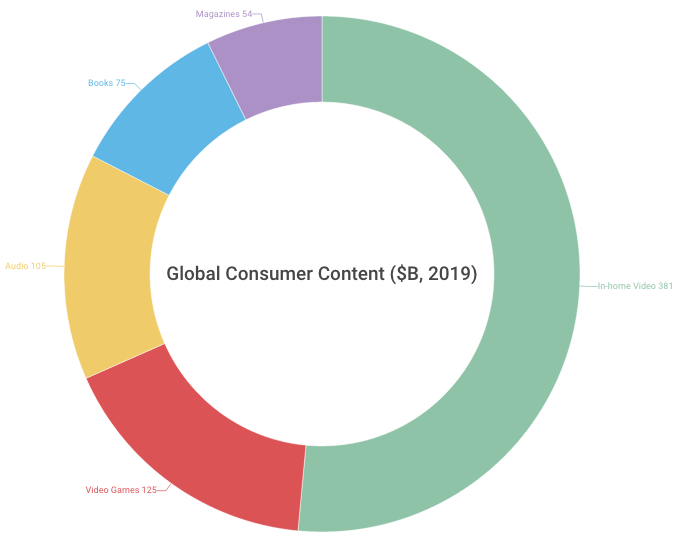

In-home video entertainment is a very big deal. $381 billion globally in 2019 big. About $100 billion in North America big. Triple the revenue of apps and games big.

No wonder, then, that it won’t get re-worked as easily or quickly as music did. The TV conglomerates are sticking to their packaged guns, forcing any potential providers of so-called “skinny bundles” (just the channels most of us care about delivered over-the-top) to take all their channels, not just select ones.

McKinsey Global Media Report, October 2015

But the sheer scale of video’s business opportunity is also why Apple’s giving up — for now — on the skinny bundle is not the end of the story. After all, Marshall McLuhan foretold this change in 1962’s The Gutenberg Galaxy: “The next medium, whatever it is … will include television as its content, not as its environment.”

The skinny bundle will happen, but it won’t be very skinny and it won’t feel like a bundle.

Say hello to the $99 jukebot.

There has to be a better way

Why so much talk about skinny bundles?

For tens of millions in the U.S. alone, our video entertainment is spread across as many as five different apps on at least two different hardware ecosystems and costs us about $120-140 per month:

- $60-75 (after promotional period ) for TV package of 200+ channels from Multichannel Video Programming Distributors (MVPDs) like Comcast, AT&T or Dish, to which they add HD and equipment fees as high as $25/mo [100 million subscribers, although not all at these price points]

- $10 for Netflix [45 million subscribers]

- $15-20 for HBO [31 million subscribers] — to get “Game of Thrones”

- $10 for Showtime [22 million subscribers] — to get “Homeland”

- Free Amazon Prime Video with your Prime membership [54 million subscribers]

There is no single interface to discover across all this content. It’s like the web before search.

Barbaric.

There is a better way

We can significantly improve the usability of all this and wring some efficiencies out of the distributed pricing.

We don’t know — and don’t care — which studio made “Superbad,” which record label Drake is on or who published Harry Potter’s eighth book. TV networks and SVOD providers are much the same: We care about the show we want to eye-guzzle — and the shows we’d enjoy watching but aren’t yet — not whether they’re on NBC, AMC, HBO or Netflix. Anything that shrinks the distance between us and those shows will be rapidly embraced.

But, with 409 scripted TV series in 2015 alone (double the count of only five years earlier), we have a problem: There’s too much television on television and interfaces like the gridded guides, search or even stores (à la Apple iTunes and Google Play) are not getting it done for discovery any longer.

If we bring the content from all these sources into one “celestial jukebox” and replace the current methods of discovery with a “personal shopper” with a messaging/GUI mechanic, we have a “jukebot.”

There’s too much television on television .

With the vast majority of what you’re interested in finally under one interface roof, the old ways will be superseded by something that will feel more like a back-and-forth conversation with a friend — supported by all available data from the likes of IMDb, Rotten Tomatoes, Facebook and Twitter — with seamless cloud-based, time-shifting, ad-skipping technology underneath it all.

This bot for your television jukebox won’t just be easier to use, it’ll be less expensive, too. Here’s how the likes of Apple, Google, Sony (whose Vue service has made some of the most headway on this front) and possibly Amazon could go shopping to aggregate the content — and related live and on-demand rights — for $99:

- Base of the not-so-skinny bundle: $36 (triple the estimated per-subscriber fees paid by the MVPDs for the OTT scenario) for about 50 channels from Disney, Viacom, Time Warner, Fox, NBCUniversal and Discovery

- ESPN/ESPN2: $24 (there has been talk about how ESPN would need to charge $36 to make up in OTT what the reigning king of per-subscriber MVPD fees may lose, but they’ve already conceded that they’ll consider smaller bundles or bundles with reduced non-live functionality, and $24 will be a massive share of the total OTT fees, considering ESPN’s subscriber base has dropped to levels last seen in 2006)

- Netflix: $10 (they like their chances alone, so won’t discount)

- HBO: $13 (won’t have to discount their direct-to-consumer price much)

- Showtime: $7 (will need to slightly discount to play)

- TOTAL COST TO LIKES OF APPLE, GOOGLE, SONY, AMAZON: $90

- PRICE TO YOU: $99 (thin margins, but this is about strategic influence)

That $30 monthly savings is enough to pay for things like your iPhone subscription, creating a better-and-cheaper service that will sell easily to the first 20-30 million consumers, with some segmentation and tiering to 50 million — which would mark a cross-over in subscriptions from MVPDs to SVOD. When that happens — as we’ve seen so many times in technology — the new normal will only gain further velocity.

Projections

If things go the way of the $99 jukebot, here’s some tea-leaf readings for the various players:

- MVPDs (Comcast, AT&T, DirecTV, etc.): Will not only lose subscribers, but even for the ones they retain, average revenues per user (ARPUs) will decline as fees ( especially around their boxes) have to go away to compete with OTT/SVOD. They understandably dislike just being the pipe and, while they could develop a $99 jukebot, they’re not better at user interfaces than Apple, Google, Sony or Amazon.

- Hulu and other smaller SVOD providers: Not big enough to command inclusion in the jukebot; the freeze-out could yield a similar fate as Yahoo Originals (spoiler alert: not good).

- Disney, Viacom, Time Warner, Fox, NBCUniversal and Discovery: May experience upheaval in transition from ads and cable fees to SVOD, but sticking to not breaking up packages keeps them from massive disruption. Fringe channels without good enough content will get pruned eventually.

- Amazon: Neutral if they allow indexing of their shows by Apple and Google for Prime members. Slightly positive if they build their own integrated jukebot.

- Apple, Google, Sony: Won’t be very profitable with jukebots, but that’s not a problem. For context, Apple’s $6 billion cut of the App Store’s 2015 $20 billion total revenue was only 2.5 percent of Apple’s $233 billion in total 2015 revenues. Jukebots are about strategic control for their providers’ devices and brands. Becoming the chokepoint for media. P.S.: It appears Apple and Google also want to have originals, but being in the hits business when there’s too much television on television already seems distracting.

- Studios/Directors/Actors/Writers: Loving the demand to make new shows for all players. It’s probably an unsustainable bubble, but they’re happy to eat while there’s more food on the table.

- Netflix: Will benefit from the concerted, integrated marketing push around jukebots and their ease of access, but already being at ~50 percent U.S. household penetration, there is no easy growth.

- HBO: With the rising seas of the jukebot push, they could grow subscribers 50 percent to parity with Netflix. Not bad, considering it took HBO 44 years to get to their current number.

The $99 jukebot is the alternative consumers deserve. Whoever gets there first moves themselves into the center of the most interesting and lucrative content business. Welcome, king.