The Learning Management System market is a wild and wooly place — relatively speaking, of course. “LMSes,” as they are known, are software applications and platforms that allow educational institutions and businesses to deliver courses, training, content and, really, manage every aspect of the learning process. Over time, the market has bifurcated, with one side catering to corporate clients with online training software and continuing education services, with the other targeting those institutions of higher book larnin’ and such.

On the education side, the market has traditionally been dominated by players like Blackboard, Moodle, Pearson and Sakai. If you graduated from college (or grad school) in the last 10 to 15 years, chances are you used one of these platforms, or some awful hybrid, proprietary system or combination thereof. Over time, however, the incumbents in educational LMS space, broadly speaking, have come to know embattled relationships with their users, and have seen lagging growth as a result.

Utah-based Instructure launched Canvas in 2011 to capitalize on this opportunity (along with the new audience emerging as a result of the crazy growth in online education) and give colleges and universities a more flexible, open-source alternative. And, if the company’s news today serves as any indication, it’s been working, as Instructure announced this morning that it has raised a hefty $30 million in series D financing.

The new round, which brings the startup’s total investment to $50 million, was led by Bessemer Venture Partners, with participation from the company’s existing investors, including EPIC Ventures and Eric Schmidt’s TomorrowVentures. As a result of the round, Bessemer partner and former IBM exec Byron Deeter will join Instructure’s board of directors. The sizable funding is the first signal that Instructure is now on a collision course with the public markets, a sentiment that was echoed by Instructure CFO Steve Kaminsky in the company’s statement today.

While this course will likely unfold over the next two years, having Deeter on its board is a strategic positive for Instructure, as the Bessemer partner has previously helped lead Eloqua and Cornerstone OnDemand to IPO and serves on the board of fast-growing companies (and eventual IPO candidates) like Box and SendGrid.

As one would expect, the Instructure co-founders tell us that the company’s new funds will be used to accelerate adoption of its LMS, which is now being used by colleges, universities and K-12 school districts, and increase the company’s footprint among online learning institutions and programs, particularly through its new MOOC product.

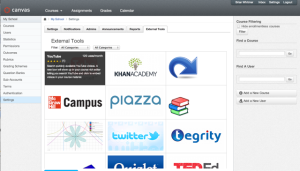

When it launched in 2011, Instructure knew that if it were going to steal marketshare from LMS incumbents, CEO Josh Coates tells us, it would need to position itself as a “next-gen” product — as much as that term is now over-used by jerks like yours truly. To do that, it designed Canvas to be an enterprise-level, open source and cloud-native LMS that doesn’t take six months to integrate, avoids Flash, while offering mobile support, analytics, integration with popular apps, speed grading, a “guaranteed uptime Service Agreement,” hands-free updates and giving developers a set of APIs and scalable server capacity — for in-person and online courses.

A lot of that may not have much meaning without much context, but the tendency among LMS players has been to leverage their hard-won (and expensive) contracts to establish a vice-grip on schools. Combined with the fact that it’s traditionally taken what seems like three decades to get an entire LMS platform up and running, these players have positioned themselves as the main software platform within the institution. This inevitably leads them to try to handle and solve every imaginable problem and use case, resulting in feature overload and bloat.

Granted, in this market, if a company wants to compete, they have to offer more than just a simple old content distribution system — no little old Tumblr can they be — but it’s a delicate balance. Remaining lightweight while handling gradebooks, assessment, analytics, mobile, tracking, distribution, social and so on? Easier said than done.

Like some other LMS platforms, Canvas’ growth since launch has largely been based on “traditional face-to-face programs,” as Phil Hill recently pointed out, but its recent additions of the University of Central Florida and MSVCC have begun to show that large online programs are attracted by Instructure’s alternative LMS. (That’s also thanks in part to its recent partnership with Cisco).

Today, Canvas has six million teacher and student users from across 425 institutions, and the company itself has booked more than $90 million in contracts. This, the founders said has led to double-digit revenue growth over the last three year — a trend which they hope the new capital will continue.

The company has also looked to set itself apart from the field by launching its own hybrid response to the MOOC phenomenon sweeping your local college and university. The Canvas Network, which has now delivered 40 open online courses from institutions like Brown to the UCF, enables schools to both make their courses open and available to the public, or make them private and just offer them to their own student body. The addition to the Canvas platform is a direct response to the success of companies like Coursera, Udacity and edX, although, in reality, it’s a little closer to what 2U has been doing in higher education.

The company has also looked to set itself apart from the field by launching its own hybrid response to the MOOC phenomenon sweeping your local college and university. The Canvas Network, which has now delivered 40 open online courses from institutions like Brown to the UCF, enables schools to both make their courses open and available to the public, or make them private and just offer them to their own student body. The addition to the Canvas platform is a direct response to the success of companies like Coursera, Udacity and edX, although, in reality, it’s a little closer to what 2U has been doing in higher education.

Adding a MOOC layer to a learning program or platform isn’t particularly original these days, as Blackboard and seemingly every player in this space scrambled to become MOOC-capable at about the same time as Instructure, for better or for worse. Naturally, going forward, if Instructure hopes to continue on its current growth trajectory, it has to lead, not move with the pack.

When we asked Bessemer partner and Instructure board member Byron Deeter how the company can continue to gain marketshare and close the gap between it and veterans like Blackboard, he said that he thinks of Blackboard as the “legacy technology vendor for the education market, essentially the PeopleSoft or SAP of higher ed, with a large installed base from years of selling licensed software, but very low customer satisfaction and technical innovation.” In comparison, he says, Instructure is the new challenger, akin to the Workday or Salesforce.com in the education market in that it has created next-gen architecture based on multi-tenant cloud computing, mobile access, and an open platform.

Of course, Deeter is just a wee bit biased. Instructure is not the only challenger in this space, even if it is one of the youngest. In terms of technology and aggressive growth, Canadian EdTech company Desire2Learn has been growing quickly, it raised $80 million last year, has 750+ employees, 700+ clients and 8 million+ learners, is now making acquisitions, is seeing more revenue and is arguable closer to IPO.

Of course, Deeter is just a wee bit biased. Instructure is not the only challenger in this space, even if it is one of the youngest. In terms of technology and aggressive growth, Canadian EdTech company Desire2Learn has been growing quickly, it raised $80 million last year, has 750+ employees, 700+ clients and 8 million+ learners, is now making acquisitions, is seeing more revenue and is arguable closer to IPO.

Sure, it’s 8+ years older, but it’s also taking an (arguably) positive approach to open-source initiatives, APIs and has been developing (or acquiring) some interesting tech of its own.

Not only that, but there’s also Edmodo, Schoology, and a handful of others.

But, as Deeter points out, nearly 70 percent of courses in public universities and 30 to 40 percent of K-12 classrooms utilize and LMS, and the latter figure especially should move north quickly over the next five years. The domestic LMS market is around $1 billion in revenues and the global market about the same, and, if one is of the mindset that the MOOC space could one day be just as big, if not bigger, Instructure is positioned in a big market that could get significantly bigger as more online programs adopt integrated or hybrid LMSes and the MOOC world grows (or, cough, pops and goes sputtering like a balloon).

In those two spaces especially, there’s plenty of greenfield and opportunity for multiple big, public companies to be minted as the markets expand. And, ask anyone that’s not Blackboard, and they’ll tell you that there’s plenty of marketshare left to be gained.