As SoftBank prepares to dive deeper into AI investments, the group posted an unexpected consecutive quarterly overall loss, as well as a continued loss in its existing investment business.

The Vision Funds actually posted a gain for the quarter of $0.8 billion, including shared assets such as its ARM holdings. Stripping out shared assets, SoftBank’s Vision Fund 1 and 2 and its Latin American fund together posted a quarterly investment loss of 13 billion yen ($91 million) — significantly less than the 2,919 billion yen loss a year ago ($20 billion).

Cumulatively, the company said that investments across the three funds, as of June 30 total a $6.3 billion loss. Overall, SoftBank Group posted a net loss of 477.6 billion yen ($3.3 billion) — a surprise, as investment analysts were widely expecting a return to profitability this quarter.

“We are carefully and slowly moving back to investment activities,” CFO Yoshimitsu Goto said in the presentation today, adding that it would “keep focusing on the AI trend.”

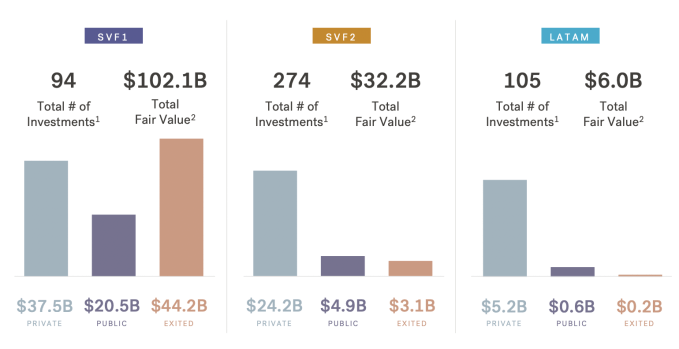

The company said that its total commitments across the Vision Funds 1 and 2 and its LatAm fund is $166.2 billion. It calculated its acquisition costs as $146.6 billion, and fair value of the assets currently as $140.3 billion.

SoftBank said that its Vision Fund 1 and 2 respectively had quarterly losses of 38.749 billion yen and 46.860 billion yen, while the LatAm fund had a gain of 47.496 billion and other investments 25.070 billion on ‘other investments. The Latin American business had a boost largely from the sale of Pismo, one of SoftBank’s portfolio companies, to Visa for $1 billion in June.

Further dragged down by share price declines in holdings in Alibaba, Deutsche Telekom and T-Mobile US, SoftBank’s overall total loss on investments in the quarter was 699 billion yen (approaching $4.9 billion).

SoftBank has made significantly more headway in activity from its first, older Vision Fund. The company said that of the 94 investments it made out of the nearly $90 billion fund, “fair value” is split between some $37.5 billion in private companies, $20.5 billion in public companies, and $44.2 billion in exits. Fair value from its $108 billion Vision Fund 2 stands at just $32.2 billion.

Image Credits: SoftBank (opens in a new window)(opens in a new windo

VF2 is still young and will be taking a lead in investments going forward, he said.

SoftBank added that some 94% of its portfolio companies from across all of its funds currently have a cash runway of more than 12 months.

We’re listening to the presentation to hear what SoftBank has to say about Arm and its AI investments and will update this post with more.

Last week, the company’s Japanese subsidiary, also called SoftBank and overseeing its domestic business, launched a new business called SB Intuitions, which will build a Large Language Model and generative AI services focused specifically on Japanese and Japan’s businesses and consumers. In July, the company also made a big investment into Symbotic — an AI-based warehouse logistics and robotics company, along with a joint venture to build services for third parties.