As investors’ appetites sour in the midst of a pandemic, a three-and-a-half-year-old Indian firm has secured $10.3 billion in a month from Facebook and four U.S.-headquartered private equity firms.

The major deals for Reliance Jio Platforms have sparked a sudden interest among analysts, executives and readers at a time when many are skeptical of similar big check sizes that some investors wrote to several young startups, many of which are today struggling to make sense of their finances.

Prominent investors across the globe, including in India, have in recent weeks cautioned startups that they should be prepared for the “worst time” as new checks become elusive.

Elsewhere in India, the world’s second-largest internet market and where all startups together raised a record $14.5 billion last year, firms are witnessing down rounds (where their valuations are slashed). Miten Sampat, an angel investor, said last week that startups should expect a 40%-50% haircut in their valuations if they do get an investment offer.

Facebook’s $5.7 billion investment valued the company at $57 billion. But U.S. private equity firms Silver Lake, Vista, General Atlantic, and KKR — all the other deals announced in the past five weeks — are paying a 12.5% premium for their stake in Jio Platforms, valuing it at $65 billion.

How did an Indian firm become so valuable? What exactly does it do? Is it just as unprofitable as Uber? What does its future look like? Why is it raising so much money? And why is it making so many announcements instead of one.

It’s a long story.

Run up to the launch of Jio

Billionaire Mukesh Ambani gave a rundown of his gigantic Indian empire at a gathering in December 2015 packed with 35,000 people including hundreds of Bollywood celebrities and industry titans.

“Reliance Industries has the second-largest polyester business in the world. We produce one and a half million tons of polyester for fabrics a year, which is enough to give every Indian 5 meters of fabric every year, year-on-year,” said Ambani, who is Asia’s richest man.

Ambani, who rarely interacts with the media and makes very few public appearances, spent the next several minutes outlining the breadth of Reliance Industries, the most valued firm in India, whose tentacles are spread across sectors including retail (Reliance Retail is the largest retail chain in India), media house (Network 18), the company’s foundation that runs schools, efforts in drugs and pharmacy and a franchise cricket team.

It was then when Ambani first publicly talked about Jio. “I want to first address the question why Reliance thought of Jio. The world is at the beginning of a digital revolution. Anything and everything that can go digital will go digital at a rate faster than you and I can imagine,” he said.

Ambani before Jio

This wasn’t the first time Ambani saw an opportunity in the telecommunications business. At the end of 2002, the year his father Dhirubhai Ambani — an Indian business icon who is celebrated as one of India’s most successful rags-to-riches stories — died, Ambani rolled out a telecom network across the country.

It spent heavily to gain a foothold in the market that already counted Airtel, Aircel, Idea, Tata Indicom and state-run BSNL as established players. Ambani offered free handsets to customers and inked partnerships with handset makers to reach the masses.

The business gained momentum but Mukesh’s telecom journey was cut short three years later because of a family feud that played out in front of the public.

Tycoon brothers Reliance Chairman Mukesh Ambani and Reliance ADA Group Chairman Anil Ambani during the launch of Digital India Week by Prime Minister Narendra Modi at IGI Stadium on July 1, 2015 in New Delhi, India. (Image credits: Ajay Aggarwal/Hindustan Times via Getty Images)

Mukesh and his younger brother, Anil, fought for their father’s property — he did not leave a will — and eventually their mother, Kokilaben, brokered a deal that saw Anil get hold of the telecom business, while his elder brother walked away with the petrochemical empire.

As part of the pact, Mukesh could not enter the telecommunications business for several years. But he had anything but given up on it.

In the run up to the embargo deadline, he hired several telecom industry veterans, and soon afterward began buying spectrum through a proxy company. In 2013, that proxy business was rebranded as … Jio.

For two years, he spent more than $30 billion to lay out fibre-optic cable across hundreds of cities and towns and many more billions to secure 4G spectrum — at a time when several telecom players were focused on gobbling their 3G allocation. In the years since, Reliance Jio has claimed that its infrastructure is capable of supporting 5G, and even 6G, technology.

It was time to let the world know.

Bloodbath

“Friends, India and Indians cannot afford to be left behind in this new world. However, India today ranks 150th in the world for internet penetration. Jio is conceived to change this. Jio will change this permanently for India,” he said at the aforementioned event in late 2015, his voice getting louder with each sentence.

“We have the youngest population in the world. Give them the tools, skills and environment. They will surprise us. It is this opportunity that motivated Reliance and Jio is the result,” he said. “I have no doubt that Jio will enable India to advance from its 150th rank in the world to among the top globally in the next few years,” he predicted.

Jio began testing the service that year, a test it would continue with a few million users for another year until the commercial rollout of the telecom network across India in September 2016.

The existing telecom operators were not ready for what would happen next.

Jio lured customers with free voice calls, the biggest revenue source for telecom operators in India, and a bulk of 4G data allowance for the first four months.

Airtel and Vodafone, the top telecom operators in the country then, struggled to fight back and initially resisted the idea of competing with Jio on its offering, Mahesh Uppal, director of Com First, a communications consultancy, told TechCrunch in an interview.

“The incumbent players in India did the opposite of what companies in their position do elsewhere in the world when a new player emerges in the market. The existing players expect the newcomer to compete aggressively on price. They often lower their prices – some times steeply- to reduce the latter’s attractiveness. Newcomers often complain to the regulators about anti-competitive practices of incumbents” he said.

“In India, the opposite happened. It was the existing players who ran to regulators with complaints. So we saw a major miscalculation from incumbent players that had already missed out on taking any major step before the launch of Jio.”

As Airtel, Vodafone, Idea and state-run BSNL scrambled to revise their voice and data tariffs, Reliance Jio was already enacting its next act to reach the masses: Partnership with smartphone vendors.

A pedestrian uses a smartphone while walking past advertising for Reliance Jio Infocomm displayed in the window of a store at the Nehru Place IT Market in New Delhi, India on Tuesday, May 30, 2017. (Image credits: Sanjit Das/Bloomberg via Getty Images)

In the course of a few weeks, Jio had partnered with 20 smartphone vendors including Apple and Samsung to bundle a Jio SIM card with their handsets, and also kick-started its market campaign, roping India’s top Bollywood actor Shah Rukh Khan as its brand ambassador.

The push worked. Reliance Jio amassed 100 million subscribers in less than six months. And India went from some 150th position to 1 in the world for mobile data consumption.

While Airtel and Vodafone struggled to compete with Reliance Jio, saw the average revenue they collected from each user drop drastically and lost tens of millions of subscribers, the fate of some other competitors was even worse.

Aircel, a Mumbai-headquartered telecom operator, went bankrupt nearly 20 years after it was founded. Idea merged with Vodafone.

In another interesting turn of events, Reliance Communications, the telecom operator run by Anil Ambani, sold its assets to Jio.

Along the way, Jio has also strengthened its suite of digital services, many of which it launched with the telecom operator and has offered as “complimentary services” to Jio subscribers.

Its digital services suite include apps to stream live television channels, movies and TV shows, and music. It also maintains a digital newsstand and a payments service.

Some of these services have already amassed tens of millions of users. JioSaavn, a music streaming service that is the merged entity of Jio’s JioMusic and Saavn, a popular streaming service it acquired in 2018, had 23 million weekly active users earlier this month, according to mobile insights firm App Annie and shared by an industry executive. MyJio, an app that bundles many of these services, had 80 million weekly active users.

Saavn is just one of the acquisitions that Jio has made to gain a foothold in the digital world. In the last four years the company has acquired stakes in movies and TV streaming business Eros Now, streaming service Balaji, and broadband and satellite TV businesses Hathway and DEN.

It has also acquired a range of startups that provide expertise in the area of artificial intelligence, chatbots and local languages such as Google-backed Fynd, NowFloats, Haptik, Radisys, Reverie, SkyTran, NetraDyne and Tesseract.

The company has announced plans to foray into the video gaming category, unveiled a video call assistant to automate customer support, inked a deal with Microsoft to subsidize Office 365 and Azure for small businesses in India, and unveiled plans to bring new movies to people’s homes on the same day of their theatrical release.

To better represent the offerings of Jio, last year Reliance Industries created a subsidiary called Jio Platforms that oversees the telecom venture Jio Infocomm and the growing ecosystem of digital services.

As a standalone unit, Reliance Jio has been doing fairly well for several years. In the quarter that ended in March this year, Jio reported a net profit of $308 million, its best quarterly performance to date.

But building the company has also put a big dent on Mukesh Ambani’s Reliance Industries, which was debt-free in 2012. Last year, he promised shareholders that he would clear the $21 billion debt the company has accumulated by early 2021.

Though Jio Platforms has not shared why it is raising so much capital, Com First’s Uppal said much of it might be put to use in helping Ambani balance Reliance’s debt.

In a March note obtained by TechCrunch, analysts at Morgan Stanley said they were initiating a position in Reliance Industries as the company was “now more focused on debt reduction and the mindset in its telecom business has shifted from limitless capex to a focus on profitability.”

A person familiar with Ambani’s thinking said that it is not unusual for him to focus on scale. The person recounted how Reliance Retail, the largest retail chain in India, also scaled from having presence in a few hundred cities to more than 6,600 in a matter of a few years.

“He thinks long term and of ways to upend multiple sectors at once,” the person said, requesting anonymity.

That crossover may have helped Jio attract Facebook, which launched Free Basics in India to onboard tens of millions of Indians on the internet but had to suspend the program in the country after local regulatory banned it on the grounds of net neutrality.

“Facebook is teaming up with Jio Platforms — we’re making a financial investment, and more than that, we’re committing to work together on some major projects that will open up commerce opportunities for people across India,” said Facebook chief executive Mark Zuckerberg at the time of the Jio deal.

“India has more than 60 million small businesses and millions of people rely on them for jobs. With communities around the world in lockdown, many of these entrepreneurs need digital tools they can rely on to find and communicate with customers and grow their businesses. This is something we can help with — and that’s why we’re partnering with Jio to help people and businesses in India create new opportunities,” he added.

The deal also unlocks a crucial revenue source for Facebook, which counts India as its biggest market. Facebook has more than 300 million users in India, and its messaging service WhatsApp has over 400 million. But the company has struggled to monetize this user base in the country.

Facebook and Reliance Jio kick-started their first collaboration last month. JioMart, a joint venture between Reliance Jio and Reliance Retail, allows WhatsApp users to place an order for grocery items and track the delivery from within Facebook-owned service. At this point, however, the “collaboration” is limited to a WhatsApp Business account — though the Facebook India head told TechCrunch in an interview that the company had bigger plans.

JioMart is attempting to enable millions of neighborhood stores to sell to consumers online — and use its vast Reliance Fresh and Reliance Smart businesses to serve as fulfilment centres.

What’s next for this company?

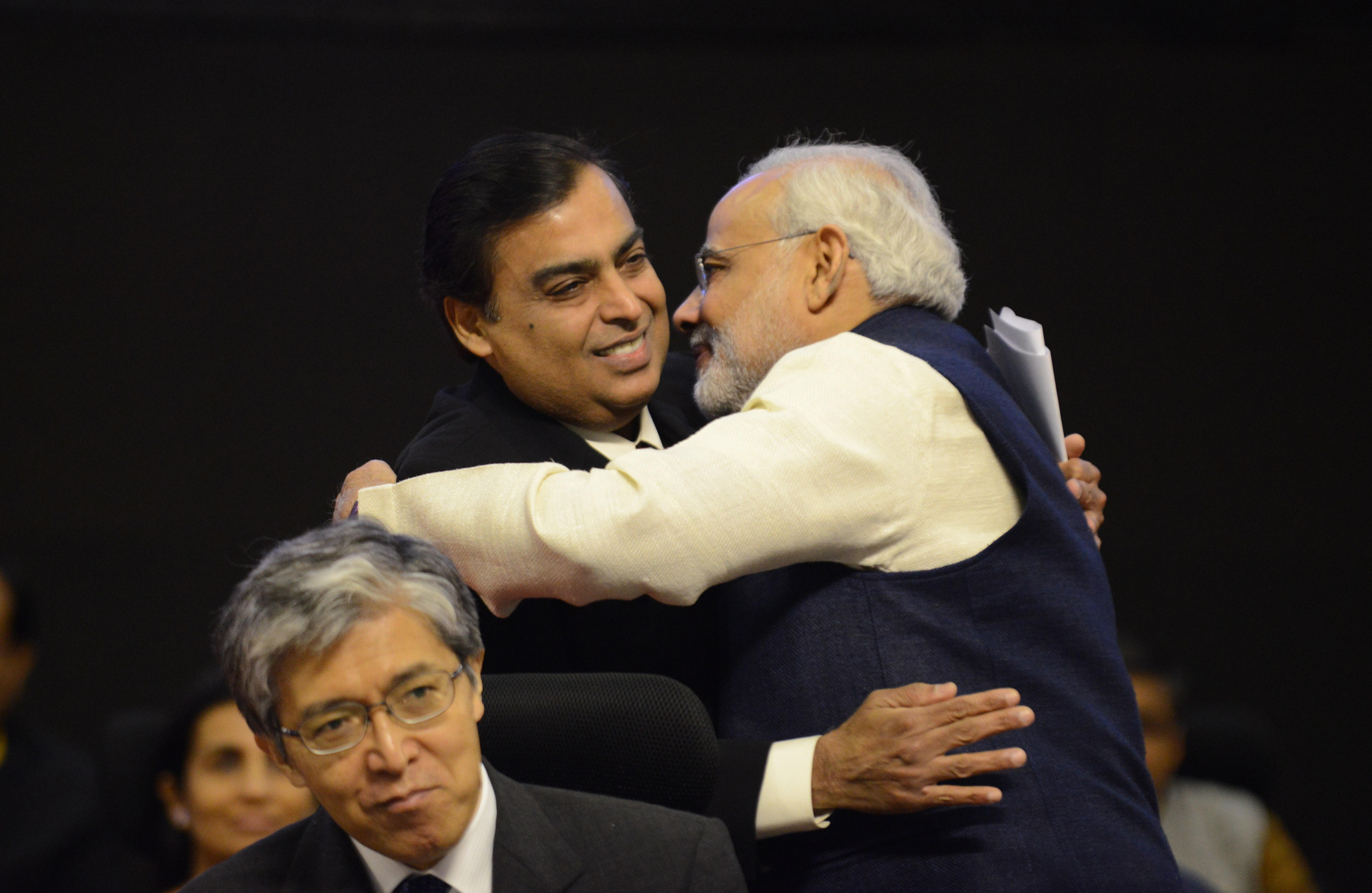

Narendra Modi greets Chairman and Managing Director, Reliance Industries Ltd. Mukesh Ambani on the launch of Vibrant Gujarat 2013 6th Global Summit at Mahatma Mandir in Gandhinagar on January 11, 2013. (Image credits: SAM PANTHAKY/AFP via Getty Images)

For Facebook, there could be one more hook in the Jio deal, a factor that has arguably helped Reliance Industries succeed several times over the years: Blessing from the government.

“Ambani, an ally of Prime Minister Narendra Modi and who has had friendly relationships with nearly every top politician in the country, has always been ahead of the curve when it comes to regulation,” an analyst who consults Reliance Jio told TechCrunch on the condition of anonymity.

“Whether it’s a sketchy rule that his empire is about to exercise (buying spectrum through a proxy business before Jio launch), or entering the telecom market with free data and voice calls, regulatory frameworks have always benefited him,” he said.

That makes JioMart, which this month expanded to 200 cities and towns, especially interesting

Ambani has marketed JioMart as “Desh ki nayi dukaan” (Hindi for “new store for India”) and conceived it to fight foreign firms. Weeks after he unveiled his idea, India enforced changes to its e-commerce law that resulted in Amazon and Walmart’s Flipkart pulling hundreds of thousands of items from their platforms overnight.

“We have to collectively launch a new movement against data colonization. For India to succeed in this data-driven revolution, we will have to migrate the control and ownership of Indian data back to India — in other words, Indian wealth back to every Indian,” Ambani said at an event last year, which was attended by Modi.

Many in the industry believe that working with Reliance Industries means that you will be subjected to less scrutiny from the regulator.

Another person familiar with the matter told TechCrunch that Reliance Jio Platforms, which has so far sold about a 17% stake in the company, might sell another 8% stake in the next few months. Media reports have claimed that Microsoft, Twitter, Google and several other firms have held talks with Jio.

The person also said that Jio has been in talks with several firms since early this year and not all deals have come through at the same time. So while there is a PR play in orchestrating how the company has made some of these splashy announcements, for the most part it did not have a choice.

The urgency in all these deals also represents Reliance Industries’ shift in how soon it wants to publicly list Reliance Jio Platforms.

Ambani has internally held talks to list Jio Platforms as soon as the end of next year or early 2022, a person directly familiar with the matter told TechCrunch. Bloomberg earlier reported about this development, adding that Ambani was eyeing Nasdaq for listing Jio Platforms.