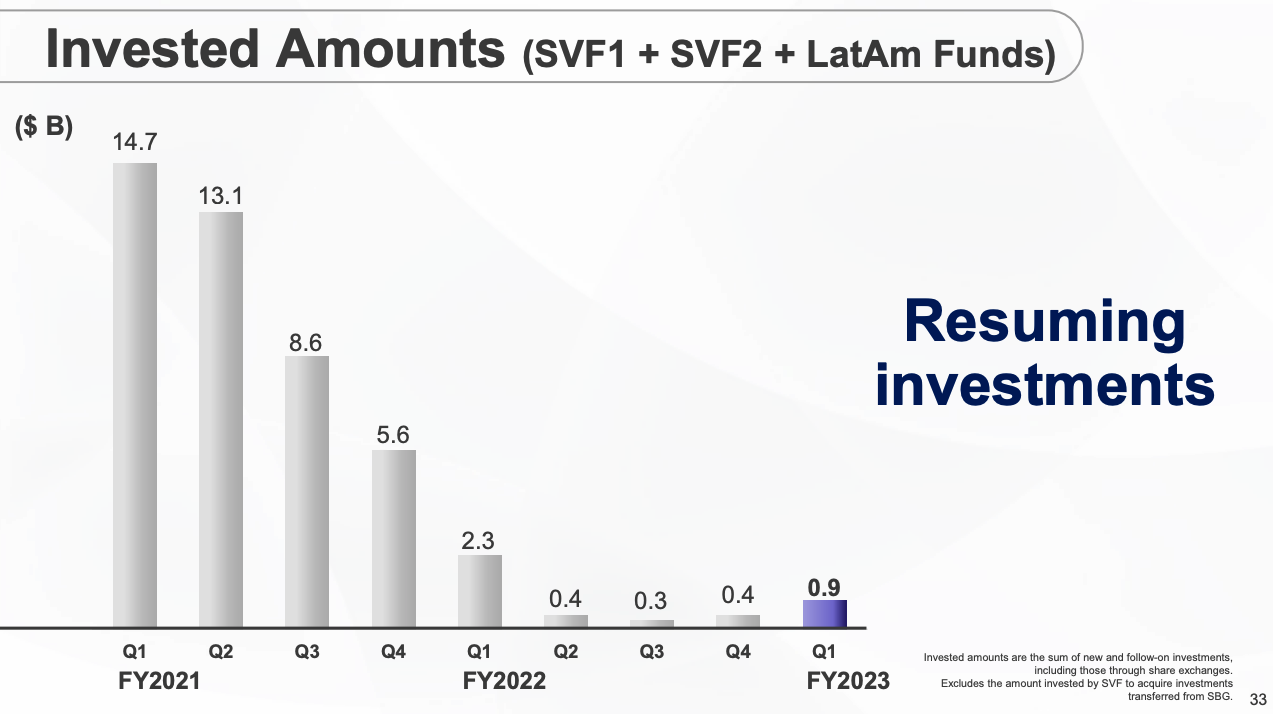

After a few quarters of going turtle, SoftBank has started ramping up its investing cadence again.

Once one of the most active and visible investors in startup land, the Japanese conglomerate is itching to get back into the fray, unlike some other investors that spent heavily only to retreat from the hurly-burly of the private markets.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

Given the ups and downs of SoftBank’s startup deals, some of which made headlines for imploding, you might think that the conglomerate would want to wait and see how its less-mature Vision Fund 2 performs in today’s somewhat turbulent economic conditions.

Well, you’d be wrong: After posting a profit of sorts on its Vision Fund efforts, SoftBank more than doubled its investments in the quarter ended June 30.

Image Credits: SoftBank

In its investor presentation, SoftBank described its posture toward the market as “shifting to offense mode.” For a company that reported a consolidated loss of 699 billion yen (~$4.9 billion) on its investments in the quarter, that’s pretty bold. It’s also exactly why SoftBank is such a fun company — and investor — to track.

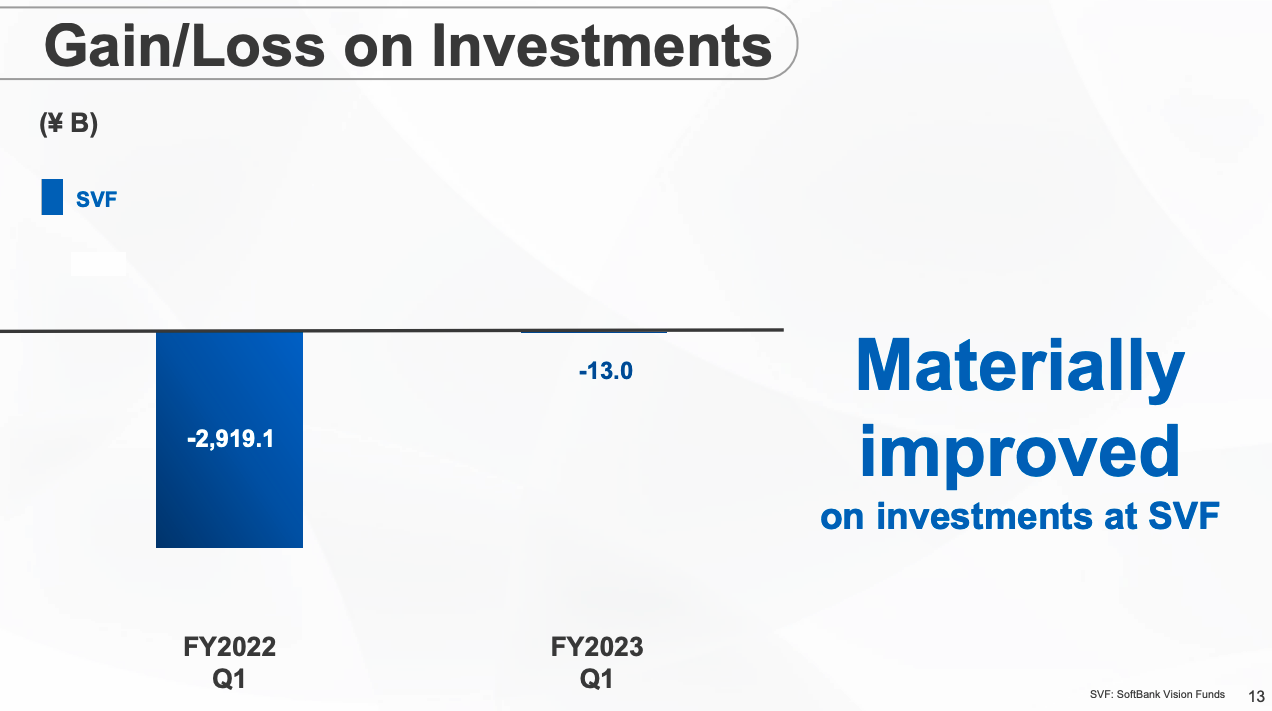

For example, SoftBank proudly noted that its investing losses from Vision Fund investments have slowed dramatically in recent months:

Image Credits: SoftBank

How did it calculate that number? SoftBank recorded gains on Vision Fund 1 deals in the quarter (+131.2 billion yen), losses on Vision Fund 2 deals in the quarter (44.0 billion yen), and gains of 47.5 billion yen and 25.1 billion yen from its Latin American deals and “other investments,” respectively. That worked out to 159.8 billion yen in total.

However! A little line item, “Gain (loss) on SVF’s investments in shares of the Company’s subsidiaries, etc,“ was worth a contra 172.8 billion yen, leaving Vision Fund investment returns at the 13 billion yen deficit.

However! A little line item, “Gain (loss) on SVF’s investments in shares of the Company’s subsidiaries, etc,“ was worth a contra 172.8 billion yen, leaving Vision Fund investment returns at the 13 billion yen deficit.

Yet! The Vision Fund portion of SoftBank’s business was in the black during the quarter, reporting 61 billion yen in income before tax. (If you’re curious how that works and want to dig deep into the mechanics of something as complicated as the Vision Fund, page 16 in this investor document is your friend.)

More importantly, gains and losses at Vision Fund 1, 2, and the company’s Latin American investments canceled out to a gain of 1 billion yen. That’s a profit, y’all!

And so, with that win tucked under its arm, SoftBank is back to putting capital to work.

It’s a potentially smart move, one that comes close to a question that this column has been ruminating on for some time: Why do investors put less capital to work when startups are cheaper? Talk of dry powder abounds in the venture capital space, even if the figure can be something of a mirage. But when you consider that investors were so willing to donate entire checkbooks for startup shares when things were going well, it’s slightly weird to note that when prices fall, those very bank accounts slam shut.

The Wall Street chestnut about blood in the streets comes to mind. SoftBank appears to be trying to spend while other investors are sitting on their hands.

But. The company is talking a lot about AI in its investor materials. For example:

Image Credits: SoftBank

AI is the only sector in venture today where things are still a little overheated, so SoftBank may be revving its capital engines and burning rubber toward the last remaining investor rat race.

Regardless, there was a time when it seemed like SoftBank was leading or was present in every mega-deal that came across our desks. Then Tiger showed up. But now Tiger is waiting out the startup game as far as we can tell, and SoftBank is treating the small portion of good news in the industry as an excuse to get back into dealmaking. That’s bullish for startups that want new capital and an investor with a track record for making big bets.

SoftBank has some catching up to do. While it may be a fool’s errand to judge a fund’s performance before its vintage date is due, the following note from SoftBank in its results package is worth chewing on:

Gross performance since inception was $12.4 billion in gain for SVF1 and $18.6 billion in loss for SVF2.

The nearly $1.6 billion that Vision Fund 2 invested in the last quarter could help plug some of this deficit. We’ll have to wait and see. But I guarantee that the resulting investor decks will be tremendous and the deals will be very interesting to track.

Frankly, we deserve some adventurous venture capital after so many months of dreary conversations about cash flow.