Catherine Bracy

Over the past couple of weeks, in the wake of the protests over extrajudicial killings of Black people, tech companies have made tens of millions of dollars in commitments to racial equity organizations.

These commitments are a powerful signal of the moral heft of the protests and will certainly support these organizations in their vital work to advance change. But, as a biracial Black woman who has staked my career on making tech more equitable, I can’t help but feel cynical about the meaning of these commitments.

When I founded TechEquity four years ago, I set out to engage the tech community in advocacy work to address the structural inequities that make the tech industry a driver of inequality, rather than broad-based opportunity. We have had more success than I could have imagined in getting tech workers to use their privilege to further that goal. Just last year, for example, our tech workers used their civic power to help pass the biggest expansion of tenant protections in America.

But convincing tech companies to step up has been a different story; they have largely opted to stay on the sidelines. Here are a few examples.

Property tax reform

For more than two years, TechEquity has been part of a coalition working to fix a gaping loophole in California’s tax code that allows corporations to avoid paying property taxes. This loophole has caused California’s school system and local governments to be massively underfunded for the last four decades, resulting in a steep decline in public education quality and social services that disproportionately impacts Black and brown communities. It also disadvantages new and forward-looking companies, like those in the tech industry, by giving a tax advantage to older corporations.

I thought that supporting the ballot initiative to close this loophole would be a no-brainer for the tech industry. I even wrote an op-ed making a very clear case why this should be tech’s issue. But so far only one tech company, Postmates, has endorsed it.

Empty promises for housing

Last year Google, Apple and Facebook made high-profile announcements that they were making a collective $4.5B commitment to solving the Bay Area’s housing crisis. Reading the fine print, it was clear that the majority of the contributions came in the form of land that wasn’t zoned for housing production. Anyone who knows anything about housing in California knows how hard it is to build housing on land where it’s already legal, let alone to change the zoning code. Without complementary investments in a political strategy to change zoning laws, this makes the majority of their massive contributions effectively meaningless.

But, as people are increasingly being pushed out of their homes and onto the streets, with homelessness disproportionately affecting Black people, these companies have made an active decision not to invest in the political and power-building work that is required to actually solve the housing crisis — even when doing so would cost significantly less than $4.5B. Stripe has made a $1M contribution to California YIMBY, a group advocating for more housing production, but it stands conspicuously alone in funding housing policy advocacy work.

Sustainable funding for homeless housing and services

In 2018, voters in San Francisco approved a measure that would increase taxes on high-grossing companies based in the city in order to pay for homelessness services and affordable housing. Because of the same arcane law that created the property tax loophole described above, the city isn’t allowed to spend the money it collects until a court case is resolved — something that could take up to seven years.

Meanwhile, there is a way for companies to allow the city to use the tax dollars they’re already paying in order to address a homelessness crisis that continues to worsen. Two companies, Salesforce and Postmates, have given the city permission to spend these funds. But many others have chosen not to follow suit.

These are just a few examples, and I haven’t even touched on the persistent lack of diversity at tech companies and the industry’s unwillingness to truly address it.

More often than not, when advocates invite tech companies to do the things that would really move the needle on equity issues, they decline to participate. We’re told it is because they just don’t think it’s appropriate to get involved in politics. They’re worried about taking a position that might draw negative attention. They don’t want to alienate policymakers or constituencies who might disagree with their stances. It’s easier to just stay out of it.

But silence is complicity. As we have learned over the last five years, almost everything tech companies do is political, whether they like it or not. It’s time for them to pull their heads out of the sand and use their power to support true racial and economic equity.

What would this look like? Tech companies could:

Throw their weight behind equitable legislation

We’ve seen how powerful it is to demonstrate tech worker support for equitable policy solutions. Tech companies can publicly endorse legislation that will improve economic resiliency for underresourced communities and potentially make the difference in whether they get passed.

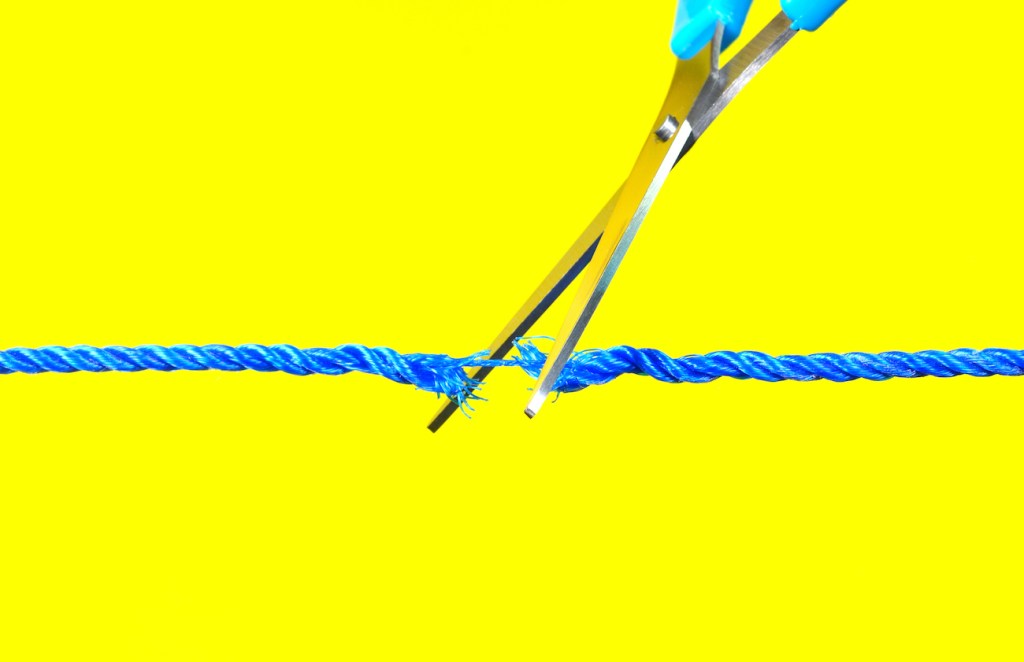

Fund advocacy work

Many of the organizations doing the best work on advancing change are working with one hand tied behind their back because restrictions on their funding make it hard for them to do advocacy work. Tech companies, unlike many other institutional philanthropy organizations, don’t have legal restrictions on funding advocacy. They can and should allow grantees to spend money to advance structural change through policy advocacy.

Focus on diversity at the executive level. The people who make these decisions on behalf of tech companies are in the executive suite — and they are overwhelmingly white. Adding people with more diverse backgrounds at the executive level can add different perspectives that can lead to more meaningful engagement on equity issues. We have found that a prerequisite to any company taking political positions is that there is executive buy-in.

When the executive team is diverse, they are more likely to see the need for the company to take a stand on these issues. It’s time to be honest about what the tech industry can do to truly invest in racial equity — and to hold companies accountable when they don’t.