Last week, SoftBank Group Corp. — Masayoshi Son’s holding company for his rapidly expanding collection of businesses — reported its fiscal year financials. There were some major headlines that came out of the news, including that the company’s Vision Fund appears to be doing quite well and that SoftBank intends to increase its stake in Yahoo Japan.

Now that the dust has settled a bit, I wanted to dive into all 80 pages of the full financial results to see what else we can learn about the conglomerate’s strategy and future.

The Vision Fund is just dominating the financials

We talk incessantly about the Vision Fund here at TechCrunch, mostly because the fund seems to be investing in every startup that generates revenue and walks up and down Sand Hill looking for capital. During the last fiscal year ending March 31st, the fund added 36 new investments and reached 69 active holdings. The total invested capital was a staggering $60.1 billion.

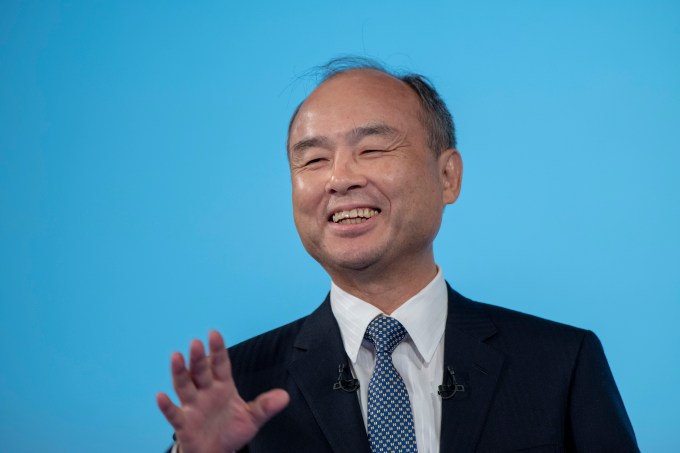

The results are impressive — at least, so far. Through the exits of Flipkart, Guardant Health, Ping An Good Doctor, and the complicated disposal of NVIDIA, the fund realized about $2.7 billion of returns in the fiscal year. It also recognized about $6.1 billion in unrealized returns across its other holdings. All that led to the headlines we saw last week, with SoftBank Group chair Masayoshi Son touting the Vision Fund and its performance to date.

All that focus on the Vision Fund though is distracting from the rest of SoftBank Group’s financials, which were far less rosy in pretty much every other segment.

The company’s Japanese telecom subsidiary increased its net sales 3.8% year-over-year and added just shy of 2 million new subscribers. Higher capital expenditures though limited the company’s profitability. The story was pretty much the same in the U.S., where Sprint increased its net sales by 3.5% but saw its network expenditures increase by 50% as it begins an aggressive rollout of 5G services. Worse, the American telco also lost more than one hundred thousand customers and saw its churn increase slightly while seeing revenue per user dip a bit.

Meanwhile, Yahoo Japan’s segment income declined by nearly a quarter, and chip design firm Arm Holdings saw its net sales flatline for the year, as geopolitical factors around U.S./China tariffs and slowing mobile phone shipments stunted its growth. Arm’s technology licensing revenue declined by 11.5%, although its segment income turned a profit from a loss last fiscal year.

And then there is Brightstar, which theoretically I should pay attention to, but it’s listed last on the segment chart and I have no f’ing clue what they do (Google them if you want). Brightstar was the only SoftBank segment to report a loss.

Altogether then, we have a combined segment income of about $11.4 billion, compared to income from the Vision Fund of roughly $11.45 billion (I’m excluding the company’s “other” segment category).

In other words, in just about two years, the Vision Fund’s realized and unrealized returns equals the income generated by all the rest of SoftBank Group’s businesses combined. Masayoshi Son’s lifetime of building a business empire is being matched — again, at least for now — by a two-year-old investment vehicle funding late-stage startups.

Now, this is a window in time, and that whole picture could change overnight. Maybe 5G mobilizes (ha!) the revenues of Sprint and SoftBank’s Japanese telco subsidiary. Maybe the Vision Fund craters due to a crash in the stock market, the U.S./China tariff battle, or something else. Or maybe BrightStar becomes the darling it was always meant to be despite the fact we have no idea what they do or why we should care about them.

Yet, I can’t help but feel that the future of SoftBank Group is really just the future of the Vision Fund. It’s a pattern we see in so many other industries, including in pharma, where top companies have spent years shedding expensive and probabilistic R&D labs for financial engineering teams to optimize their return profiles.

Across its various companies, SoftBank Group employs literally hundreds of thousands of people, but it is the 400 (going on 800) professionals at the Vision Fund that are driving the dollars. If that doesn’t explain the rise and power of finance, I don’t know what else will.

SoftBank’s dire debt situation improves ever so slightly

Photo by Alessandro Di Ciommo/NurPhoto via Getty Images

Last year in a pre-launch Extra Crunch article, Arman Tabatabai and I wrote an analysis into the debt structure of SoftBank and the challenges that the group faces due to its voracious appetite for cash. As we wrote at the time about Saudi Arabia’s investment into the Vision Fund:

The answer turns out that it’s not just that the country can write large checks, it is that they are willing to write large checks to one of the most heavily levered companies in the world. SoftBank — including its Vision Fund — has engorged itself on massive levels of debt in order to increase returns — often at the expense of operational stability.

The Vision Fund itself had taken $14.6 billion in debt to lever up its returns, and the rest of SoftBank Group’s portfolio was also heavily levered given its heavy involvement in cash-guzzling telecom and R&D.

A year later, and the debt picture appears to be improving ever so slightly. The holding company SoftBank Group saw its short-term borrowings shrink by nearly half (about $2.4 billion), while the Vision Fund cleared out nearly all of its roughly $3.3 billion in current debt, which is defined as debt that matures within one year.

That was the good news. The bad news is that 5G is expensive. Sprint increased its current debt by nearly a third, with most of that coming from long-term corporate bonds becoming current. SoftBank’s financials show that Sprint saw its free cash flow decline by nearly $1.8 billion as a result of its infrastructure buildout, and a similar story seems to be occurring at SoftBank’s Japanese telecom subsidiary.

The much more rosy picture appears in SoftBank’s long-term debt holdings, which shrunk by $14.8 billion out of $111.3 billion outstanding. The big drivers of that decrease was SoftBank Group, Sprint, and the Vision Fund repaying back debt and corporate bonds.

So net-net, SoftBank appears to have used the proceeds of its IPO of the Japanese mobile unit plus its Vision Fund returns to taper at least some of its long-term debt and improve its balance sheet. That said, this is a company that still has more than a $100 billion of debt across its subsidiaries, and all the macro risks to its businesses are as present as ever. So while the improvement is welcome, the fundamental challenge of the business remains as real as ever.

Other “fun” observations of SoftBank’s financials

Photo by Alessandro Di Ciommo/NurPhoto via Getty Images

Beyond the Vision Fund’s dominance of SoftBank’s returns these days, and the slightly more rosy debt picture for the conglomerate, I noticed a couple of other interesting tidbits from the financials:

- The Vision Fund has massively invested in transportation and logistics. That category of investment encompasses the largest number of startups among the groupings the firm has selected (consumer, enterprise, fintech, frontier tech, health tech, real estate & construction, and transportation & logistics). This category had a total of 17 investments out of the 69 in the Vision Fund, and also had the most investment in the past fiscal year, with all but two of them being new investments.

- One strategy that SoftBank appears to be more frequently employing is buying equity in startups straight from SoftBank Group’s balance sheet, and then later reselling those shares to the Vision Fund at its fair market price. SoftBank has done this on 17 of its active investments in total, all of which were conducted during this fiscal year with the exception of OYO, which was transferred in the prior year. There has been talk about scuffles over what investments the Vision Fund should make, so I don’t think it is coincidence that SoftBank appears to be using this tactic more frequently to maintain closing speed with startups while the logistics of the Vision Fund’s purchase get figured out.

- The Vision Fund saw 29 of its investments increase in fair market value, while 12 of them decreased and 28 stayed flat (likely since the investments are so new that their fair market values wouldn’t change). It might be a bit cynical to focus on the negative investments, but I am surprised that there are already so many declines for a fund so early in its lifecycle.

- SoftBank’s investment in Nvidia proved to be a huge boon in the run up of the crypto craze, and then a huge loss when that market crashed. Thanks to financial engineering, SoftBank realized a return of $2.9 billion, despite realizing a loss of nearly $2 billion on the shares in Fiscal 2019.

- In the world of ridiculously convoluted financial details, SoftBank’s Delta Fund has sold its DiDi shares to SoftBank’s Vision Fund, and the Delta Fund no longer has any investments. If you don’t know what the Delta Fund is, consider yourself lucky.

- SoftBank lost around $330 million on a deal with PayPal to provide payment services to Japanese consumers.

Ultimately, there are lots of interesting dynamics to this company, and even more to come: the company is waiting to figure out where Uber’s share price lands post-IPO (it is the largest shareholder with 16.3% ownership), and it is also waiting for the IPOs of WeWork and Slack (7.3% ownership) where it has large stakes. Expect the next year to determine whether the Vision Fund’s performance will help to mitigate the rest of the conglomerate’s lethargic growth and still alarming levels of debt.

This article was written with the assistance of Arman Tabatabai from New York