Startups that find product-market fit can do well in any industry, but that’s not enough if you’re a web3 company. No, you have to go beyond and find real use cases for the emerging technology.

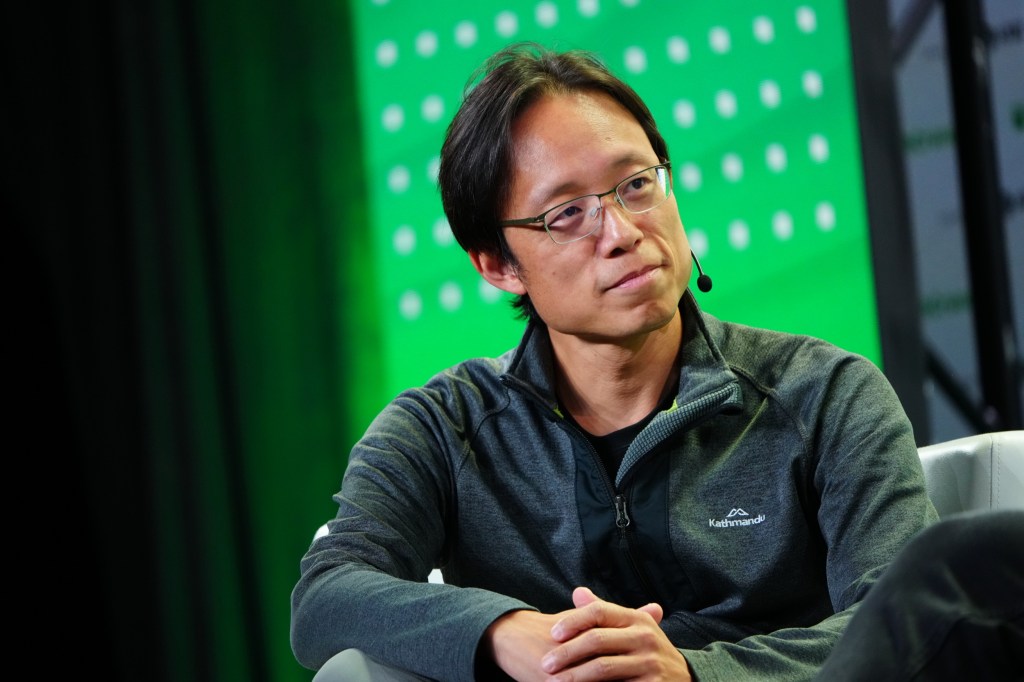

And according to Staci Warden, CEO of Algorand Foundation, the startups that went after real use cases — like asset tokenization — will grow, particularly now that the crypto industry is striving to emerge from the bear market.

There’s a lot more activity during bull markets as crypto tourists enter the industry in hopes of making it big. But that energy tapered off over the past few years as the market turned.

“We’ve lost some protocols, but I think those that are still with us, they have a very good sense of product-market fit and are trying to go after real use cases,” Warden told me on the Chain Reaction podcast recently.

Many protocols and companies have taken the time to be regulated and work on bridging the real world and the world of crypto, Warden said. “I don’t love that expression ‘real world,’ because I think crypto is part of the real world, but I think we’re seeing more and more engagement there.”

Warden thinks one of the biggest avenues for real world use cases is tokenization of assets and areas that aren’t even tradable yet.

She’s not the only one who thinks this. Tokenization can come in a number of formats and be driven by everyone from small crypto startups all the way to big financial institutions.

In March, Blackrock’s CEO Larry Fink wrote that tokenization of asset classes could drive efficiencies in capital markets, shorten value chains and improve cost and access for investors. Last month, JPMorgan’s Onyx and Apollo Global launched a new service that aims to tokenize assets for their clients while using Avalanche’s blockchain.

https://techcrunch.com/2023/03/25/avalanche-wants-to-digitize-all-of-the-worlds-assets-on-the-blockchain/

Warden views tokenization as a way to bring liquidity to markets that are not liquid. “That involves splicing up big chunky assets into small slivers that households can invest in.” As an example, she pointed to how people generally can’t invest in others’ rental property income, but it’s a source of diversified revenue, and protocols like Lofty AI can create algorithms that enable fractional ownership for investors beyond the original party.

When asked which areas she’d like to see developers build in the future, she doubled down on tokenization. “I’d like to see a bunch of different kinds of rental property tokenization,” she added. “I think it’s much more important to get the word out and to get liquidity into these markets, than doing a ton of other things.”

As for things that don’t exist in tradable forms, it’s not about “splicing them into smaller pieces,” Warden said. “It’s about making them tradable.”

A good example of this is Argentinian airline Flybondi, which allows customers to resell their tickets through NFT ticketing company, TravelX. By making the airline tickets NFTs, customers can transfer, rename or gift their tickets to others — all without having to go to a middleman.

Looking forward, Warden thinks there’s opportunity in tokenizing things in smaller amounts but greater liquidity, so these “small slivers of tokenized assets can function like money.”

She envisions a money market fund that’s tokenized into tiny pieces. “Why couldn’t you buy a pizza with a little piece of your market fund, for example, instead of having to use cash?”

“All of these things, I think they begin to encroach a bit on traditional finance and try to make inroads, kind of for the better of both worlds,” Warden said.