To get a roundup of TechCrunch’s biggest and most important crypto stories delivered to your inbox every Thursday at 12 p.m. PT, subscribe here.

Welcome back to Chain Reaction.

It’s been an insanely busy and chaotic past seven days. Unless you live under a rock, you probably know what I’m talking about. But for those who don’t (or just want a recap), let’s get into it.

Last week, a few massive U.S. banks made headlines. Signature Bank, a crypto-friendly New York regional bank, was closed by regulators due to systemic risk that could threaten the U.S. banking system. This closure came just days after Silicon Valley Bank crashed and Silvergate Capital wound down its operations.

Signature, known as one of the largest crypto lenders, was the second casualty from the ongoing banking crisis in the U.S., but regulators said that its customers will be made whole, meaning the government is stepping in to protect the economy from further damage.

For reference, Signature Bank had 40 branches across New York, California, Connecticut, North Carolina and Nevada. As of December 31, 2022, the bank had $110.4 billion in total assets and total deposits of $82.6 billion. Around 30% of the bank’s deposits came from the crypto industry.

Going forward, the crypto industry needs to watch closely for deposit flight from regional banks over the next week, Tegan Kline, chief business officer and co-founder of Edge & Node, said. “If it gets worse, the regulators have a tremendous problem on their hands. Many regional banks may have to close.”

In the wake of all the banking chaos, bitcoin and ether, the biggest cryptocurrencies by market cap, had a seven-day increase of about 15% and 8%, respectively, at the time of publication, according to CoinMarketCap data. The global market cap for all cryptocurrencies also increased 8.3% during the same time period to about $1.1 trillion, slightly down from a weekly high of $1.14 trillion on Tuesday, the data showed.

The overall market turmoil has seemingly created a bullish sentiment in the crypto economy, however, as traders responded positively to the news and the overall market cap rose on the week.

This week in web3

Chaos in US banks could push crypto industry toward decentralization (TC+)

The crypto industry lost a number of banking on- and off-ramps due to recent collapses in the U.S. banking industry, signaling that there may be a shift in the space toward decentralization and a need for regulation going forward. With these banks’ closure, it will become difficult for cryptocurrency businesses to move money between entities and access banking services, Mina Tadrus, CEO of quant investment management firm Tadrus Capital LLC and general partner of Tadrus Capital Fund, said. “Furthermore, such closures could mean reduced trust from investors who may no longer be aware of the necessary safeguards involved in their bank transactions.”

SVB’s mess could become stablecoins’ problem (TC+)

After USDC depegged from $1 last week, many in the crypto industry are questioning whether Silicon Valley Bank’s collapse will have bigger implications on the stablecoin ecosystem. If anything, this latest market event “will trigger more interest in the stablecoin sector among global regulators,” said Lucas Kiely, chief investment officer of digital wealth platform Yield App. “This can only be a good thing for the industry, which needs much clearer guidelines for more institutions to enter.”

Meta winds down support for NFTs on Instagram and Facebook

Looks like Meta is NGMI, as some might put it. Meta’s head of commerce and financial technologies, Stephane Kasriel, posted on Twitter that the company will sunset its NFT and digital collectibles features on Instagram and Facebook. This short-lived product only began testing with select Instagram creators last May, plus some Facebook users in June. By July, Meta expanded NFT support on Instagram for creators in 100 countries. Less than a year later, Meta is moving on from NFTs…RIP.

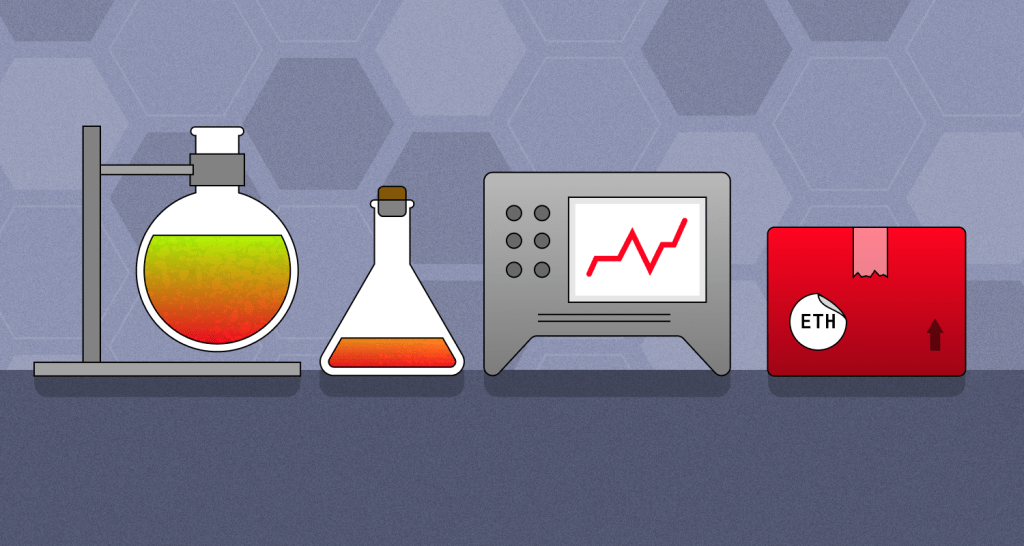

Hackers steal around $200 million from crypto lender Euler Finance

Euler Finance, a non-custodial DeFi protocol, was exploited of about $197 million in crypto on Monday. While this sounds like a lot of money — and it is — it’s only the 26th largest crypto theft ever, according to the Rekt Database, which tracks DeFi scams, hacks and exploits. Since then, the team behind the protocol has launched a $1 million reward for information leading to the attacker’s arrest and return of the funds.

India probing ‘several’ crypto cases for money laundering, seizes over $115 million

India’s Enforcement Directorate is investigating “several” crypto cases for money-laundering schemes and has seized $115.5 million to date in such crimes, the Ministry of Finance said, the latest in a series of crackdown by the authorities on the nascent space. The disclosure comes at a time when India is pushing ahead with rules to better scrutinize the activities of cryptocurrency firms, even as until now New Delhi has resisted formulating a blanket law to regulate the virtual digital assets.

The latest pod

For last week’s episode, Jacquelyn interviewed Jack Mallers, the founder and CEO of Strike, a bitcoin-based payment network and financial app that is trying to grow cross-border payments and remittance markets. Last year, Mallers’ company raised $80 million in a Series B round to grow into that space and also has partnered with major companies like Visa, Clover and Fiserv.

Mallers is also the CEO of Zap, a bitcoin investment and payments company that transacts on the Lightning Network, which is a second layer on Bitcoin’s blockchain that allows for off-chain transactions between parties.

We discussed Mallers’ backstory, how he got into the Bitcoin scene in his late teenage years, whether the lightning network could be better than the payment networks that exist today and how big players could get into the space. This episode was heavily focused on Bitcoin, so buckle up.

We also dove into:

- Lightning Network’s global potential

- El Salvador’s adoption of Bitcoin

- Creating new infrastructure to make Bitcoin more accessible

- Future of Strike and the Bitcoin ecosystem

Subscribe to Chain Reaction on Apple Podcasts, Spotify or your favorite pod platform to keep up with the latest episodes, and please leave us a review if you like what you hear!

Follow the money

- Backed with $3 million, Soul Wallet aims to bring self-hosted crypto wallets to the next billion

- KuCoin and Circle back Chinese yuan-pegged stablecoin CNHC in $10 million round

- Virtual fashion platform DressX raises $15 million

- DWF Labs invests $10 million in blockchain infra provider Orbs Network

- NFT social platform Metalink raises $6 million in a seed round

This list was compiled with information from Messari as well as TechCrunch’s own reporting.