Apple’s hardware event yesterday wasn’t particularly eventful for its most popular devices, bringing only iterative changes to Apple Watch and the iPad. But the company tipped its hand as to a new, aggressive approach to services with a fitness product and new unified subscription called Apple One. What are the implications of this shift?

For one thing, Cupertino is engaging in a form of future-proofing to offset slowing hardware sales and potentially a loss of App Store income.

And yet some of the services may not survive the next few years. What happens when no one wants to pay for Apple Arcade or TV+? Will its newest service, Fitness+, impact self-employed fitness workers who are building their own brands by undercutting them and offering exclusive watchOS integration?

Lastly, the whole deal may look different depending on what country you live in — and no one likes to feel left out.

TC staff dilate on these possibilities below:

- Brian Heater: This is Apple’s new bread and butter.

- Kirsten Korosec: If you’re a self-employed fitness pro, Apple just ate your lunch.

- Lucas Matney: Apple One is doomed from the start.

- Devin Coldewey: Apple’s increasingly complex global ecosystem.

This is Apple’s new bread and butter

Of course Apple’s not at any risk of losing money on the hardware front. It still sells a ton of iPhones, a lot of computers and more smartwatches than anyone else. But certain categories are seeing a slow down. The iPhone in particular — the long-time tentpole product of Apple’s hardware offering — has been impacted as smartphone sales have plateaued and slowed down nearly across the board.

Accordingly, services have become an increasingly important piece of Apple’s quarterly revenue. Earlier this year, the company noted a year-over-year sales increase of 17%, due in no small part to recent additions like Arcade and TV+. Today’s addition of Fitness+ will no doubt juice the numbers even further, arriving at a perfect moment for in-home workouts amid the COVID-19 pandemic.

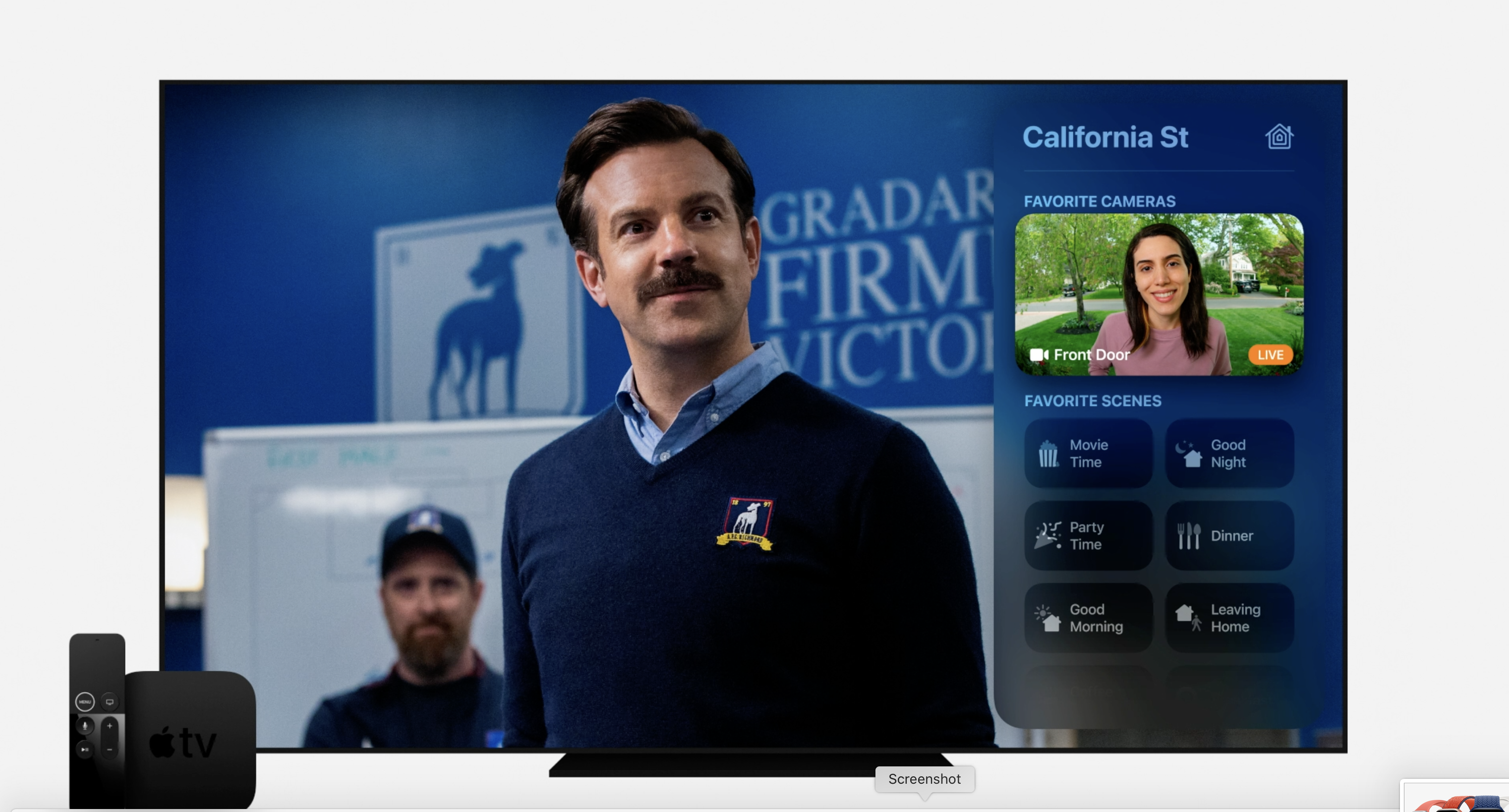

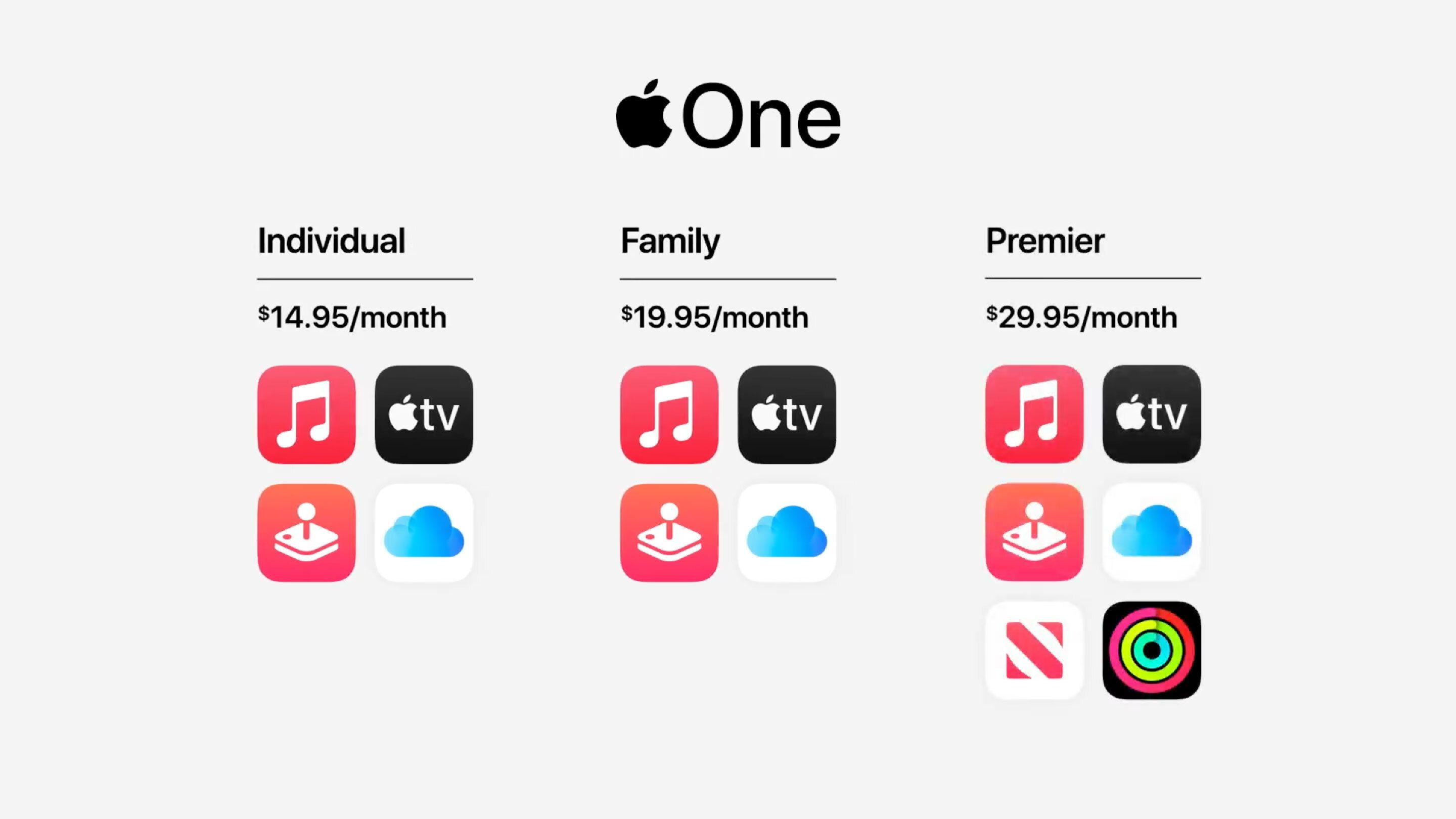

But it’s the long-rumored arrival of Apple One that holds the key to the future for the company. Paying $30 a month for a bundle of six services is a deal for some. It’s also a surefire way to entice users to sign up for undersubscribed services like News+ and new offerings like Fitness+. Even more importantly, the move plays into the company’s long-standing focus on ecosystems.

After all, if you’re already paying the monthly fee for iCloud, TV+ and Arcade, say, maybe it’s time to finally pull the trigger on Music and drop Spotify. For this reason, it’s clear why the service bundle isn’t mix and match: Apple is hoping that those who’ve committed to one or two services won’t find it difficult to go all in on the lot.

If you’re a self-employed fitness pro, Apple just ate your lunch

Creating an ecosystem of services does not guarantee dominance. However, Apple is in a particularly strong position to carve out market share in the fitness industry thanks to specific economic conditions caused by the COVID-19 pandemic.

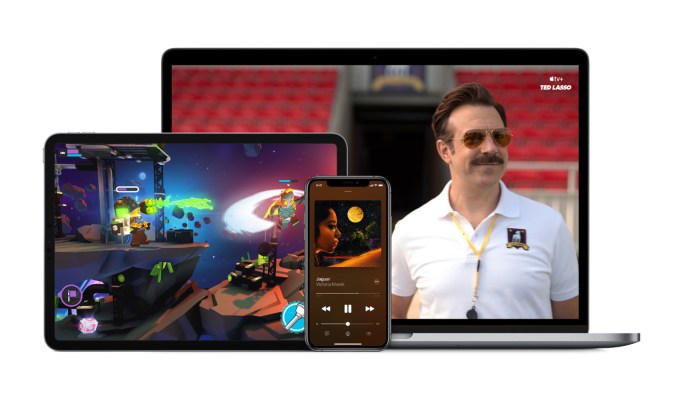

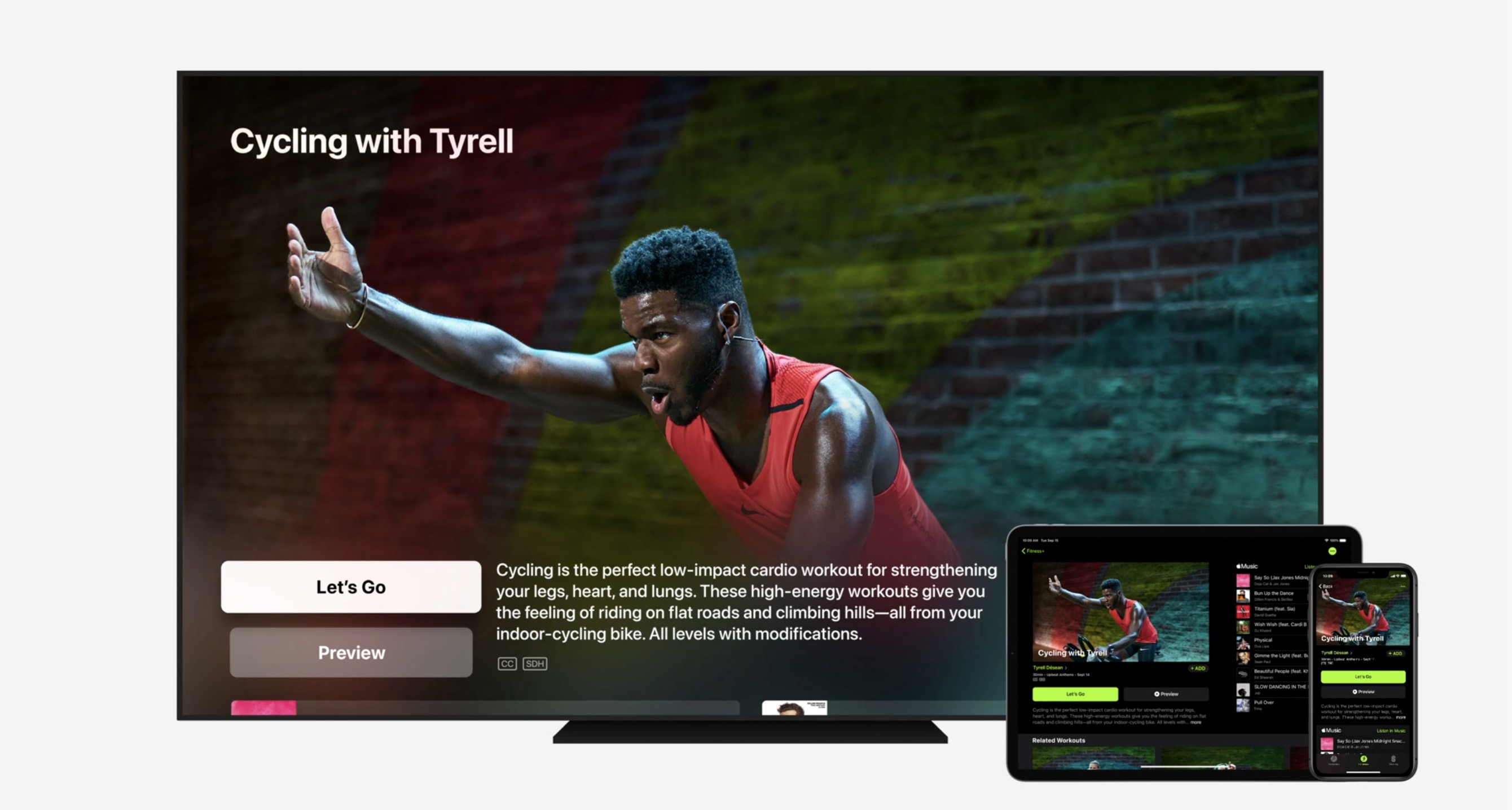

Apple announced Tuesday the impending launch of a new fitness subscription service called Fitness+ that will give users access to workouts, instructors and music. The Fitness+ videos are delivered through an iPhone, iPad or Apple TV. The videos and the accompanying music — which can be saved as a playlist to listen to later — are notable. What really matters here is that Fitness+ is synced with the Apple Watch, combining health metrics like heart rate, calories burned, pace and distance.

This coupling of hardware, health metrics and a subscription service that will deliver content in 10 fitness areas, including yoga, treadmill running and walking and strength training has a compelling advantage over the thousands of fitness apps already on the App Store. Fitness apps might not be the only collateral damage caused by Fitness+. Thousands of small studios and personal trainers, many barely clinging to survival, are likely to be casualties of the fray.

Before the COVID-19 pandemic, instructors at yoga and dance studios as well as gyms coached customers in person. In the past six months, personal trainers — many of whom were laid off — along with gyms and studios have moved their businesses online in an effort to stay operating and generating revenue in spite of government lockdowns caused by COVID-19.

Patreon, the platform for online content creators, doesn’t have specific stats on the number of fitness-related accounts. However, the company says that since mid-March, 7,500 local businesses have launched on Patreon. Those numbers include fitness instructors and owners of small studios who turned to video and Patreon to reach clients and keep revenue coming in.

Meanwhile, COVID-19 has given the fitness app business a considerable boost as people seeking a way to stay in shape turned to their phones. U.S. consumer spending in the top 10 grossing fitness instruction apps on the App Store more than doubled year-over-year in August 2020, rising to $12.2 million in August 2020 from nearly $6 million in August 2019, according to app data firm Sensor Tower. Installs of the top 10 most-downloaded fitness instruction apps also saw year-over-year growth, climbing to 1.8 million installs in August 2020 from 1.3 million in the prior year, an increase of 38%, the firm said.

Against this backdrop, Apple has entered to steal away some of the fitness fruit — including that of the small business owner. The prospects for these fitness apps and small businesses grow even dimmer when the cost of Fitness+ is considered. Users get ever-changing workouts, instruction and music for $9.99 a month or $79.99 a year and can add up to five family members.

It’s not an assured win. Any studio owner knows that talent matters and can often create a loyal base of customers, even without the low price and health metrics. But it adds more pressure, in these days of online fitness instruction, than ever before.

Apple One is doomed from the start

I’ve grown increasingly convinced that Apple’s pivot to services is trending toward total failure and that none of their recent launches are long for this world. The company has brought a sizable audience to Apple Music, but subsequent attempts to rethink subscription models for TV, news and gaming have not only felt half-baked, but fundamentally misguided.

That’s why I was surprised to see Apple launch yet another subscription service: Apple Fitness+. It’s the company’s attempt to capitalize on Peloton’s recent stock surge and build out more services around their health ecosystem. Frankly, of all the subscriptions that they’ve launched in the past 18 months, this feels the most natural of a fit. Apple has really dialed in the unsexy health features of the Watch over the past several generations and it’s grown into a great suite, if Apple can buy their way into capturing the magic of Peloton then they might have a shot of stealing their momentum.

The possible success of Fitness+ won’t make TV+, News+ or Arcade feel any less like failed rollouts without long to live, which is what makes the launch of Apple One seem so doomed from the start. People seem to be firmly in Spotify or Apple Music camps these days, and Apple Music is clearly the main value prop of the $15 per month entry-level subscription. One year into a lengthy free trial, Apple TV+ has yet to offer up anything truly worthwhile. Apple Arcade feels like a product built for the past, before Apple ushered in freemium MMOs that grow quickly because of network effects. News+ is a deal, but feels deeply disconnected.

Services are a huge opportunity for Apple, but throwing money at a problem isn’t a guarantee of success, even for one of the world’s largest companies.

Apple’s increasingly complex global ecosystem

Apple has always had a highly unified global brand, but that’s starting to change as it gets into the services business, which requires serious upkeep to localize, keep updated and comply with regulations.

The new, unified Apple One subscription isn’t going to make a lot of sense somewhere Apple’s content and financial plays have yet to make inroads. Sure, there’s the “premium” tier of subscription, but that’s not fooling anyone — you might as well call it the “sorry our best stuff isn’t available where you live” tier.

Of course Apple is a U.S. company, and the U.S. is its test market. But for a couple years now it has been leaning into that harder than ever, with certain products only available in English-speaking countries and others, like the Apple Card, only in the States.

In a way, this provides an opportunity for the bold: Apple is pushing mainstream acceptance of various concepts because it has the cash and reach to do so, but if it isn’t doing so in your country … perhaps someone else should.

Of course it’s not as simple as “clone an Apple service.” But while the U.S. may be the test market, it also provides a sort of crystal ball vision of how it may play out next year when it rolls out to other markets. Who got eaten right away? How did competitors innovate and compete? What were the unexpected costs of accommodating the new service? Which new opportunities emerged?

Watching Apple throw its weight around (and occasionally flail) in the U.S. lets others prepare for what Americans experienced live. Maybe that means brace for impact — but maybe it means stand on the gas.