Despite predictions to the contrary, Apple did not announce a cheaper, mass market version of the iPhone today. Instead, it announced an upgraded iPhone 4 called the iPhone 4S. It’s the same on the outside, but with all new insides.

However, there are more affordable iPhones now on the market: the old ones. Apple says it’s keeping the iPhone 3GS and iPhone 4 around. Not only that, it’s dropping their prices. Why would Apple keep these aging devices alive? Simple. To battle Android, Symbian, RIM and Windows Phone – especially in emerging markets.

According to today’s announcement, the iPhone 3GS is now free with a contract. The iPhone 4 has been reduced to $99. While the new lower prices are based on 2-year agreements with mobile carriers, the fact that the phones are not being killed off entirely is important.

These are the “new” cheaper, mass market iPhones.

Apple didn’t specify where these discounted devices would be sold, only noting that the iPhone 4S would be available in the U.S., Canada, Australia, U.K., France, Germany and Japan. It would not be surprising to see these older models used as Apple’s inroads into emerging markets, though.

Here’s why:

More people are buying Android smartphones than iPhones. That fact is not in dispute.

According to recent estimates from comScore, Android’s U.S. market share is 41.8% to Apple’s 27%. In Europe, where Symbian still reigns, it’s 22.3% for Android vs. 20.3% for iPhone. Worldwide, some analysts now peg Android as having nearly 50% of the smartphone market.

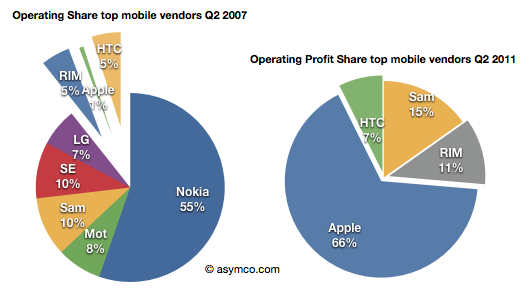

What iPhone lacks in volume, though, it makes up for in profit, capturing two-thirds of available mobile phone profits in Q2 2011. One could even argue that Apple does not need to provide a low-cost iPhone – it was doing just fine without one, thank you very much.

For Apple, however, not having a presence in emerging markets was a challenge it needed to address. Take for example, India – the second largest telecom market after China. According to a recent Bloomberg report, Apple accounted for just 2.6% of India’s smartphone shipments in a market with 602 million subscribers. That’s fewer devices than it shipped to Norway, Belgium or Israel.

Nokia dominates the Indian market, with 46% of shipments in Q2. Even struggling handset maker RIM reached 15% in shipments there. And Samsung, who plays the field with bada, Android and Windows Phone devices, reached 21% (source: IDC). Bloomberg cites issues with iPhone availability, advertising and the Indian carriers, the latter having just started to launch their 3G networks this year. (Without 3G, much of what the iPhone could do, it only does well when Wi-Fi is available.) Price, too, is an obvious concern.

Meanwhile, in China, the iPhone is expensive, sometimes even costing more than it does in the U.S. That’s ironic, given China’s role in iPhone manufacturing and assembly. It’s also only available through the country’s second-largest carrier, China Unicom. However, reports from July stated that Apple CEO Tim Cook (then COO) was looking to bring the iPhone to China’s largest carrier, China Mobile, which has 600 million subscribers compared with China Unicom’s 200 million.

Despite the technical challenges of launching in these regions, not to mention the competition from name-brand competitors and knockoffs alike, Apple knows it can not continue to ignore the need to compete in these markets. China and India, of all the emerging markets, are important due to their sheer size – after all, Apple doesn’t generate all its income from device sales. Failing to capture market share in these regions is simply a missed opportunity to generate revenue.

Even Cook admitted during Apple’s most recent earnings call China’s importance to Apple’s growth in the Asia-Pacific region, as well as its importance to the company’s overall results. According to Cook, iPhone sales in China were a “key driver” of Apple’s $8.8 billion in revenue for the quarter. And Chinese Apple stores have the highest traffic (4x the traffic as their American counterparts) and highest revenue of any Apple stores in the world.

Today, during the Apple keynote, Cook talked about the opening of two new retail stores in Asia this past week: Hong Kong and Shanghai. The Shanghai store, now the largest in Asia, saw 100,000 visitors on its opening weekend. For comparison purposes, it took the L.A. store a month to hit that same number.

So while a “cheaper” iPhone in these markets would mean lower margins on Apple hardware, the incredible size of the markets means there’s an opportunity to make up for that loss through device sales potential.

Competitors Android, RIM, Nokia and Windows Phone often battle iPhone on price, as their app ecosystems and content businesses (e.g., Zune is no iTunes, Google Music doesn’t even sell songs) are still lacking in comparison to Apple’s. With price out of the equation, Apple’s growth potential has just been radically changed.

In other words, with the new iPhone 4S, Apple continues to cater to the high-end crowd who would have upgraded anyway. With the iPhone 4 and 3GS, Apple goes after the market that wanted a smartphone of any kind, as long as it was affordable. It goes after those who wanted the iPhone, but didn’t have the money.

That said, a discounted iPhone alone may not be enough for Apple to take the market share lead in smartphones, given that there hundreds of Android devices vs. just these three iPhone models. It stands to reason, though, it will at least make a dent in Android’s seemingly unstoppable market share growth.

Oh, and the new Sprint iPhone won’t hurt either.

Image credits: asymco, Apple