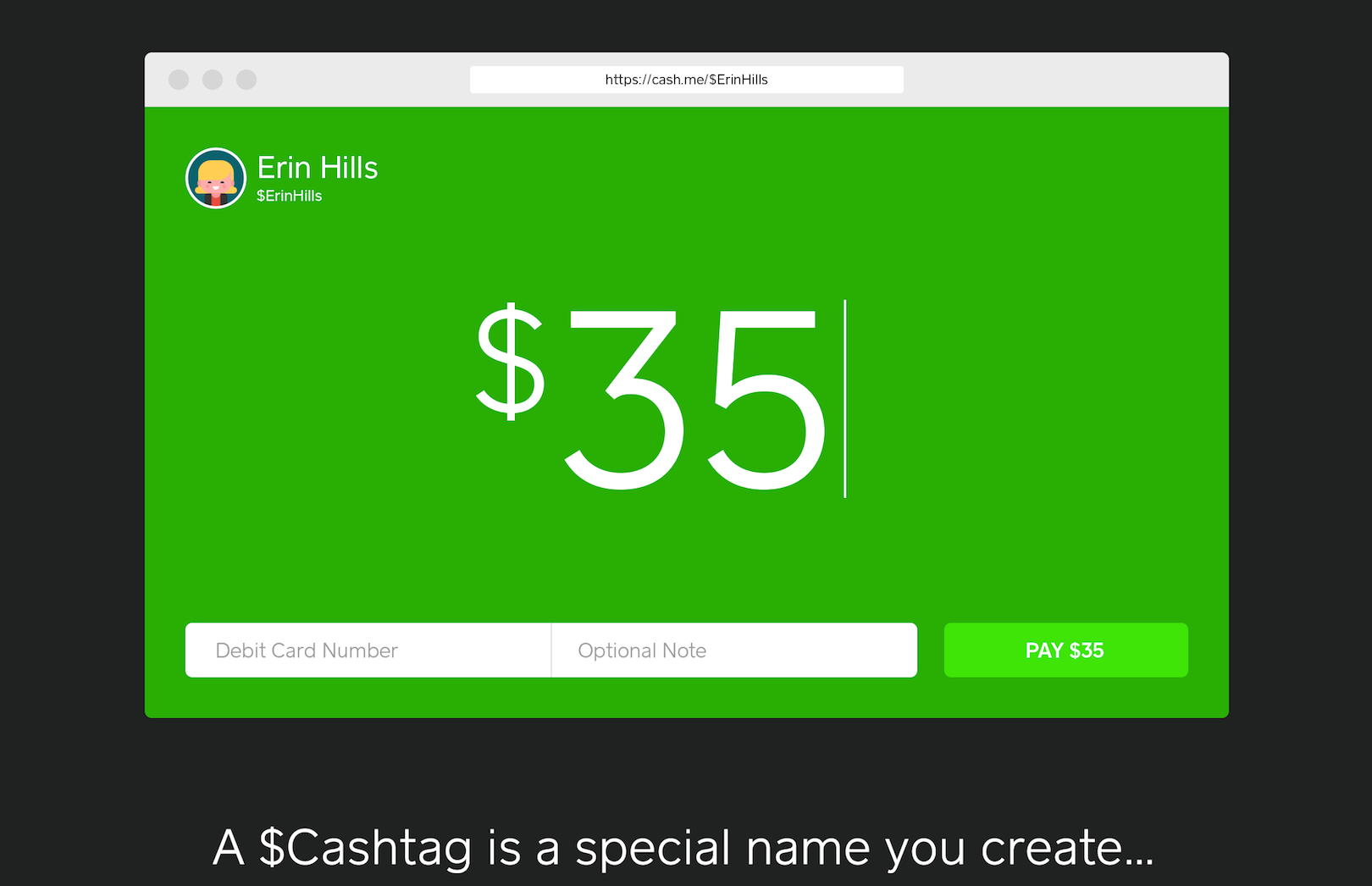

Square is expanding its Cash product to allow businesses to accept payments. In addition, Square is announcing a new identity system called Cashtags (technically $Cashtags) that allows people to claim a unique address that can be used by anyone to send cash directly.

I’ve been waiting for Cash to expand to paying businesses. Cash itself is one of the cleanest, lowest friction constructs I’ve ever seen to exchange money from one lazy person to another — and that includes actual cash. Institutionalizing the ability to use it to pay for services or goods only makes sense.

There will be plenty of people taking you through the press release for Cash and rehashing the party line. But it’s late the night before this embargo lifts and I’m running on a Monster energy drink and some peanuts. So let’s break down these announcements like friends. Just you and me, talkin’ bout postmodern cash.

This is Brian.

First, the businesses. I spoke to Square Cash lead Brian Grassadonia about the new direction for Cash and some of the thought processes behind this whole Cashtag thing too. Here’s the skinny.

Businesses can accept Square Cash payments of any amount with no monthly limit. Personal users are still limited to $250 per transaction and $2,500 per week. This, Grassadonia explains, is largely due to the low-friction nature of Cash. They require more information from an individual user before they let them send more — businesses must provide this info including a name, birth date and last four digits of a Social Security number right off the bat.

Businesses are also the first to be charged for the privilege of using Cash — a flat 1.5% fee is taken from each transaction. Personal users are still not charged a fee.

At this point, I flat-out asked Grassadonia whether Square would make enough from those business transactions to make Cash come in above the water line on the books. “We’re building a cost structure around square cash that is super competitive. It makes sense for both us and our sellers,” Grassadonia said, which I thought was a great answer, if not an especially detailed one.

These businesses, by the way, are not intended to be standard brick-and-mortar retailers, though it is possible for them to sign up and use Square Cash. There is no provision for detailed back-and-forth about serial numbered items or complex SKU inventories, for instance.

Instead, this initial rush is aimed at non profits, artists, Twitter people, online media folks and entrepreneurs. Wikipedia, KhanAcademy, USO and RED all have Cashtags assigned at launch. A YouTuber adding a Cashtag graphic to their video has instantly enabled an additional revenue stream outside of ads. Like Patreon, but zero friction.

One type of business that makes sense for this phase of Square Cash? Services. Photographers, for instance, will be quoted in Square promo materials for this rollout and (as a former photographer) I think this makes a lot of sense. There isn’t a complex inventory, the volume is (relatively speaking) low and the rate is far, far, better than any credit card processing option — including Square.

Square Cash payments are, as always, deposited and debited directly from bank accounts, instantly allowing any business that fires up a Cash account to side step the sometimes prohibitive fees associated with taking cards. Couple that with the incredibly low-friction on-boarding procedure of Square Cash and you’ve got something interesting.

Which brings us to…ahem…$Cashtags.

$Thisisathing

These are unique IDs that anyone can claim at Cash.me, a new website for Square Cash. At first glance, this seems like a vanity URL, and it is. Cash.me/$Panzer is a profile page, for instance, that lets people see me and make payments directly. But it’s more than a vanity thing — and when you see it…

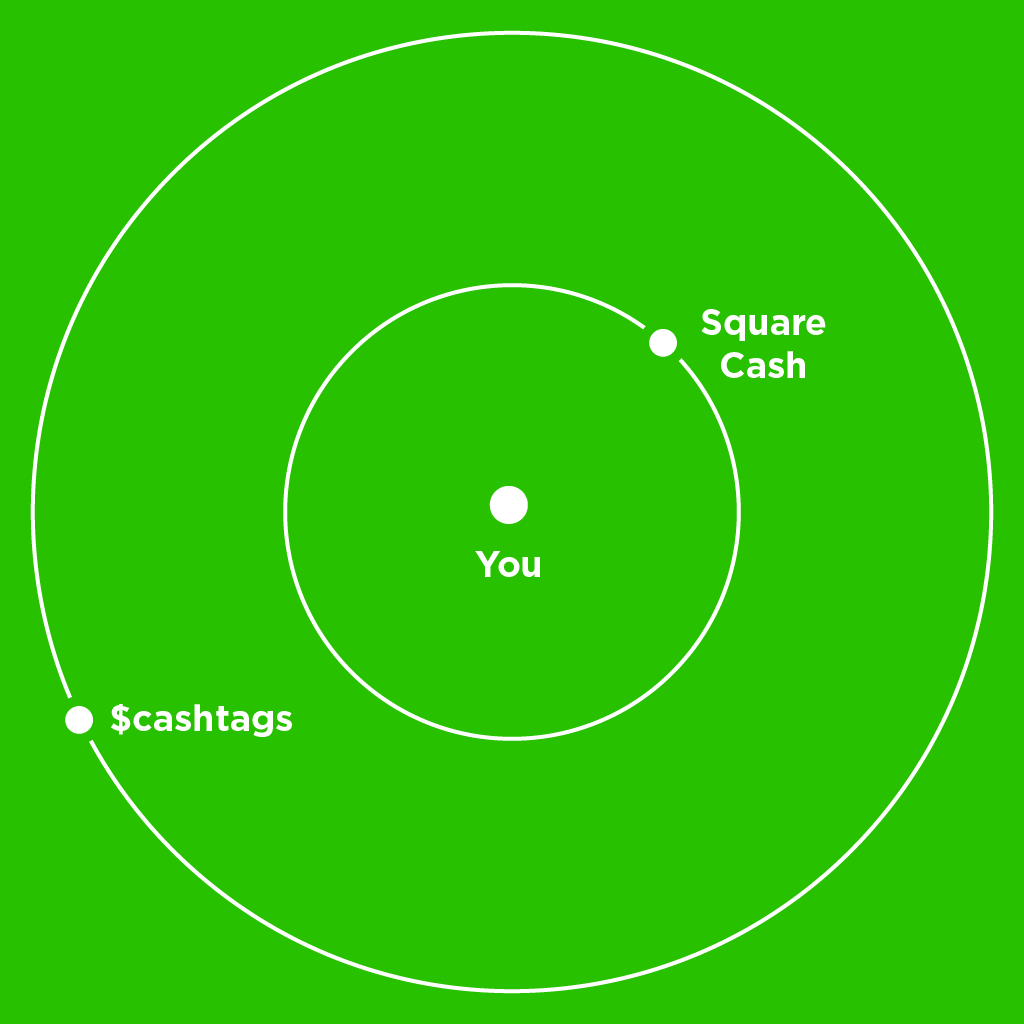

Square Cash is about ‘replacing paper cash and checks’ will be the chant (do a search of the news today, I dare you) that you’ll hear. It’s a sidebar business to Register, Capital, Reader, et al. I get it, it’s a compelling offer and it’s not inaccurate. But to me, the addition of Cashtags to Square Cash accomplishes two things.

- It widens the orbit of Square Cash.

- It disconnects a transaction from any personal information — beyond perhaps a name.

The first point is an easy one to understand. Previously, Square Cash was ostensibly limited to people who you knew, or at least wanted to share a bit of personal info with. If you were inclined, would you Square Cash a random street performer if it meant you had to share your phone number? Probably not. Would you do it if they had a sign with $Radicalbiketricks printed on it, and you knew all they would ever see would be your own Cashtag? More likely.

This, incidentally, is why I don’t really see Facebook’s new Messenger payments on parity with Square Cash. I’m sure a lot of people will use that, and that’s cool. It’s not my problem which system is more popular, that’s for Mark and Jack to worry about. But if you’re talking about the wider orbit of people you don’t know — only Square Cash is currently set up to do that in a way that makes you comfortable.

Which leads us to the second point.

Un-linking financial and personal information from a transaction is nearly impossible unless you either own the payments stack or wield a massive amount of clout — enough to distort the girders of consumer finance.

Of all the payments systems out there, only two have proven willing to do this. Square does it the first way, Apple does it the latter.

Sure, Cashtags act as an easy, public and distributable way of funneling cash. But they also act as a firewall that disconnects the act of passing money from one party to another from the actual financial underpinnings. You send Square money, Square digitally launders the money to remove the stench of your personal information and hands it off to the receiving party in the form of a fresh digital bill with a scribbled ball-point $Cashtag on it.

Moneyeball

Here’s why this matters: messing with people’s money is like touching their eyeball.

People will stand in line for hours for a free $3 cupcake or bobblehead or whatever, and they’ll only complain on Twitter or Meerkat. Expose them to any amount of risk of some weirdo possibly maybe being able to swipe $3 from your account without them knowing and they will sign a class action suit so fast your head will spin.

At least they would if they even realized the amount of risk they expose themselves to by simply handing a check with an account and routing number on it to anyone who asks. Or by handing over a credit card number that doesn’t change for years to a crappy under-protected security system at a big box retailer to be scraped by a credit card number farm in some other country.

Aside from the regular old credit card fraud loopholes you are undoubtedly safer paying with a one-time token via Apple Pay than you are using plastic. The same goes if you pay using a Cashtag and Square Cash at a business.

Of course, all of this fun stuff doesn’t mean that Square Cash will be massively profitable for Square. They undoubtedly hope it will act as a brand ambassador, pulling additional people into Square’s ecosystem and building brand identification and trust. Good luck. Selfishly, I hope it works because my friends and I send cash to each other constantly for this and that. It keeps us all honest and prevents any grumpiness over what is owed whom.

But on a larger scope, the Cashtag may have an outsized effect on the way we think about payments and identity, for several reasons.

Cashtags are instantly understandable, and recognizable. You could see them at the bottom of a non-profit donation ad or scribbled on cardboard next to a swap meet table.

Making Cashtags instantly actionable turns any scrap of paper into a secure portal for cash. It also makes it feel safe in a way that pulling out your wallet in public and counting off bills almost never does.

Those factors could combine to make this announcement less silly than a dollar sign replacing a pound sign.