Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

Today, something short. Continuing our loose collection of looks back of the past year, it’s worth remembering two related facts. First, that this time last year SaaS stocks were getting beat up. And, second, that in the ensuing year they’ve risen mightily.

If you are in a hurry, the gist of our point is that the recovery in value of SaaS stocks probably made a number of 2019 IPOs possible. And, given that SaaS shares have recovered well as a group, that the 2020 IPO season should be active as all heck, provided that things don’t change.

Let’s not forget how slack the public markets were a year ago for a startup category vital to venture capital returns.

Last year

We’re depending on Bessemer’s cloud index today, renamed the “BVP Nasdaq Emerging Cloud Index” when it was rebuilt in October. The Cloud Index is a collection of SaaS and cloud companies that are trackable as a unit, helping provide good data on the value of modern software and tooling concerns.

If the index rises, it’s generally good news for startups as it implies that investors are bidding up the value of SaaS companies as they grow; if the index falls, it implies that revenue multiples are contracting amongst the public comps of SaaS startups.*

Ultimately, startups want public companies that look like them (comps) to have sky-high revenue multiples (price/sales multiples, basically). That helps startups argue for a better valuation during their next round; or it helps them defend their current valuation as they grow.

Given that it’s Christmas Eve, I’m going to present you with a somewhat ugly chart. Today I can do no better. Please excuse the annotation fidelity as well:

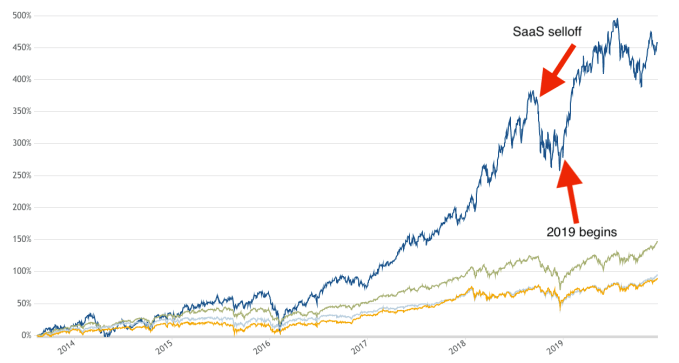

As you have deduced, the blue line is our Cloud Index, while the lower lines are the other major American indices. We don’t care about them at the moment.

What does matter is that you can see the late September-early October SaaS selloff clearly as we reach the end of 2018. And, when 2019 begins, a return to form in terms of price. We can also see that companies like Slack (late-April direct listing) and CrowdStrike (mid-June IPO) went public after SaaS prices had not only recovered, but had reached all-time record-highs.

SaaS and cloud stocks have risen about 41 percent according to the Cloud Index, as of pre-trading this morning compared to where they closed on December 31, 2019. That’s an astounding run that the tech industry isn’t talking enough about. (I bet that’s because folks view SaaS and cloud stocks as more fairly valued now than overvalued.)

So SaaS and cloud IPOs this year were diving into very warm waters when they tested the public market’s appetite for their equity. Perhaps even more importantly, SaaS and cloud companies are still trading near all-time record-highs. This should mean that we see a gosh darn stampede towards the door come the new year; every unicorn that generates recurring revenue should be racing to take advantage of this moment.

Recall that we’ve written about the huge number of unicorns that need to exit. Now sounds good.

Here’s a final argument in favor of everyone going public (not merely that I would appreciate it), via Bessemer once again:

BVP Nasdaq Emerging Cloud Index EV/Rev Multiple: 10.9x

That’s the most recent figure. It’s above historical norms. Sure, it’s no Slack, but that’s still a simply amazing number. Especially for a group of companies only growing at about 32 to 34 percent, year-over-year. (The same number was 8.6x last August, and some VCs have predicted a far smaller figure in the past. 10.9x is super good.)

Wrapping with an unwise prediction, I bet that far too many of the unicorn cohort, let alone the companies in the $100 million ARR club, will not take advantage of the current situation. For reasons of greed, blindness or simple arrogance, I can’t in good faith predict a unicorn exit-rush when there’s little historical backing for the thought and there’s supposed to be another Vision Fund coming.

That’s enough for today. Merry Christmas if you celebrate. And if you don’t, happy day and I hope you are well. Hugs from here!