Microsoft had one hell of a year. Their best ever, in fact, from a revenue perspective. They’re no Apple, but hey, who is? Nearly $70 billion in revenue for what is primarily a software company is amazing. But the great numbers continue to mask one thing: the gaping, blood-soaked wound that is the Online Services Division.

Reading Microsoft’s press release on their earnings, you’d think everything is fantastic in the division. “Online Services Division revenue grew 17% for the fourth quarter and 15% for the full year, primarily driven by increases in search revenue.” Big growth! Awesome!

Wait a minute…

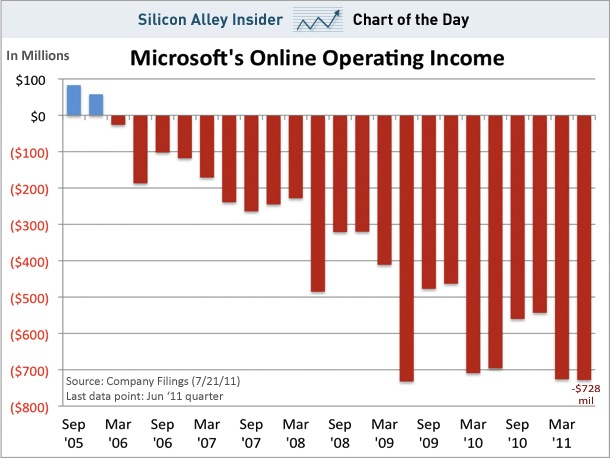

What Microsoft once again conveniently left out is any talk of how profitable the division is. That’s because it’s not profitable. Oh boy is it ever not profitable. The division lost $728 million for quarter. Remarkably, that’s the second-worst loss they’ve ever reported — only $4 million shy of the record $732 million loss in Q4 2009.

After I pointed out the loss last quarter, apologists were quick to jump on the “they just need more time” argument. Well, unbelievably, they continue moving the wrong way. Last quarter’s loss was an astounding $726 million. They somehow lost $2 million more this past quarter.

Even crazier, this is the 22nd consecutive quarter that Microsoft has reported an overall loss in the Online Services Division. There hasn’t been a profit reported since 2005.

Think about that for a second. 22nd consecutive quarters of losses. Revenues are increasing, but the losses are increasing faster. They’re spending well over two dollars for every dollar they earn.

And then there is the biggest number of all. For the year, the Online Services Division lost $2.557 billion.

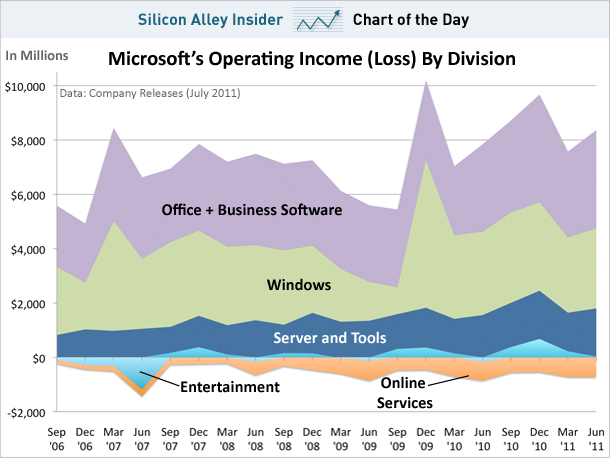

Yes, Microsoft can afford these losses thanks to their other wildly profitable businesses. But at what point do they start to reconsider their online strategy?

Spending more than they’re earning has worked for them in the past with the Entertainment and Devices division, which is now increasingly profitable. But again, Online Services has been losing money for almost 6 straight years now. And this was the worst year yet. Things are getting worse, not better.

Windows, Business (Office), and Servers are essentially subsidizing Online Services (Entertainment still doesn’t come close to covering the loses Online Services is seeing). And while Business and Servers had strong years with good growth, the Windows business actually shrank from last year. What happens if the other businesses start to shrink too? Will Microsoft be able to continue to justify the Online loses?

For their part, Microsoft mainly blames the loses on the Yahoo deal:

OSD operating loss increased due to higher operating expenses, offset in part by increased revenue. Cost of revenue grew $641 million driven by costs associated with the Yahoo! search agreement and increased traffic acquisition costs. General and administrative expenses decreased $157 million or 60% due mainly to transition expenses in the prior year associated with the inception of the Yahoo! Commercial Agreement. Research and development increased $117 million or 11% due to increased headcount-related costs.

Don’t overlook another crazy stat: Microsoft was able to decrease general and administrative expenses by 60 percent for the year, and still lost more than ever.

The next few quarters will be interesting to watch. Microsoft paid $8.5 billion in May to buy Skype — another online business with a history of losing money. It’s Microsoft’s largest acquisition ever. And while the deal closed in late June in the U.S., it still has to be approved in Europe, which may take until October. Also interesting, Skype will not actually be a part of OSD, and will instead be its own division. Still, as an online-based division, everyone will be watching it alongside OSD.

Will the worst online startup in history finally be able to turn things around in the coming year? Or will they continue to bathe in blood?

The charts below by BusinessInsider really drive the point home.