New data from mobile analytics firm Flurry indicates the incredible growth potential of the Chinese smartphone market. The country, which ranked 11th place at the start of 2011 in terms of iOS and Android activations, has now climbed into the number one spot, beating out the U.S., now number two.

In addition, looking at data from Q1 2011 to Q1 2012, Flurry found that China led in app session growth as well, increasing 1,126% year-over-year. And the growth is especially notable because China was already the world’s 7th largest country by the end of Q1 2011.

In January of last year, the U.S. accounted for 28% of the world’s total iOS and Android activations, while China accounted for just 8%. A little over a year later, those metrics dramatically shifted. By February 2012, China surpassed the U.S., and is now on track to account for 24% of activations by the end of March, while the U.S. drops to 21%. (Note that Flurry is projecting out towards the end of the month here).

The change has been gradual – China’s activations hovered in the single digits for the first part of last year. But as 2012 began, the big shift was soon on the horizon. In January of this year, China reached 18% while the U.S was 26% and in February, China topped the U.S. at last, going neck-and-neck at 23% to 22% (U.S.)

What this data means is that the gap is now closing between the two countries in terms of installed base, and China, already the world’s second largest app economy, may soon overtake the U.S. as the country with the largest number of smartphone users, too. China today is estimated as having twice the size of the next largest smartphone install base, the U.K., notes Flurry.

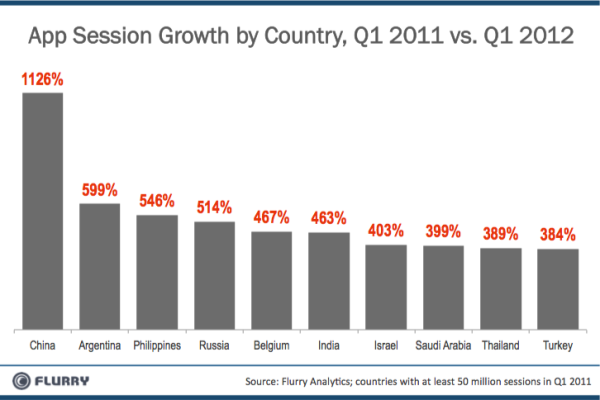

Another means of measuring China’s growth comes from examining app session growth. Here, China leads the world with the staggering 1,126% jump on this front over last year. Other emerging markets where app session growth has been climbing, include (in order) Argentina, the Philippines, Russia, Belgium, India, Israel, Saudi Arabia, Thailand, and Turkey.

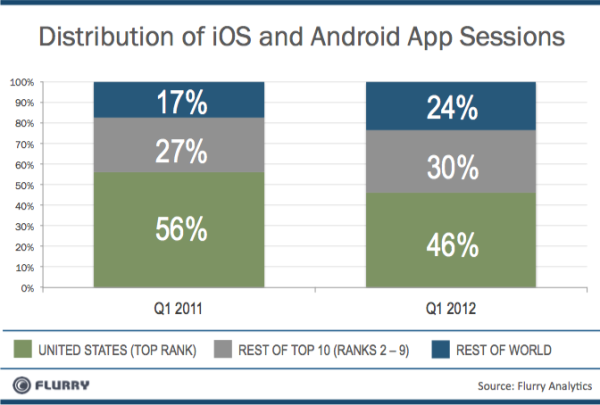

Flurry also looked at the numbers of app sessions over the past year. Since Q1 2011, the number of sessions in the U.S. has more than doubled, however, its share of total sessions has declined from 56% to 46%. This is a reflection of the U.S. market’s maturity, to some extent: it’s still growing, but other countries are growing more quickly. When combining the #2 through #10 ranked markets (China, the U.K., South Korea, France, Australia, Canada, Japan, Germany and Spain), sessions have collectively increased 3.4 times from Q1 2011 to Q1 2012, and session share has gone from 27% to 30%. The rest of the world combined has gone from 17% to 24% during the same time, or 4x growth.

Flurry had already called out China as one of the world’s largest upcoming addressable markets at year-end 2011, when it examined the shift in installed bases worldwide. China led the way on many metrics here, including apps running across Flurry’s userbase (China was #2) and the number of addressable users from the middle class (those who could afford smartphones) – China was #1 here, behind even the U.S.

Other firms besides Flurry have been tracking China’s potential, too, including mobile analytics site App Annie which stated that the country grew its mobile download numbers by almost 300% in the last year, and research firm Distimo, which reported that over 30% of Apple’s App Store downloads were coming from China by the end of 2011, as opposed to only 18% at the beginning of the year.

China today has over 980 million mobile users, but many of these are feature phone users. As the mobile market matures, developers interested in capturing the interest of new smartphone owners will have to work on localization strategies – not just translation, but true customizations for the market itself and the Chinese culture. Developers may also need to work with local partners, local carriers and distributors to attack the market appropriately.

China is also a critical region for smartphone makers, of course, including Apple, which CEO Tim Cook recently described the country as being “off the charts” in terms of last quarter’s sales. And let’s not forget that in the last two quarters of 2011, China overtook the U.S. in terms of shipments of smartphones, according to IDC.

More importantly, the growth of smartphones in China isn’t just reflective of a shift in the mobile industry, it’s a shift in computing as a whole. Says Flurry:

With smart devices adoption rates more than four times greater than those witnessed during the 1980s PC revolution and twice as great as those seen during the 1990s Internet Boom, no other consumer technology has been more accessible than smart device application software. It’s literally taking over the world.